- United States

- /

- Electrical

- /

- NYSE:SES

Kaltura Leads The Charge With Two Other Noteworthy Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed results with major indexes posting weekly gains, investors continue to navigate a landscape marked by new record highs and ongoing economic uncertainties such as the government shutdown. In this context, penny stocks—often representing smaller or emerging companies—remain an intriguing investment area despite their somewhat outdated moniker. By focusing on those with solid financials and growth potential, investors can uncover opportunities that offer both stability and upside in today's market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.04 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.95 | $705.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.18 | $201.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.85 | $636.96M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9925 | $7.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.92 | $88.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.74 | $10.96M | ✅ 2 ⚠️ 3 View Analysis > |

| Marine Petroleum Trust (MARP.S) | $4.28 | $8.56M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 364 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Kaltura (KLTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kaltura, Inc. offers a range of software-as-a-service (SaaS) and platform-as-a-service (PaaS) products globally, with a market cap of $233.28 million.

Operations: The company's revenue is derived from two main segments: Media & Telecom, contributing $48.39 million, and Enterprise, Education and Technology, which accounts for $132.96 million.

Market Cap: $233.28M

Kaltura, Inc., with a market cap of US$233.28 million, is currently unprofitable but has improved its financial position by reducing losses over the past five years and maintaining a positive cash flow runway for over three years. The company trades at a significant discount to its estimated fair value and has more cash than debt. Recent developments include being added to the S&P Global BMI Index and unveiling the Media Publishing Agent to enhance monetization strategies. Despite insider selling, Kaltura's strategic partnerships, such as with Vodafone, signify potential growth in cloud-native services and international expansion.

- Click here to discover the nuances of Kaltura with our detailed analytical financial health report.

- Learn about Kaltura's future growth trajectory here.

Pyxis Oncology (PYXS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pyxis Oncology, Inc. is a clinical-stage company focused on developing therapeutics for the treatment of solid tumors, with a market cap of $159.39 million.

Operations: The company's revenue is derived from its biotechnology startup segment, amounting to $2.82 million.

Market Cap: $159.39M

Pyxis Oncology, Inc., with a market cap of US$159.39 million, is a clinical-stage company facing challenges typical of penny stocks. It is currently pre-revenue with no meaningful revenue streams and remains unprofitable with increasing losses over the past five years. Despite having no debt and sufficient short-term assets to cover liabilities, its cash runway may be less than a year if cash flow continues to decline at historical rates. Recent events include being dropped from the S&P Global BMI Index and ongoing clinical trials for its cancer therapeutics, which could impact future prospects significantly.

- Click here and access our complete financial health analysis report to understand the dynamics of Pyxis Oncology.

- Understand Pyxis Oncology's earnings outlook by examining our growth report.

SES AI (SES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SES AI Corporation focuses on developing and producing AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for various applications, including electric vehicles and drones, with a market cap of approximately $751.44 million.

Operations: SES AI Corporation does not currently report any revenue segments.

Market Cap: $751.44M

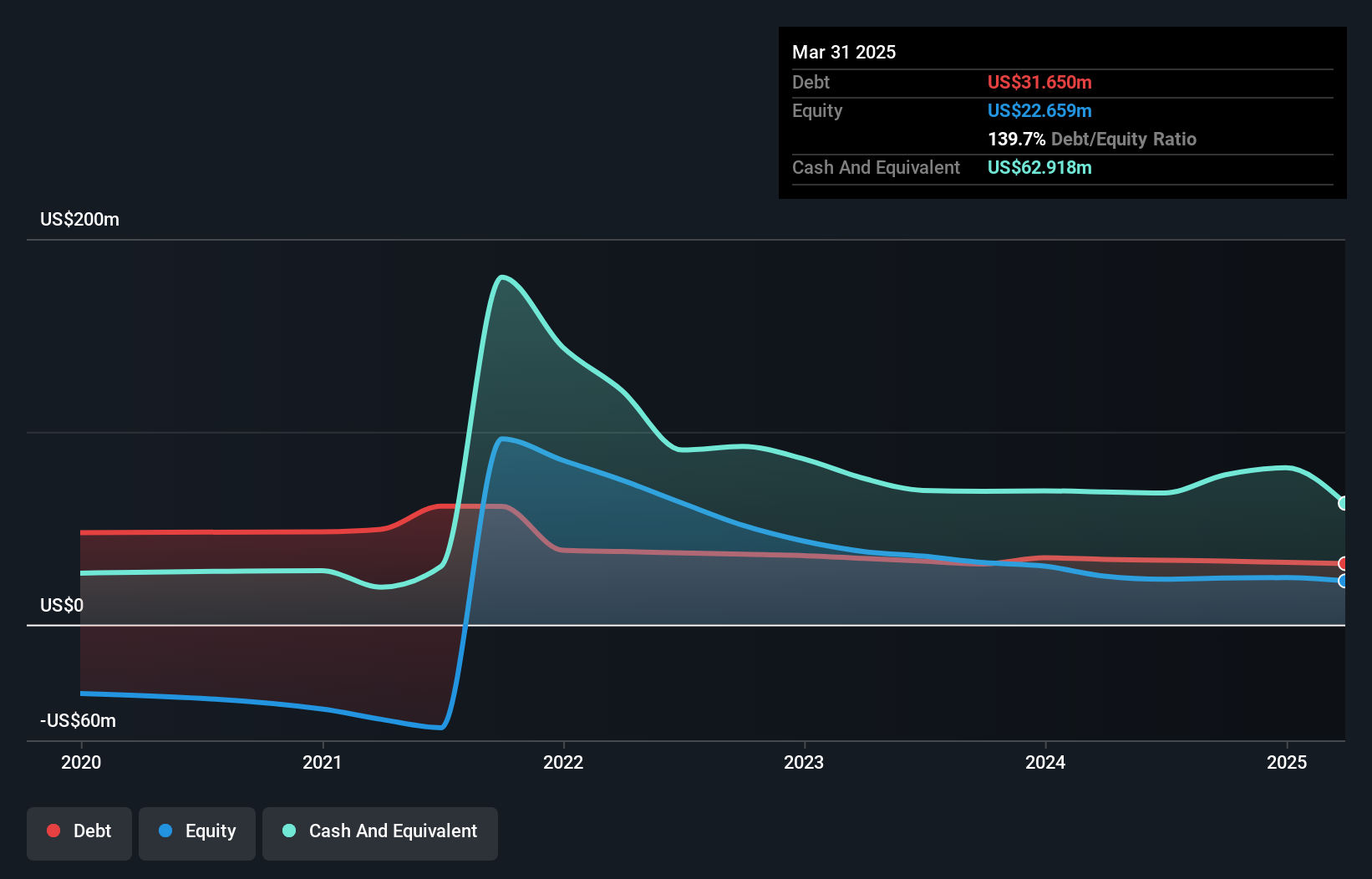

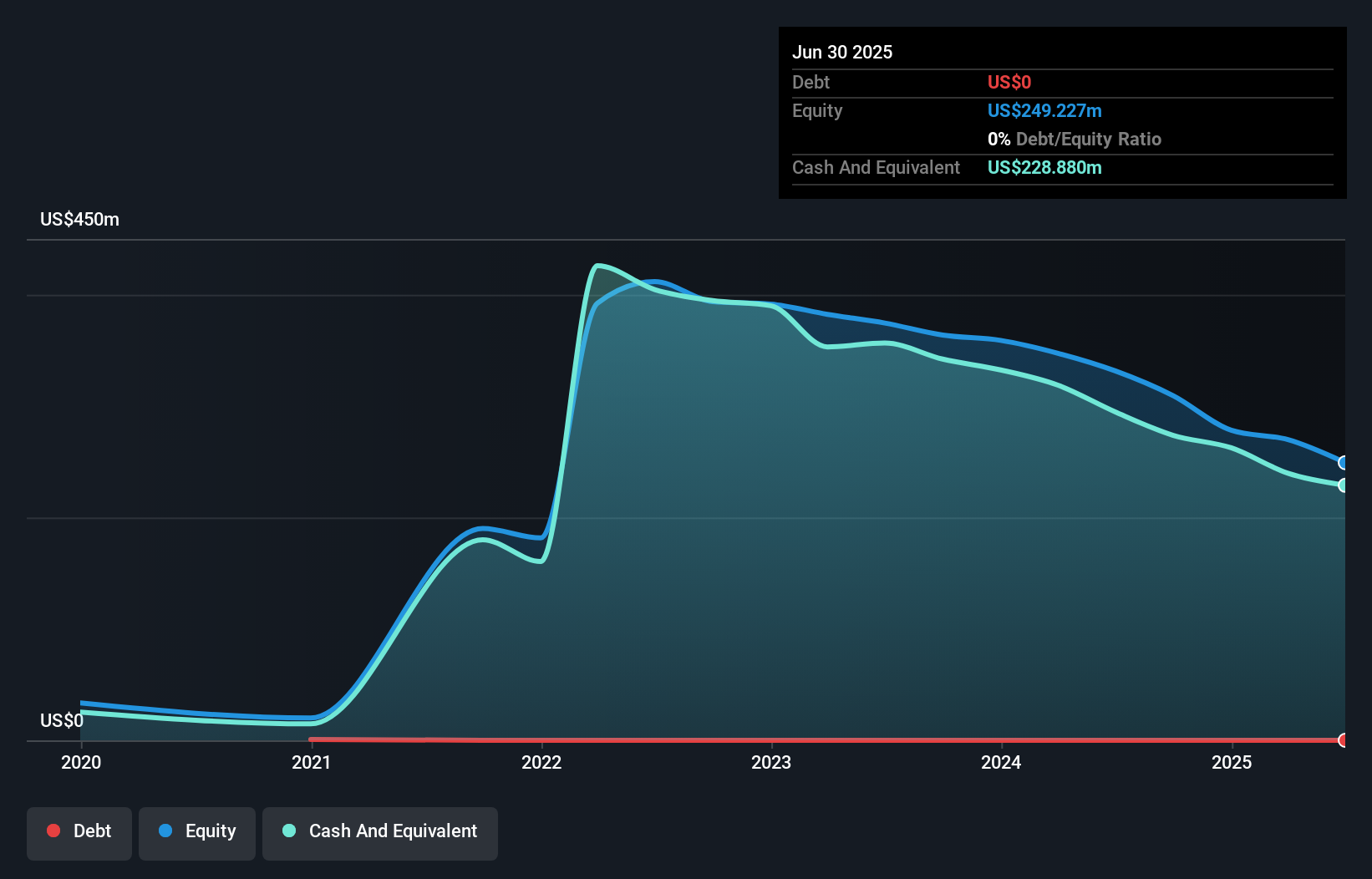

SES AI Corporation, with a market cap of approximately US$751.44 million, remains pre-revenue and unprofitable, facing typical challenges associated with penny stocks. Despite this, it maintains a strong financial position with no debt and short-term assets exceeding liabilities. The company has a cash runway exceeding three years at current cash flow levels. Recent developments include the release of Molecular Universe MU-0.5 to accelerate battery R&D and product development for major industry players. Additionally, SES AI affirmed its 2025 revenue guidance between US$15 million to US$25 million while appointing Andrew Boyd as a new board director to bolster governance expertise.

- Get an in-depth perspective on SES AI's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into SES AI's future.

Taking Advantage

- Take a closer look at our US Penny Stocks list of 364 companies by clicking here.

- Ready To Venture Into Other Investment Styles? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SES

SES AI

Develops and produces AI enhanced lithium metal and lithium ion rechargeable battery technologies for electric vehicles, urban air mobility, drones, robotics, battery energy storage systems, and other applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives