- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

What Recent Partnerships Mean for Repligen’s Value After a 20.7% Price Surge

Reviewed by Bailey Pemberton

Are you wondering whether now is the right moment to buy, sell, or simply hold on to your Repligen shares? You are not alone. Investors have been watching the stock closely as it has shown signs of volatility and renewed momentum. In just the past month, Repligen’s share price shot up by 20.7%, a striking move considering it had dipped 3.3% in the most recent week. Over the year, the stock is up 12.4%, despite being down over the past three and five years. That mix of short-term strength and longer-term challenges has a lot of people watching for turning points in the company’s story.

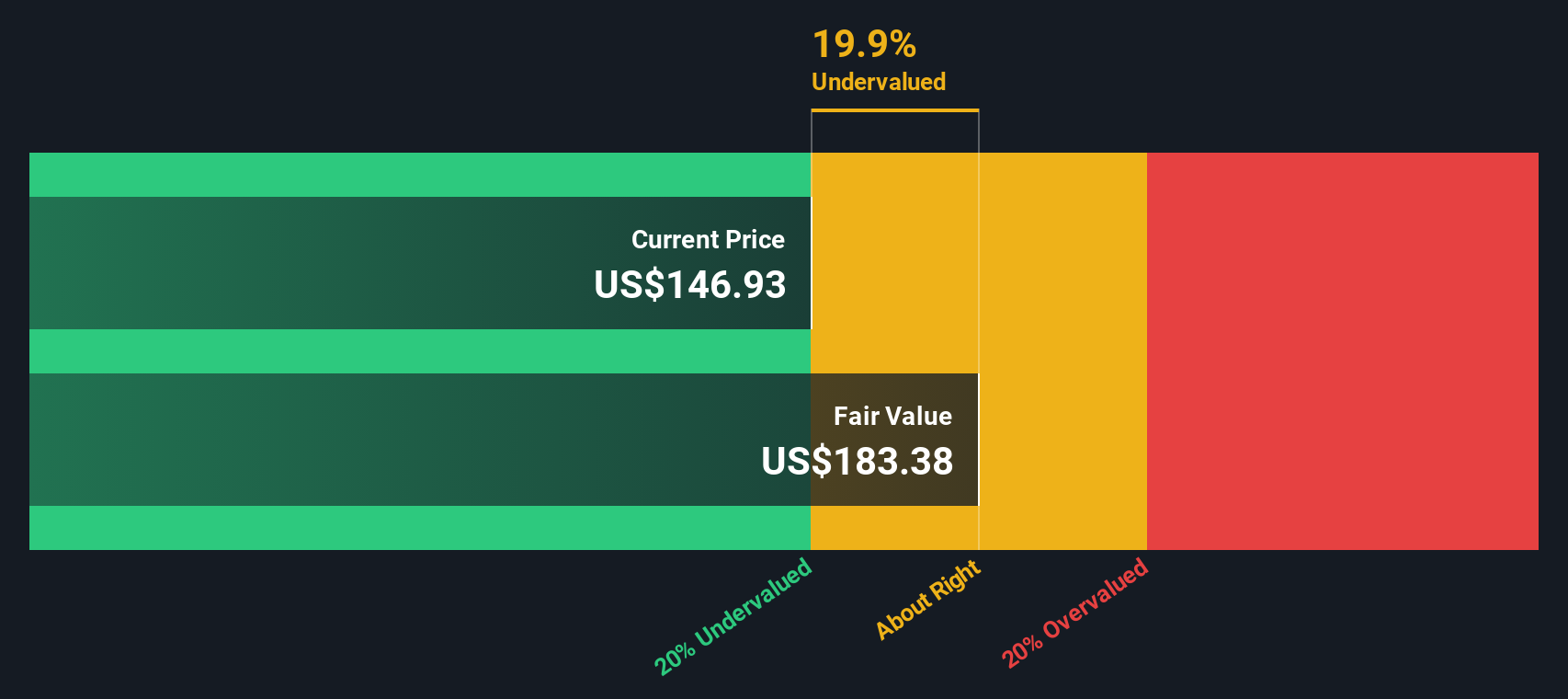

Much of the recent buzz centers around Repligen's expanding partnerships in the bioprocessing industry, as well as increased demand for advanced purification solutions. These positive headlines have helped shift investor perception, nudging Repligen’s valuation score to a 3 out of 6. This means the company is found to be undervalued in half of the standard checks typically used to measure a fair price. It is the sort of score that gets savvy investors thinking about whether a bargain is unfolding, or if a rally is already priced in.

So how do those valuation methods stack up, and what might they miss? Let's take a closer look at the different ways investors assess Repligen’s worth. There is an even more practical way to understand valuation that we will explore at the end of this article.

Approach 1: Repligen Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a core method for evaluating a company by projecting its future cash flows and discounting them to today's value. This approach aims to estimate what Repligen is truly worth based on its ability to generate cash in the years ahead.

According to the latest data, Repligen delivered $77.4 million in free cash flow over the last twelve months. Analysts provide estimates for annual free cash flow up to 2029, forecasting a steady rise to $381.6 million by the end of that year. After that, projections are extrapolated using growth trends. By 2035, the model estimates free cash flow to reach $711.3 million, though these long-range figures should be treated with added caution.

Bringing all these cash flow forecasts together, the DCF model calculates Repligen’s intrinsic value at $197.37 per share. This is 23.2% above the current market price, meaning the stock appears significantly undervalued right now based on discounted cash flow analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Repligen is undervalued by 23.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Repligen Price vs Sales

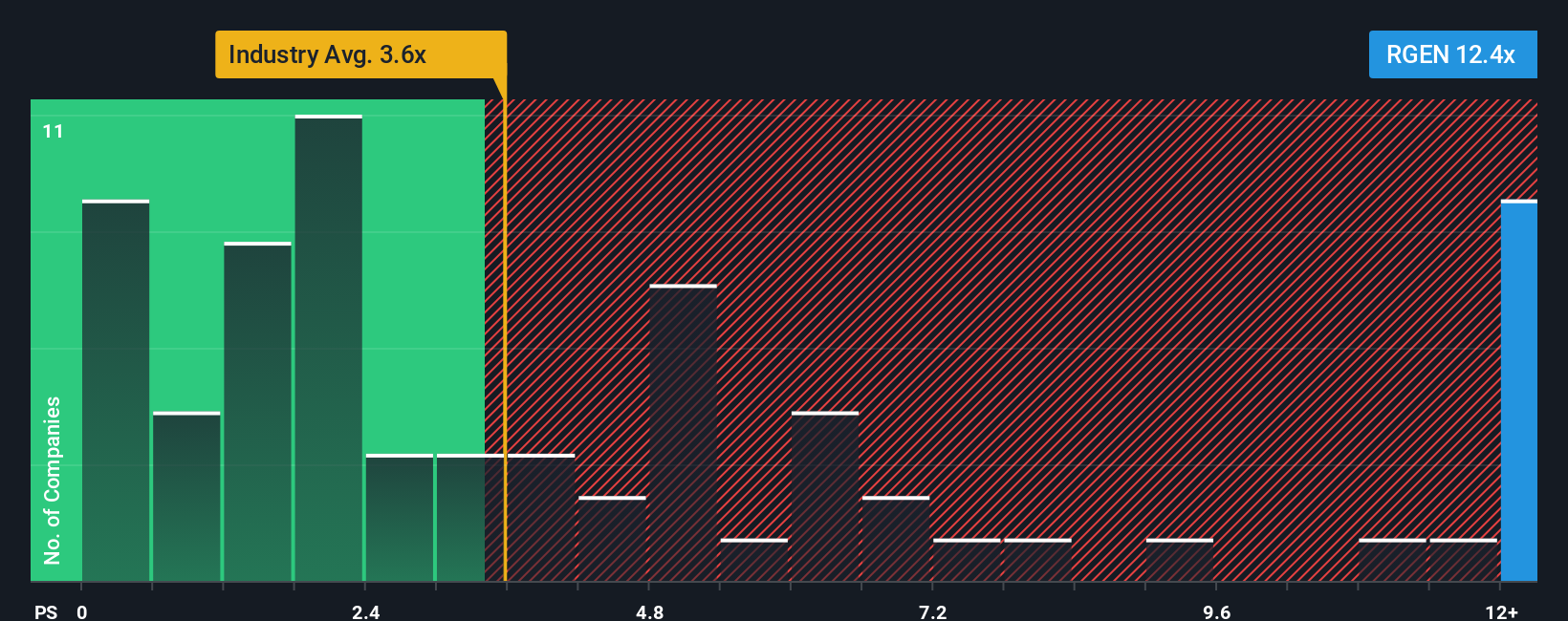

The price-to-sales (P/S) ratio is a favored metric for valuing companies like Repligen that are not currently profitable but still generate significant revenue. It allows investors to assess how much they are paying for each dollar of sales, which is particularly useful when earnings are negative or volatile.

Growth expectations and risk levels greatly influence what counts as a "normal" or "fair" P/S ratio. Companies with faster expected growth and lower perceived risks often justify paying a higher multiple, while more mature or riskier businesses usually attract lower ratios. In Repligen's case, the current P/S ratio sits at 12.7x. This is notably higher than the Life Sciences industry average of 3.5x and the average among peers, which is around 3.5x as well.

Simply Wall St introduces the idea of the “Fair Ratio,” a proprietary calculation that estimates an appropriate P/S ratio by factoring in the company’s earnings growth outlook, profit margin, industry, market cap, and risk profile. This comprehensive approach provides a more tailored benchmark than just comparing peers or the wider industry. For Repligen, the Fair Ratio is calculated at 5.25x.

With Repligen's actual P/S ratio at 12.7x, which is well above its Fair Ratio of 5.25x, the data suggests the stock is trading at a premium based on this valuation method.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Repligen Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story, a set of beliefs and forecasts about Repligen's future that links its business drivers to concrete financial estimates and a fair value. Instead of just following standard ratios, Narratives let you personalize the investment view by combining your assumptions about revenue, earnings growth, and margins with the numbers that matter most to you.

On Simply Wall St’s Community page, millions of investors use Narratives to translate their perspective on a company into a trackable valuation. Narratives make it easy to see how changes in the story, such as new product launches, shifting customer demand, or industry news, dynamically update your forecast and yield a real-time Fair Value. This allows you to compare your calculated Fair Value to the current share price, so you can always see if Repligen is, in your view, a buy, sell, or hold.

For example, with Repligen, one investor’s Narrative might focus on rapid innovation and margin expansion, supporting a high fair value of $220. Another investor who is cautious about biotech funding and global trade risks might estimate a fair value as low as $130. Try building your own Narrative and instantly see how your views stack up against the market.

Do you think there's more to the story for Repligen? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

A life sciences company, develops and commercializes bioprocessing technologies and systems in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives