- United States

- /

- Biotech

- /

- NasdaqGS:QURE

Swelling losses haven't held back gains for uniQure (NASDAQ:QURE) shareholders since they're up 147% over 1 year

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. Take, for example uniQure N.V. (NASDAQ:QURE). Its share price is already up an impressive 147% in the last twelve months. It's also good to see the share price up 88% over the last quarter. Unfortunately the longer term returns are not so good, with the stock falling 13% in the last three years.

In light of the stock dropping 7.1% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

View our latest analysis for uniQure

Because uniQure made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

uniQure actually shrunk its revenue over the last year, with a reduction of 74%. We're a little surprised to see the share price pop 147% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

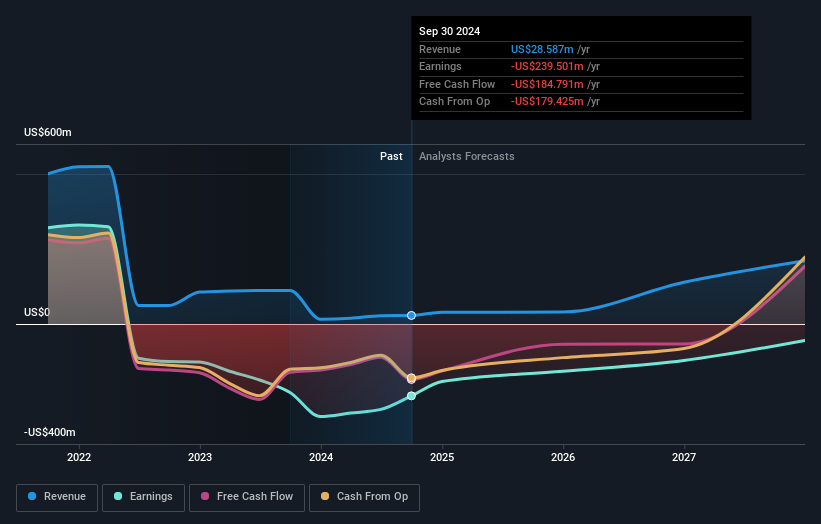

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

uniQure is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that uniQure has rewarded shareholders with a total shareholder return of 147% in the last twelve months. That certainly beats the loss of about 12% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with uniQure (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if uniQure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:QURE

uniQure

Develops treatments for patients suffering from rare and other devastating diseases in the United States.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives