- United States

- /

- Biotech

- /

- NasdaqGS:REGN

How Positive EMA Opinion for Libtayo Has Changed Regeneron Pharmaceuticals’ (REGN) Investment Story

Reviewed by Sasha Jovanovic

- On October 17, 2025, Regeneron Pharmaceuticals announced that the European Medicines Agency's Committee for Medicinal Products for Human Use adopted a positive opinion for Libtayo as an adjuvant treatment for adults with cutaneous squamous cell carcinoma at high risk of recurrence after surgery and radiation.

- This regulatory milestone, which closely follows recent FDA approval and is backed by robust Phase 3 trial data, highlights growing international momentum behind Libtayo’s expansion in the oncology market.

- We'll consider how this favorable EMA opinion and regulatory progress for Libtayo could reshape Regeneron’s investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Regeneron Pharmaceuticals Investment Narrative Recap

To own Regeneron Pharmaceuticals, you have to believe its innovative pipeline and leading therapies can offset mounting pressures from competition, pricing, and a shrinking revenue base for established products like EYLEA. The recent positive EMA opinion for Libtayo strengthens Regeneron’s oncology portfolio, but given the company’s heavy reliance on EYLEA, this news is unlikely to materially change the most important immediate catalyst, stabilizing and growing core revenues, or lessen the near-term risk from EYLEA’s branded and biosimilar rivals.

Among recent updates, the October FDA approval of Libtayo as adjuvant therapy for high-risk CSCC is especially relevant. This now-parallel US and potential EU market access represents an important expansion effort, aligning with Regeneron’s goal of diversifying its revenue streams and strengthening its foundation ahead of upcoming regulatory decisions on other high-value assets.

In contrast, investors should also consider the risk that, despite such wins, heavy pipeline investments may not translate into sufficient new product revenue...

Read the full narrative on Regeneron Pharmaceuticals (it's free!)

Regeneron Pharmaceuticals' narrative projects $16.6 billion in revenue and $5.0 billion in earnings by 2028. This requires 5.4% yearly revenue growth and a $0.5 billion earnings increase from $4.5 billion currently.

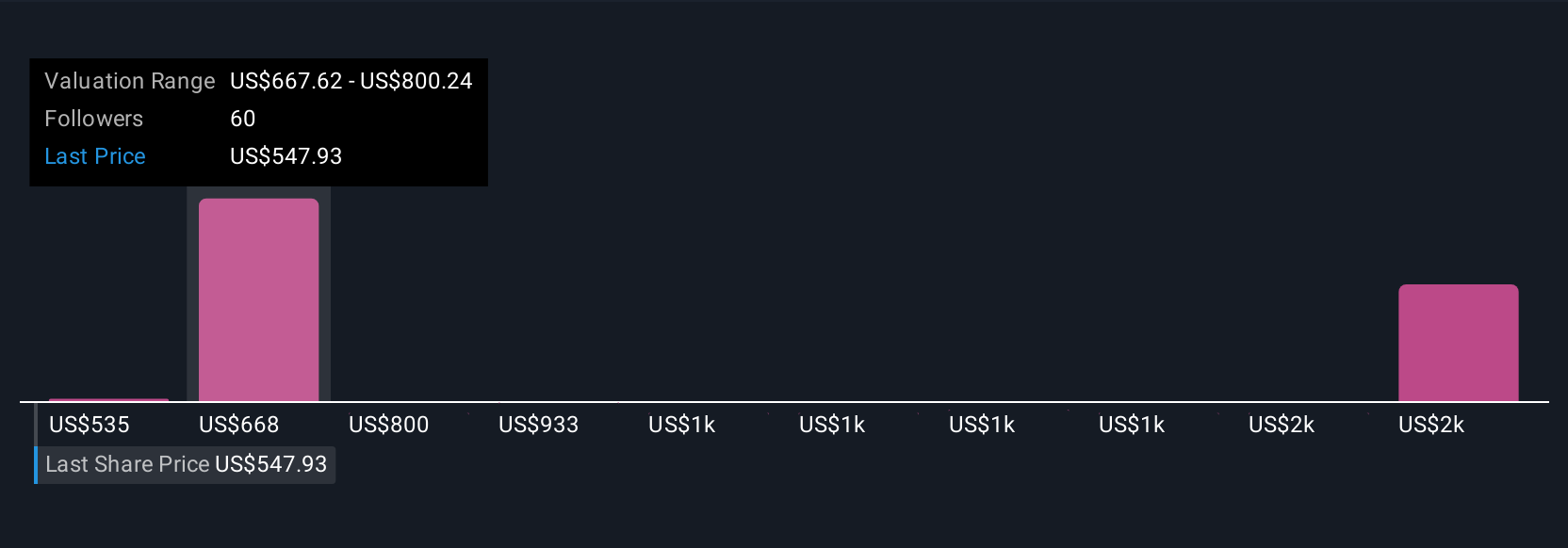

Uncover how Regeneron Pharmaceuticals' forecasts yield a $722.20 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Some of the highest analyst forecasts expected Regeneron could reach revenues of US$17.8 billion and earnings of US$6.2 billion by 2028, viewing oncology launches like Libtayo as fuel for rapid growth and share gains. These optimistic views contrast with consensus concerns about pipeline productivity and dependency on EYLEA, showing just how much opinions on Regeneron's future can differ, recent news could prompt a rethink of both the risks and rewards in play.

Explore 10 other fair value estimates on Regeneron Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Regeneron Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regeneron Pharmaceuticals research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Regeneron Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regeneron Pharmaceuticals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives