- United States

- /

- Biotech

- /

- NasdaqGS:RARE

Ultragenyx Pharmaceutical (RARE): Can Pipeline Advances Offset Ongoing Losses as Revenue Guidance Holds Steady?

Reviewed by Sasha Jovanovic

- Ultragenyx Pharmaceutical reported third quarter financials showing revenue of US$159.93 million and a net loss of US$180.41 million, while also reaffirming its 2025 total revenue guidance of US$640 million to US$670 million, expecting growth of 14-20% versus 2024.

- An important insight is that alongside its financial update, Ultragenyx advanced its rare disease pipeline by dosing the first patient in the Aurora study, broadening clinical reach for Angelman syndrome therapies, which could impact long-term growth prospects.

- We'll explore how Ultragenyx's commitment to revenue growth and pipeline expansion following its latest report shapes its current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ultragenyx Pharmaceutical Investment Narrative Recap

To be a shareholder in Ultragenyx Pharmaceutical, you need to believe that its expanding rare disease pipeline, clinical progress, and commitment to revenue growth can offset ongoing net losses and high cash burn. The recent financial results confirm guidance for 2025 revenue growth, offering confidence in execution, but do not meaningfully change the biggest short term catalyst, the advancement of late-stage clinical programs, nor lessen the substantial risk tied to the company's lack of profitability.

The initiation of the Aurora study for GTX-102 in Angelman syndrome is particularly relevant. This clinical milestone not only signals deeper pipeline progress but shows Ultragenyx's efforts to address broader patient groups, which may serve as a future growth catalyst if late-stage data succeed.

In contrast, investors should be aware of the persistent risk of increasing operational losses and financial strain if near-term revenue expansion and cost control goals do not...

Read the full narrative on Ultragenyx Pharmaceutical (it's free!)

Ultragenyx Pharmaceutical's narrative projects $1.4 billion in revenue and $46.9 million in earnings by 2028. This requires 32.0% yearly revenue growth and a $579.8 million increase in earnings from the current $-532.9 million.

Uncover how Ultragenyx Pharmaceutical's forecasts yield a $84.10 fair value, a 151% upside to its current price.

Exploring Other Perspectives

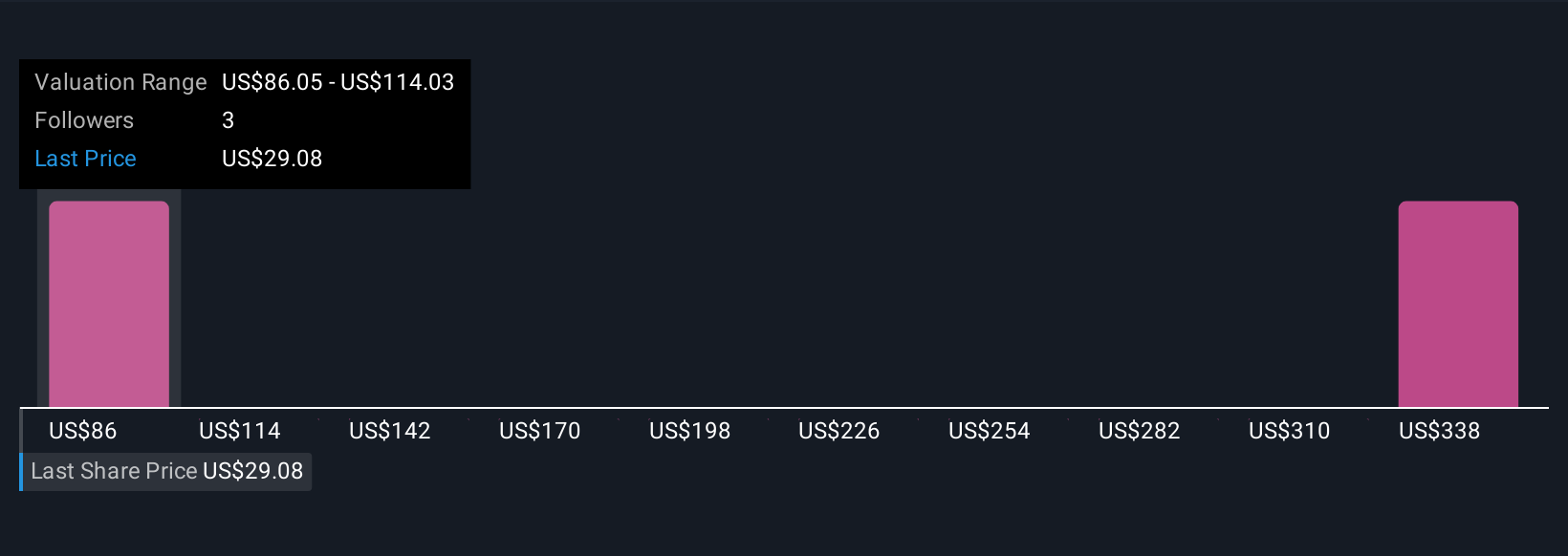

Two Simply Wall St Community estimates put Ultragenyx’s fair value between US$84.10 and US$360.44. While views on value vary widely, the company's reliance on successful pipeline milestones may shape returns in unexpected ways, explore all opinions to see how your own perspective compares.

Explore 2 other fair value estimates on Ultragenyx Pharmaceutical - why the stock might be worth over 10x more than the current price!

Build Your Own Ultragenyx Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ultragenyx Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ultragenyx Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ultragenyx Pharmaceutical's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RARE

Ultragenyx Pharmaceutical

A biopharmaceutical company, focuses on the identification, acquisition, development, and commercialization of novel products for the treatment of rare and ultra-rare genetic diseases in North America, Latin America, Europe, the Middle East, Africa, and the Asia-Pacific.

High growth potential and good value.

Market Insights

Community Narratives