- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

Repligen (RGEN): Assessing Valuation After New Chromatography Resins Expand Its Gene Therapy Toolkit

Reviewed by Simply Wall St

Repligen (RGEN) just widened its bioprocessing toolkit with three new chromatography resins aimed at gene therapy workflows, a move that quietly matters for both long term growth expectations and the stock’s quality story.

See our latest analysis for Repligen.

Repligen’s new resin launches land after a bumpy stretch, with a strong 90 day share price return of 28.96 percent off a softer year to date base. However, the 1 year total shareholder return of 7.63 percent still masks a weaker multi year record, suggesting sentiment is improving but not yet fully healed.

If this kind of niche life sciences innovation interests you, it could be worth exploring other specialist names through our curated healthcare stocks for more potential opportunities.

With shares up double digits this quarter but still nursing multiyear scars, and trading at a modest discount to bullish analyst targets, is Repligen quietly setting up a fresh buying opportunity, or is the market already banking on a full growth rebound?

Most Popular Narrative: 15.7% Undervalued

With Repligen closing at $157.72 against a narrative fair value of $187, the current setup implies investors are not fully pricing in the recovery path.

Continued product launches (new resins, Metenova single use mixers, integrated PAT platforms) and recent acquisitions (e.g., 908 bioprocessing) are building additional recurring consumable pull through and expanding the addressable market, directly supporting long term revenue and operating margin growth.

Want to see what kind of growth it takes to back that valuation gap? The narrative leans on brisk revenue compounding, expanding margins, and a future earnings multiple more often associated with sector leaders. Curious how those moving parts stack together into a single fair value number? The full story is one click away.

Result: Fair Value of $187 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained biotech funding weakness and ongoing gene therapy softness could delay volume recovery, which may pressure margins and challenge the underlying growth narrative.

Find out about the key risks to this Repligen narrative.

Another Lens on Valuation

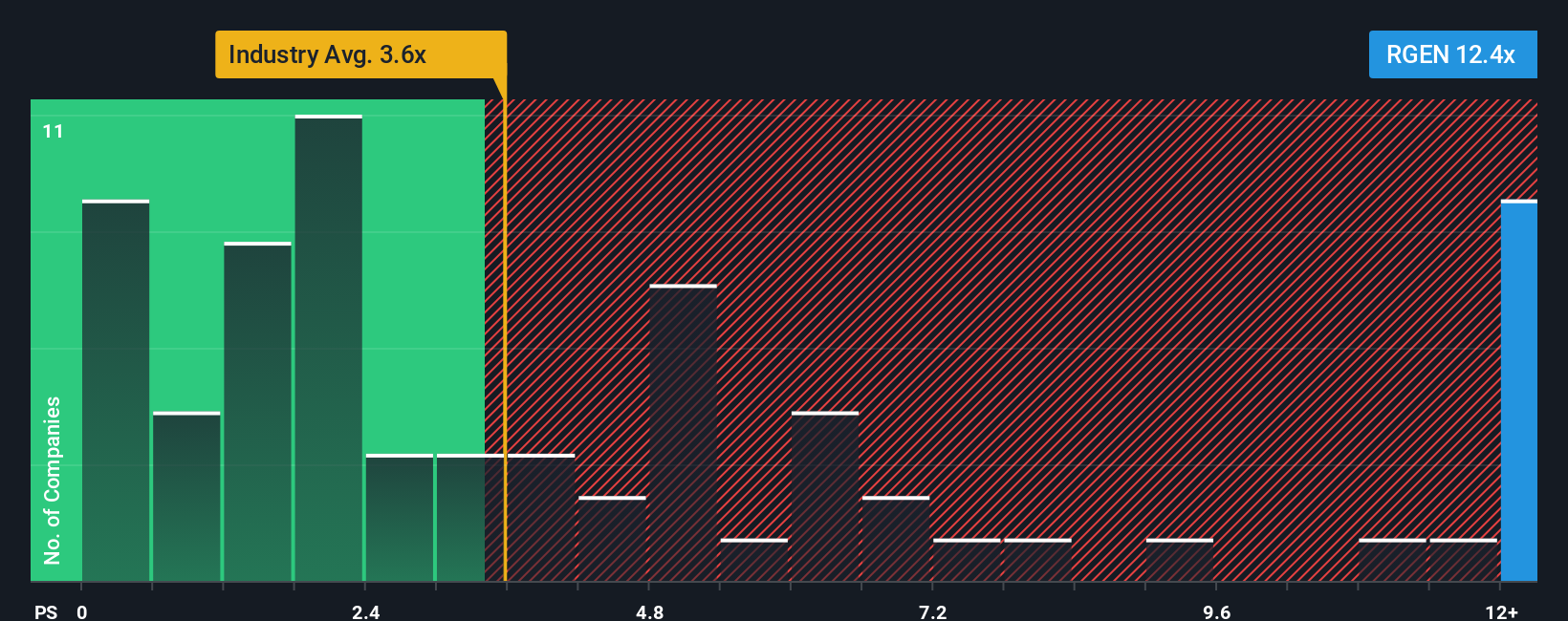

On simple sales metrics, Repligen looks stretched, trading on a price to sales ratio of 12.5 times versus 3.3 times for the US Life Sciences industry and 2.8 times for peers, and even well above its own fair ratio of 5.4 times. Is the market overpaying for growth resilience here, or just front running a full recovery?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Repligen Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes using the Do it your way tool.

A great starting point for your Repligen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction opportunities?

Before you move on, lock in your next ideas now with the Simply Wall St Screener so you are not catching tomorrow’s winners after the crowd.

- Capture potential multibaggers early by targeting these 3628 penny stocks with strong financials that already show robust balance sheets and surprisingly strong fundamentals.

- Ride powerful structural trends by focusing on these 29 healthcare AI stocks at the intersection of medical innovation and artificial intelligence.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that combine solid yields with sustainability checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

A life sciences company, develops and commercializes bioprocessing technologies and systems in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion