Did You Manage To Avoid Proteostasis Therapeutics's (NASDAQ:PTI) Devastating 78% Share Price Drop?

Proteostasis Therapeutics, Inc. (NASDAQ:PTI) shareholders will doubtless be very grateful to see the share price up 218% in the last quarter. But only the myopic could ignore the astounding decline over three years. Indeed, the share price is down a whopping 78% in the last three years. So we're relieved for long term holders to see a bit of uplift. The thing to think about is whether the business has really turned around.

View our latest analysis for Proteostasis Therapeutics

Proteostasis Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Proteostasis Therapeutics saw its revenue shrink by 16% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 40% per year. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

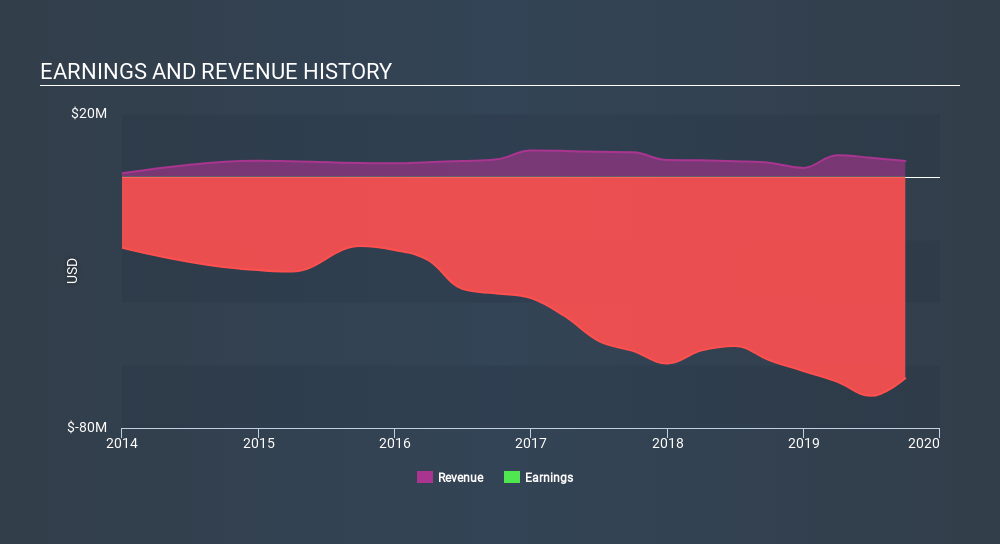

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Proteostasis Therapeutics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Over the last year, Proteostasis Therapeutics shareholders took a loss of 53%. In contrast the market gained about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 40% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Proteostasis Therapeutics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives