- United States

- /

- Pharma

- /

- NasdaqGM:RANI

Why Rani Therapeutics Holdings (RANI) Is Up 11.0% After Major Chugai Deal, Board Appointments, and $60M Raise

Reviewed by Sasha Jovanovic

- Rani Therapeutics Holdings recently announced the appointment of Abraham Bassan and Vasudev Bailey, Ph.D., to its Board of Directors, alongside the closing of a US$60.3 million private placement led by prominent healthcare investors and a major collaboration and license agreement with Chugai Pharmaceutical for its RaniPill technology.

- The combination of new board appointments, significant financing, and a partnership that could yield up to US$1.09 billion in payments highlights increased investor and industry confidence in Rani’s approach to oral biologics.

- We'll explore how the Chugai collaboration, with its sizable milestone potential, impacts Rani Therapeutics' evolving investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Rani Therapeutics Holdings Investment Narrative Recap

To own shares in Rani Therapeutics Holdings, investors must believe in the transformative potential of the company’s RaniPill technology for oral biologic drug delivery. The recent board appointments and the US$60.3 million financing significantly mitigate near-term funding risk and support continued advancement of the RT-114 obesity program, which remains the primary catalyst, though achieving product milestones is still critical to longer-term prospects.

The recent collaboration and license agreement with Chugai Pharmaceutical is particularly relevant, as it introduces a substantial milestone opportunity, up to US$1.09 billion if expanded to multiple drugs, further reinforcing Rani’s approach and providing a possible new, non-dilutive funding stream linked to successful development.

Yet, in contrast, investors should be aware there are still important questions about how quickly new partnerships can translate into meaningful revenue, especially if...

Read the full narrative on Rani Therapeutics Holdings (it's free!)

Rani Therapeutics Holdings' narrative projects $38.2 million in revenue and $8.9 million in earnings by 2028. This requires 217.0% yearly revenue growth and a $38.6 million increase in earnings from current earnings of -$29.7 million.

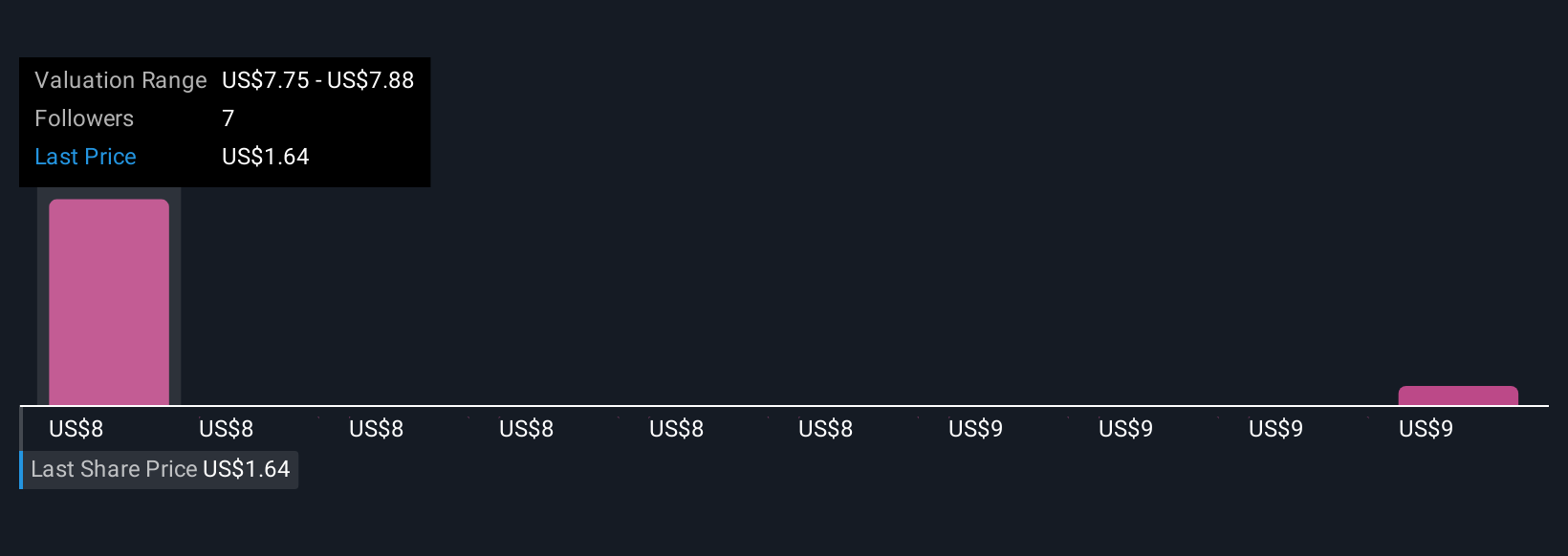

Uncover how Rani Therapeutics Holdings' forecasts yield a $9.00 fair value, a 395% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Rani Therapeutics range narrowly from US$9.00 to US$9.50 per share. While these valuations indicate widespread bullish sentiment, the company’s ongoing financial losses and negative equity highlight the importance of closely monitoring operating performance before drawing firm conclusions, see how others assess the tradeoffs.

Explore 3 other fair value estimates on Rani Therapeutics Holdings - why the stock might be worth over 5x more than the current price!

Build Your Own Rani Therapeutics Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rani Therapeutics Holdings research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Rani Therapeutics Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rani Therapeutics Holdings' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RANI

Rani Therapeutics Holdings

Operates as a clinical stage biotherapeutics company, focusing on technologies to enable the administration of biologics and drugs orally for patients, physicians, and healthcare systems with a alternative to painful injections in the United States.

Moderate risk with limited growth.

Market Insights

Community Narratives