- United States

- /

- Life Sciences

- /

- NasdaqGM:QTRX

Even With A 36% Surge, Cautious Investors Are Not Rewarding Quanterix Corporation's (NASDAQ:QTRX) Performance Completely

Quanterix Corporation (NASDAQ:QTRX) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

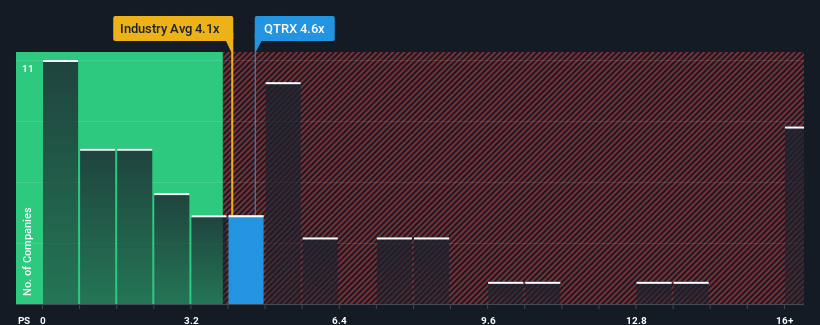

Even after such a large jump in price, there still wouldn't be many who think Quanterix's price-to-sales (or "P/S") ratio of 4.6x is worth a mention when the median P/S in the United States' Life Sciences industry is similar at about 4.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Quanterix

How Quanterix Has Been Performing

Quanterix certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Quanterix's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Quanterix's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Revenue has also lifted 17% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 16% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 7.1% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Quanterix's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Quanterix's P/S?

Quanterix's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Quanterix currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Quanterix that you need to be mindful of.

If you're unsure about the strength of Quanterix's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Quanterix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:QTRX

Quanterix

A life sciences company, engages in development and marketing of digital immunoassay platforms that advances precision health for life sciences research and diagnostics in North America, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives