- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Is Regeneron’s Stock Price Surge Justified After Recent FDA Approvals?

Reviewed by Bailey Pemberton

- Ever wondered if Regeneron Pharmaceuticals is actually a good buy, or if its price tag is outpacing its true value? You are not alone. That curiosity is exactly what we are here to tackle.

- The stock has seen significant movement recently, rising 11.6% in the last week and 34.1% over the past month. This activity has caught the attention of growth-oriented investors.

- This surge is attributed to recent headlines highlighting Regeneron's latest FDA approvals and notable progress in its drug pipeline, which has added to the momentum in the stock price. Market analysts attribute much of this optimism to the company’s growing presence in the biotech sector.

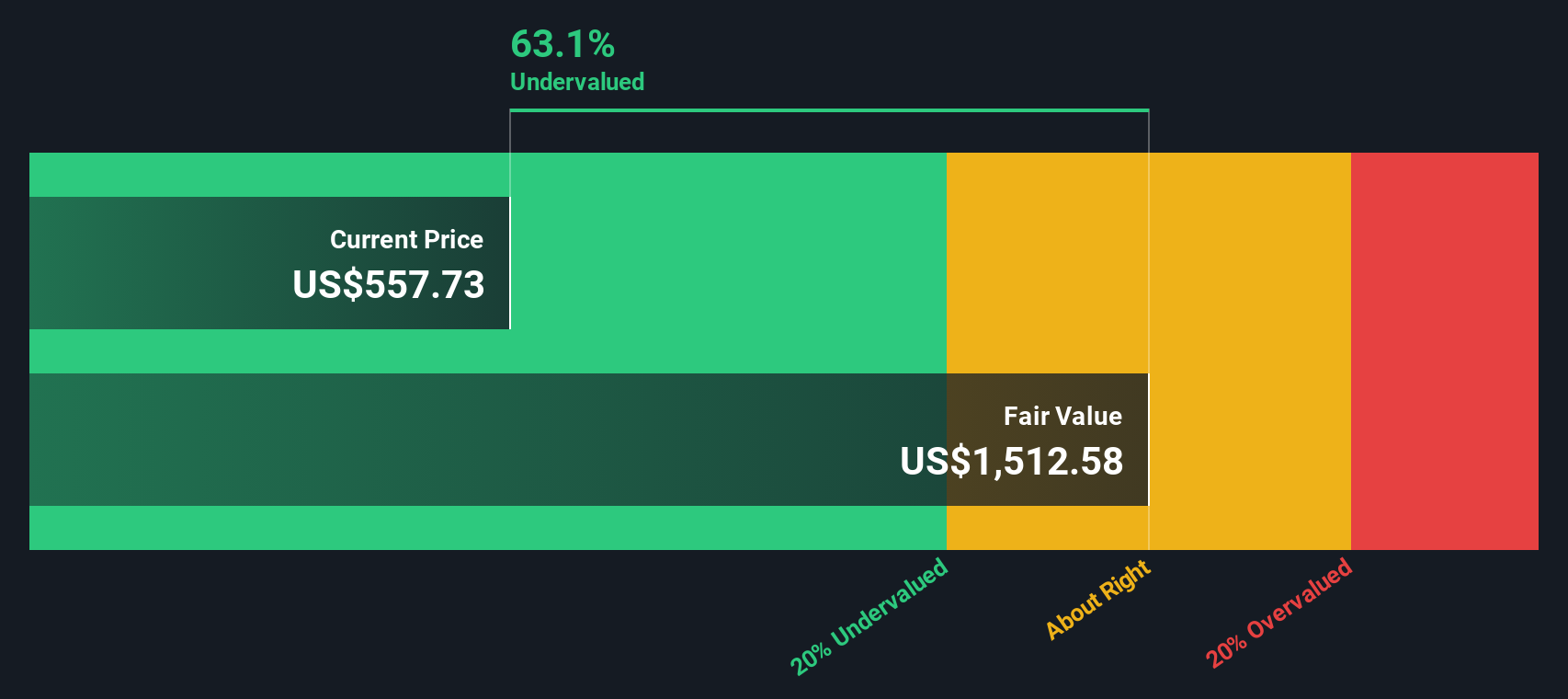

- On a scale of 1 to 6, Regeneron currently scores a 5 using our valuation checks, which suggests it appears undervalued on most metrics. Next, let us explain exactly how these checks work, and keep reading because we will also share an approach to evaluating value at the end of this article.

Find out why Regeneron Pharmaceuticals's 4.5% return over the last year is lagging behind its peers.

Approach 1: Regeneron Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value. This approach gives investors a way to gauge whether a stock is trading above or below its intrinsic worth based on actual cash generation potential.

For Regeneron Pharmaceuticals, the current Free Cash Flow stands at $4.0 billion. Analysts provide FCF estimates for the next five years, after which projections are extrapolated. According to the model, Free Cash Flow is expected to grow steadily, reaching about $6.4 billion by 2029 and over $8.6 billion by 2035, all in USD terms.

Using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Regeneron comes out to $1,598 per share. This value is about 50.9% higher than the current market price. By this measure, the stock is considered significantly undervalued today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Regeneron Pharmaceuticals is undervalued by 50.9%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

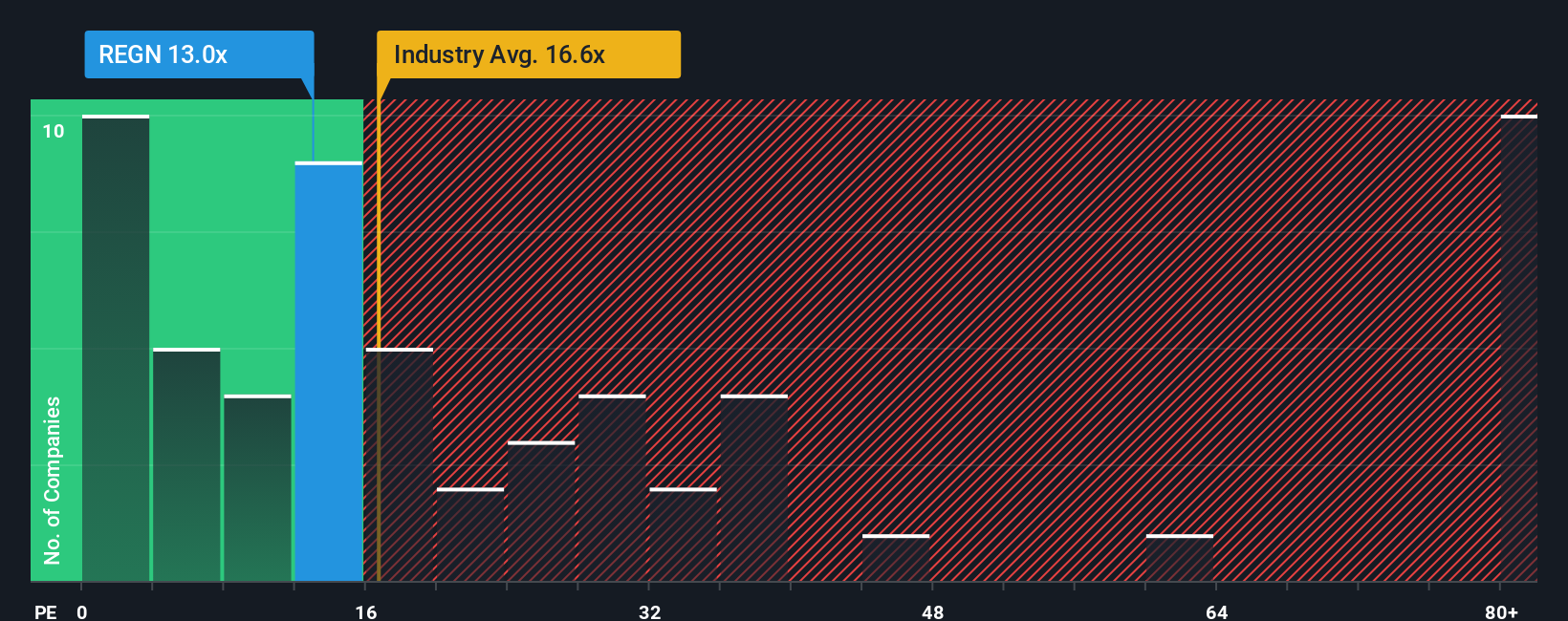

Approach 2: Regeneron Pharmaceuticals Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely regarded as a helpful valuation metric for profitable companies like Regeneron Pharmaceuticals because it reflects how much investors are willing to pay today for each dollar of future earnings. This measure makes it easier to compare the value of profitable stocks across the industry and with the company’s own historical levels.

Investors generally expect companies with higher growth prospects and lower risk to justify a higher PE ratio, while slower-growing or riskier businesses typically trade at lower multiples. In Regeneron's case, the current PE ratio is 17.6x. For comparison, the average PE ratio for the Biotechs industry stands at 19.1x, and the average among its peers is even higher at 23.1x. This suggests Regeneron is trading at a discount compared to both benchmarks.

However, to provide a more accurate assessment than a simple comparison with peers or the broader industry, Simply Wall St calculates a “Fair Ratio” for each company. This Fair Ratio, at 26.8x for Regeneron, takes into account important factors like a company’s earnings growth, profit margins, risk profile, industry, and market capitalization. Because it reflects the specific characteristics of the business rather than using a generic benchmark, the Fair Ratio offers a more nuanced and tailor-made valuation yardstick for investors.

When Regeneron's current PE of 17.6x is measured against its Fair Ratio of 26.8x, the stock appears substantially undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

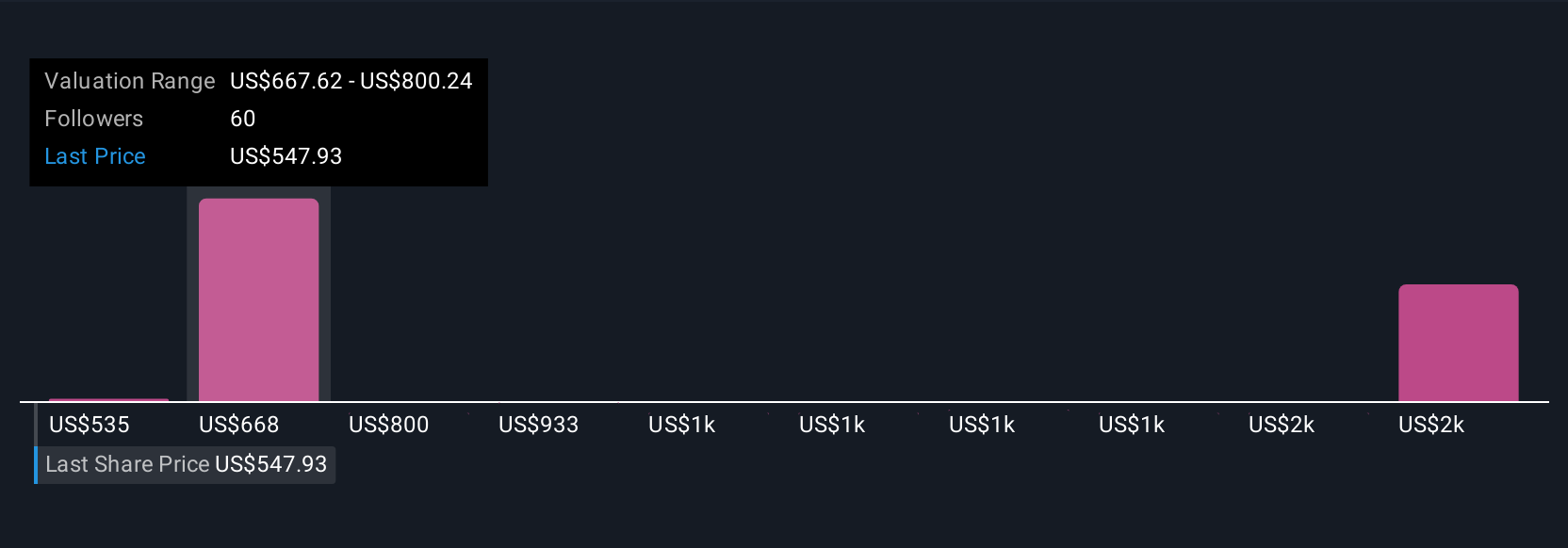

Upgrade Your Decision Making: Choose your Regeneron Pharmaceuticals Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives empower investors to go beyond the numbers by attaching their view of Regeneron Pharmaceuticals’ future, including its market opportunities, risks, and potential breakthroughs, to financial forecasts like expected revenue, earnings, and margins.

Each Narrative is a living story. You set your assumptions and outlook for the company, Simply Wall St helps you connect that story to a fair value calculation, and together you get a dynamic, personalized snapshot of what Regeneron could really be worth. Narratives are free and easy to use in the Simply Wall St Community, a platform trusted by millions of investors worldwide.

Narratives help you quickly decide when it might be time to buy or sell by comparing your calculated Fair Value to the current share price. They automatically update as new data, earnings releases, or major news hits the market.

For example, some investors believe Regeneron could be worth as much as $890 per share if Dupixent and EYLEA far exceed expectations, while others see more downside risk with a target closer to $543 in the face of rising biosimilar competition and price controls.

For Regeneron Pharmaceuticals, we have provided previews of two leading Regeneron Pharmaceuticals Narratives for your review:

- 🐂 Regeneron Pharmaceuticals Bull Case

Fair Value: $890.00

Undervalued by approximately 11.86%

Revenue Growth Rate: 7.9%

- Best-in-class therapies, an innovative pipeline, and strong product adoption are expected to drive rapid market share gains and diversified long-term growth.

- Strategic investments in manufacturing and biologics platforms support operational efficiency and help capitalize on global demand for precision medicines.

- Main risks include heavy revenue dependence on key drugs, biosimilar competition, payer pressure, and high R&D costs. The bullish case assumes accelerated growth and margin expansion led by core franchises and pipeline launches.

- 🐻 Regeneron Pharmaceuticals Bear Case

Fair Value: $768.36

Overvalued by approximately 2.12%

Revenue Growth Rate: 6.7%

- An expanding pipeline and new market access are likely to deliver sustained but measured revenue and earnings growth in the coming years.

- Ongoing investment in R&D and advanced manufacturing provides cost advantages and margin protection. However, core reliance on EYLEA presents risks from intensifying competition and pricing pressure.

- Analysts see upside potential but highlight uncertainties including regulatory delays, commercial execution risks, pipeline skepticism, and policy or pricing challenges that may affect long-term growth prospects and compress profit margins.

Do you think there's more to the story for Regeneron Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success