- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Regeneron (REGN) Margin Dip Underscores Market Caution Despite Strong Relative Valuation

Reviewed by Simply Wall St

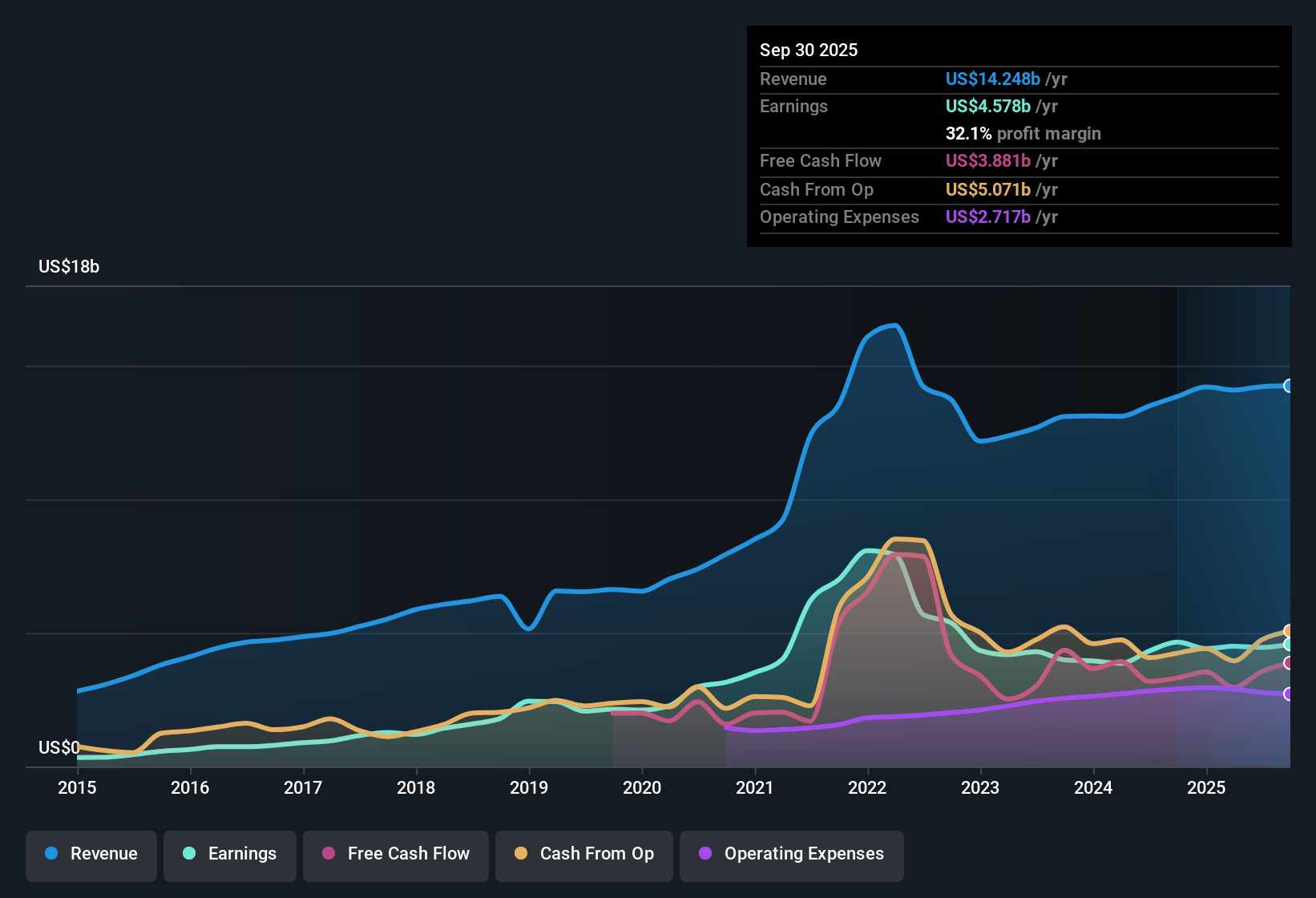

Regeneron Pharmaceuticals (REGN) reported earnings forecasted to grow 7.41% per year and revenue expected to rise at a 7% annual rate, both of which trail the broader US market’s growth expectations of 15.7% and 10.3%, respectively. Net profit margins stand at 32.1%, down slightly from 33.6% in the previous period. Over the past five years, the company’s earnings have declined by an average of 4.6% per year, turning negative in the most recent year. Despite this slower growth profile, Regeneron stands out for its relative value and strong profit quality, presenting a differentiated case for investors monitoring the current earnings season.

See our full analysis for Regeneron Pharmaceuticals.Next, we will see how these results compare with the most prominent narratives around Regeneron. Sometimes these results confirm what investors already believe, and other times they offer surprises.

See what the community is saying about Regeneron Pharmaceuticals

Valuation Discount to Peers Widens

- Regeneron's Price-to-Earnings ratio is 14.7x, below both the US biotech industry average (17.4x) and peer group average (22.7x).

- Consensus narrative notes that this discount reflects ongoing market caution about Regeneron's growth slowdown and concentrated revenue sources, but it also leaves room for upside if pipeline launches and new indications for Dupixent and EYLEA HD outperform expectations.

- The current share price of $652.91 trades at less than half of DCF fair value at $1,545.48. This highlights an unusually large disconnect compared to historical valuation spreads.

- Analysts' consensus view expects the company to grow revenues by 5.4% annually over the next three years, with margins forecast to dip modestly but remain robust among industry leaders.

Profitability Holds Despite Margin Dip

- Net profit margins currently stand at 32.1%, down slightly from 33.6% in the prior period. Margins remain strong relative to the sector and recent history.

- Bulls argue Regeneron's best-in-class therapies and manufacturing investments are likely to stabilize or expand margins in the long term, especially as the product mix shifts toward innovative biologics and pipeline launches.

- Strategic focus on manufacturing capacity and pipeline diversification supports the bullish case for improved operational efficiency and better gross and net margins over time.

- For bulls to be right, margins would need to rebound from 31.4% today to 34.7% in three years, anchored by successful market penetration for new drugs like Dupixent and EYLEA HD.

Steep Earnings Decline Breaks Growth Momentum

- Regeneron’s earnings have declined an average of 4.6% per year over the past five years, with growth turning negative in the most recent year and diverging meaningfully from the broader US market.

- Analysts' consensus view highlights that while the advancing pipeline and new market entries could start to reverse this trend, heavy reliance on EYLEA in the face of biosimilar threats and pricing pressure adds near-term risk to achieving a turnaround.

- The persistent earnings contraction challenges the bullish outlook and puts more pressure on successful clinical and commercial execution from late-stage pipeline assets.

- Consensus price target of $750.17 implies around a 15% premium from today’s share price, but assumes stabilization in earnings and improved profitability over the medium term.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Regeneron Pharmaceuticals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on the latest figures? Take just a few minutes to shape your own perspective and share your view, then Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Regeneron Pharmaceuticals.

See What Else Is Out There

Regeneron's several years of shrinking earnings and forecast lag behind US market growth, signaling performance that has become inconsistent and underwhelming for investors seeking steady returns.

If steadier results are what you want, use our stable growth stocks screener (2124 results) to spot companies delivering reliable growth through market ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives