- United States

- /

- Biotech

- /

- NasdaqGM:PTGX

Protagonist Therapeutics (PTGX): Evaluating Valuation After Recent Pipeline Updates and Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Protagonist Therapeutics.

Momentum is clearly building for Protagonist Therapeutics as the company has released a series of updates on its late-stage drug candidates. The stock now sits at $90.07, with a year-to-date share price return of 131%. For longer-term holders, the one-year total shareholder return is 106%, and the three-year figure stands at 1,016%, indicating continued investor confidence in the company’s pipeline and growth outlook.

If biotech breakthroughs inspire your portfolio moves, the next logical step is to explore more innovators via our healthcare opportunities screener See the full list for free.

Given the company’s strong run-up and rapid growth, investors must now consider whether Protagonist Therapeutics is trading at a discount to its true value or if the market has already priced in its future success. Is there still a buying opportunity here, or are expectations already reflected in the share price?

Price-to-Earnings of 122.7x: Is it justified?

Protagonist Therapeutics is currently trading at a price-to-earnings (P/E) ratio of 122.7x, which is substantially higher than both the US Biotechs industry average and peer group. At a last close price of $90.07, this valuation raises important questions about whether the stock is overvalued relative to its future earnings potential.

The P/E ratio measures how much investors are willing to pay today for a dollar of the company's earnings. For biopharmaceutical companies like Protagonist Therapeutics, this rate usually reflects market optimism about the pipeline, anticipated revenue growth, and prospects for future profitability. High multiples often indicate expectations of significant growth or upcoming product launches, but they can also amplify the downside if those expectations fall short.

Compared to the US Biotechs industry average P/E of 19.1x and a peer average of 25.6x, Protagonist Therapeutics stands out with its notably elevated multiple. Even the estimated Fair Price-to-Earnings Ratio of 35.9x suggests the current valuation is stretched. This implies that the market has already priced in a substantial amount of optimism and may need even stronger performance to justify the premium.

Explore the SWS fair ratio for Protagonist Therapeutics

Result: Price-to-Earnings of 122.7x (OVERVALUED)

However, clinical setbacks or delays in key approvals could quickly dampen enthusiasm and impact Protagonist Therapeutics’ elevated valuation.

Find out about the key risks to this Protagonist Therapeutics narrative.

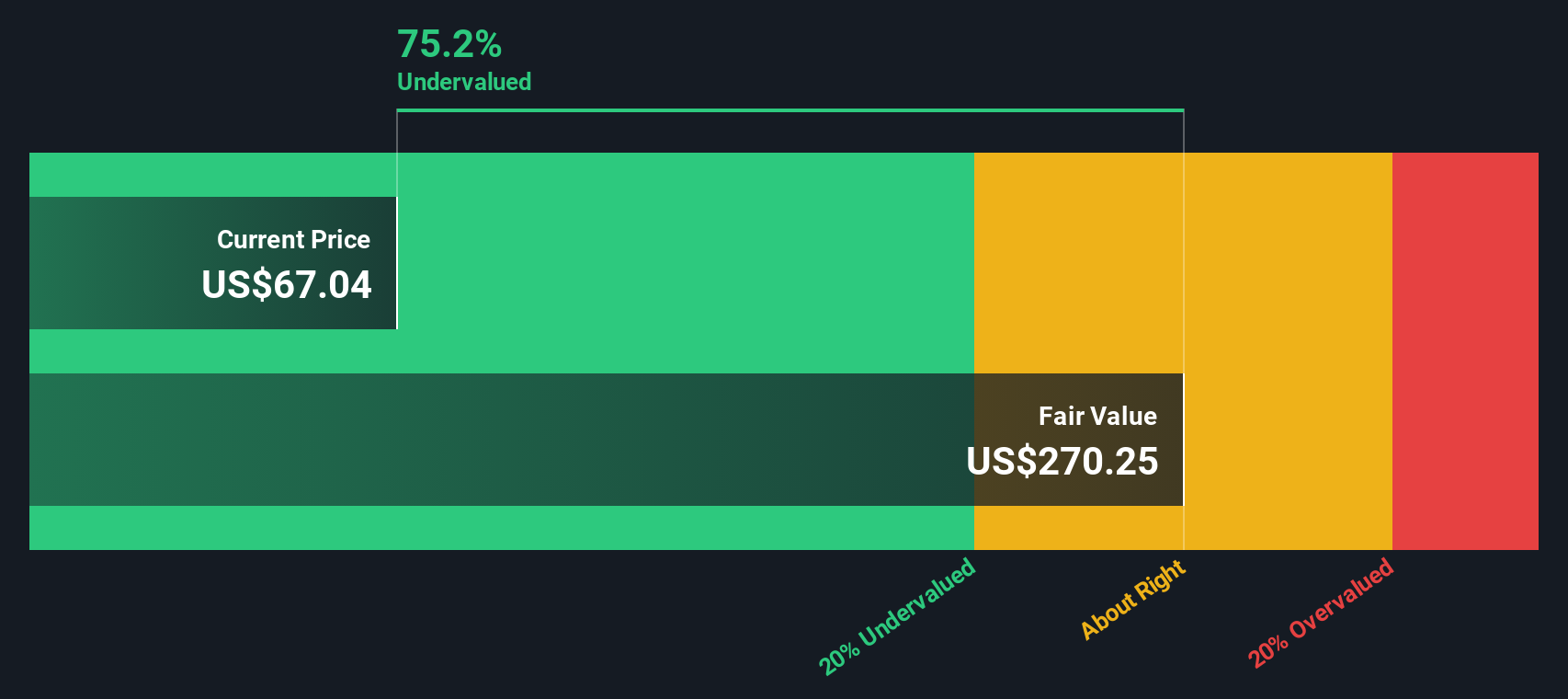

Another View: Our DCF Model Suggests Undervaluation

While the current price-to-earnings ratio suggests that Protagonist Therapeutics is richly valued, our SWS DCF model tells a different story. The stock is trading 23% below our estimated fair value of $117.17, which may imply potential upside if the company's projections hold true. Could this be a hidden value play, or does the market see risks not reflected in the cash flow forecast?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Protagonist Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Protagonist Therapeutics Narrative

If you want to dig deeper or come to your own conclusions, you can easily explore the numbers and shape your own perspective in just a few minutes, Do it your way.

A great starting point for your Protagonist Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still. Step beyond a single stock and unlock fresher opportunities by browsing targeted lists that match your strategy. Don’t let the next winner slip away.

- Uncover strong yield plays and jump into these 15 dividend stocks with yields > 3% that deliver reliable income beyond just share price growth.

- Catalyze your portfolio with artificial intelligence trends by checking out these 25 AI penny stocks powering innovation in automation and data-driven decision-making.

- Future-proof your investments and accelerate exposure to tomorrow’s tech with these 28 quantum computing stocks at the forefront of computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PTGX

Protagonist Therapeutics

A biopharmaceutical company, develops peptide therapeutics for hematology and blood disorders, and inflammatory and immunomodulatory diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.