- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Regeneron Pharmaceuticals (NasdaqGS:REGN) Exits Multiple Russell Growth Indices

Reviewed by Simply Wall St

On June 30, 2025, Regeneron Pharmaceuticals (NasdaqGS:REGN) was removed from multiple key indices, a development that may influence its investment appeal and stock liquidity. Over the last month, the company's shares increased by 6%, a move that coincides with Regeneron's Dupixent approval for bullous pemphigoid and its addition to the Russell 1000 Dynamic Index. These events align with broader market trends, as major U.S. indices, including the S&P 500 and Nasdaq, have rallied to new highs. Overall, the index removals and new product approvals likely contributed alongside market optimism to Regeneron's positive share performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

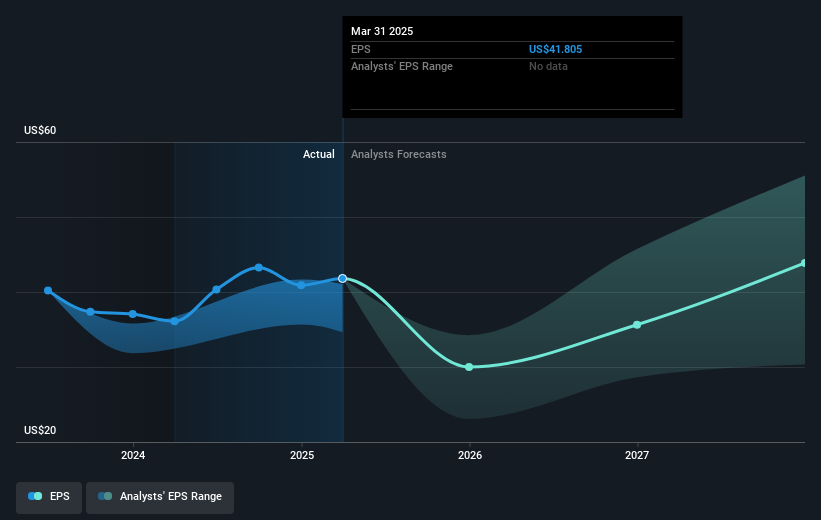

The removal of Regeneron Pharmaceuticals from key indices on June 30, 2025, while coinciding with a 6% share price increase due to Dupixent's approval, presents mixed implications for the company's future prospects. Over the longer term, Regeneron's total shareholder return, encompassing both share price and dividends, recorded a 12.25% decline over three years. In comparison, the company's performance underperformed both the broader U.S. biotech industry and the market itself in the past year.

These recent developments could bolster Regeneron's revenue and earnings forecasts, bolstered by positive momentum from product approvals and inclusion in indices like the Russell 1000 Dynamic Index. However, the competitive pressures and regulatory challenges mentioned in the narrative might also exert downward pressure on margins and sales, particularly in light of a significant decline in EYLEA's U.S. sales earlier in the year. Analysts have set a price target of approximately US$727.21 for Regeneron, and the current share price represents a 39.6% discount to this target, suggesting potential room for growth if the company navigates its challenges effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives