- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Did Regeneron's (REGN) Strong Q2 Results and FDA Approvals Just Shift Its Investment Narrative?

Reviewed by Simply Wall St

- In early August 2025, Regeneron Pharmaceuticals announced strong second-quarter financial results, highlighted by higher revenues and adjusted earnings per share that exceeded analyst expectations, along with the declaration of a US$0.88 cash dividend and an update on their ongoing share repurchase program.

- The company also secured multiple FDA approvals, including an accelerated nod for Lynozyfic in multiple myeloma and expanded indications for Dupixent, reinforcing its research and development pipeline momentum.

- We’ll examine how Regeneron’s better-than-expected financial results and expanded product approvals may shape its future investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Regeneron Pharmaceuticals Investment Narrative Recap

To be comfortable as a Regeneron shareholder, I need to believe that pipeline innovation and product expansion, especially via new indications for Dupixent and fresh approvals like Lynozyfic, can offset ongoing commercial challenges with EYLEA. The latest quarterly results showed revenue and adjusted earnings beating forecasts, and several product wins reinforce a robust R&D engine. However, these factors do not materially ease the near-term risk relating to further EYLEA HD regulatory delays due to manufacturing site issues.

The most relevant announcement this quarter is the US$0.88 cash dividend, reflecting Regeneron’s growing focus on returning capital to shareholders alongside share repurchases, which remain notable as they may support earnings per share during periods of product volatility and when regulatory hurdles persist.

Yet, before considering Regeneron’s growth story, investors should understand that the manufacturing challenges causing regulatory delays represent a meaningful risk that could suddenly ...

Read the full narrative on Regeneron Pharmaceuticals (it's free!)

Regeneron Pharmaceuticals is projected to reach $16.0 billion in revenue and $4.4 billion in earnings by 2028. This is based on analysts' expectations of 4.3% annual revenue growth and a decrease in earnings of $0.1 billion from current earnings of $4.5 billion.

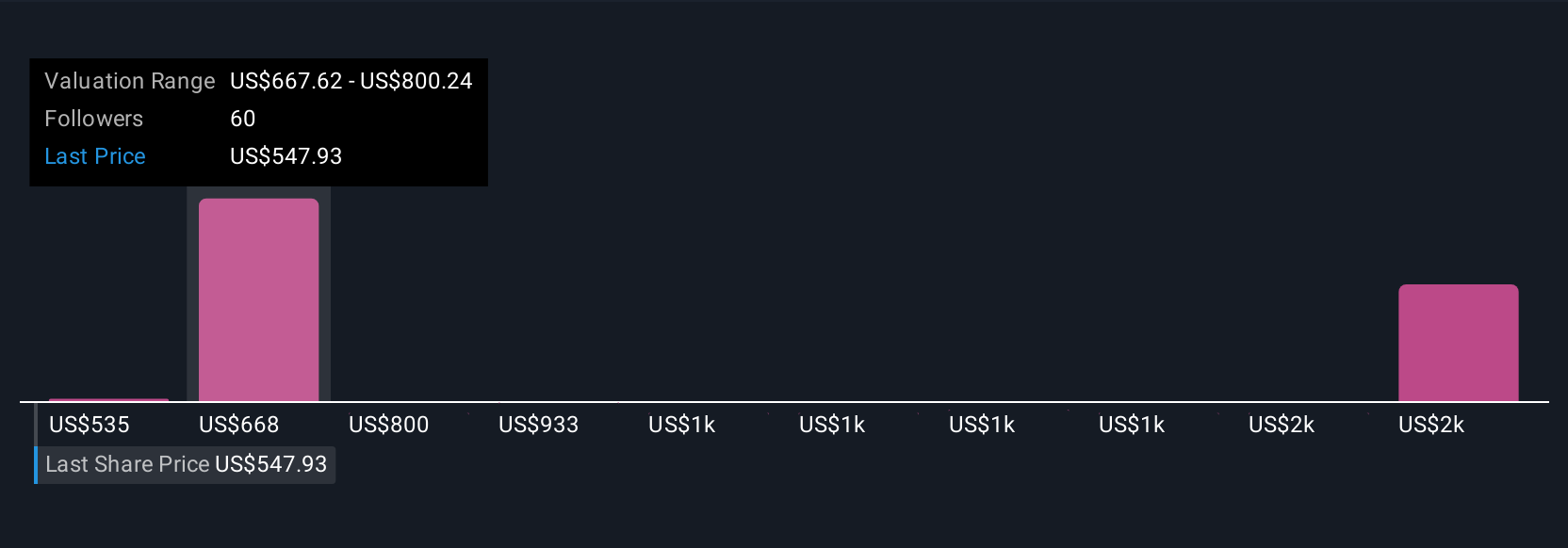

Uncover how Regeneron Pharmaceuticals' forecasts yield a $721.52 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Analysts at the upper end of the range were forecasting Regeneron to reach US$17.2 billion in annual revenue and US$6.0 billion in yearly earnings by 2028, painting an even more optimistic view for growth if pipeline launches and regulatory wins accelerate. Your expectations might differ widely, so it’s useful to consider both the upsides and the challenges when weighing this stock.

Explore 8 other fair value estimates on Regeneron Pharmaceuticals - why the stock might be worth just $535.00!

Build Your Own Regeneron Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regeneron Pharmaceuticals research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Regeneron Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regeneron Pharmaceuticals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives