- United States

- /

- Biotech

- /

- NasdaqGS:QURE

Does QURE's High Short Interest Reveal Deeper Questions About Its Gene Therapy Partnership Strategy?

Reviewed by Sasha Jovanovic

- In recent days, uniQure N.V. has drawn increased investor attention due to a high short interest of 17.91% and recognition from Seeking Alpha's Quant metrics with a strong "Buy" rating of 4.99. The company’s partnership with Bristol Myers Squibb continues to advance its cardiovascular gene therapy pipeline, highlighting progress in a cutting-edge area of biotechnology.

- The elevated short interest reflects heightened market scrutiny, while the collaboration underscores the industry’s growing confidence in uniQure’s gene therapy initiatives.

- We’ll now explore how increased investor scrutiny, fueled by the high short interest, could influence uniQure’s investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

uniQure Investment Narrative Recap

To be a shareholder in uniQure, you need to believe in the company’s long-term promise as a leader in gene therapy, particularly the opportunity surrounding AMT-130 for Huntington’s disease. The recent spike in short interest and strong Seeking Alpha rating doesn’t materially impact the primary short-term catalyst, the upcoming BLA regulatory submission for AMT-130 in early 2026, nor does it greatly shift the main risk of regulatory uncertainties or delayed approvals, which remain paramount to the investment case. One announcement especially relevant to investors amid this heightened scrutiny is the positive pivotal trial data for AMT-130, released in late September. The promising results showcase progress for what could be one of the first disease-modifying treatments for Huntington’s, affirming why upcoming regulatory interactions and the FDA submission timeline hold outsized importance for near-term share price momentum and risk. In contrast, investors should also be aware of the potential challenges if the regulatory review for AMT-130 takes longer than expected or faces...

Read the full narrative on uniQure (it's free!)

uniQure's narrative projects $306.4 million revenue and $32.3 million earnings by 2028. This requires 147.5% yearly revenue growth and a $249.9 million increase in earnings from -$217.6 million.

Uncover how uniQure's forecasts yield a $75.09 fair value, a 29% upside to its current price.

Exploring Other Perspectives

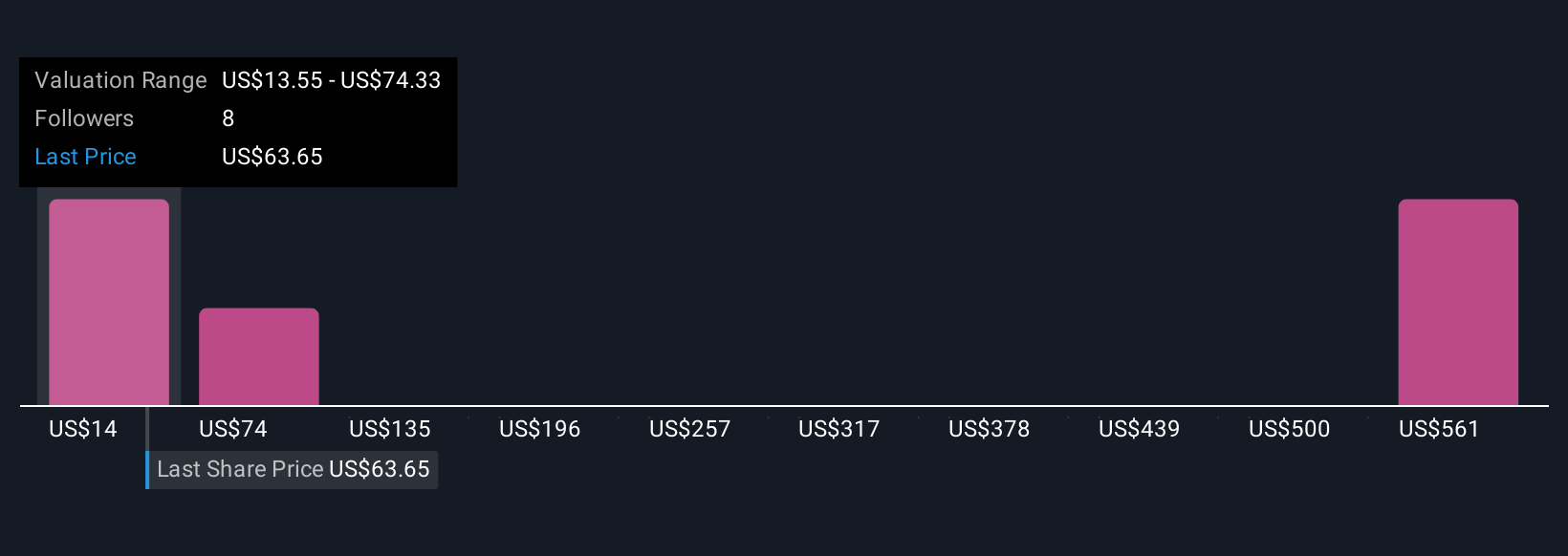

Six fair value estimates from the Simply Wall St Community range from US$13.55 to US$611.82 per share. While opinions differ widely, many remain focused on the impact of regulatory milestones and clinical trial outcomes for AMT-130 as key signals for future performance.

Explore 6 other fair value estimates on uniQure - why the stock might be worth over 10x more than the current price!

Build Your Own uniQure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your uniQure research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free uniQure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate uniQure's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if uniQure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QURE

uniQure

Develops treatments for patients suffering from rare and other devastating diseases in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives