- United States

- /

- Biotech

- /

- NasdaqGM:PTGX

Is It Too Late to Consider Protagonist Therapeutics After Clinical Trial Progress and Triple Digit Gains?

Reviewed by Bailey Pemberton

Thinking about what to do with your Protagonist Therapeutics shares, or perhaps eyeing an entry? You are not alone. After years of eye-popping growth, Protagonist is once again grabbing attention, both for its share price and the question of whether it is still a bargain or has already outpaced its value. Just in the last year, shares have climbed an impressive 65.2%, jumping a staggering 818.8% across three years, and nearly tripling over the past five. While there was a slight dip of 0.3% in the past week, that's set against a recent 23.3% rally over 30 days and a jaw-dropping 96.8% gain year-to-date. It's not hard to see why investors are excited, but also wondering if all the good news is priced in.

Driving the story lately, Protagonist Therapeutics announced significant progress in its clinical pipeline, including positive mid-stage trial results for its lead candidate. This development has reduced perceived risk around the company and arguably fueled some of the recent price surge. Of course, with new attention comes the perennial valuation debate: is it getting expensive, or is there still further to go?

Based on a set of six key valuation checks, Protagonist earns a value score of 2, signaling it is undervalued on two counts but not broadly across the board. That number puts today's valuation into perspective, yet there is more to the story. In the sections to come, we'll break down how the company stacks up across different valuation approaches. Plus, I'll share a smarter way to weigh the real value of Protagonist at the end.

Protagonist Therapeutics scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Protagonist Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to their present value. This helps investors gauge what the business is worth now, based on its expected future growth and profitability.

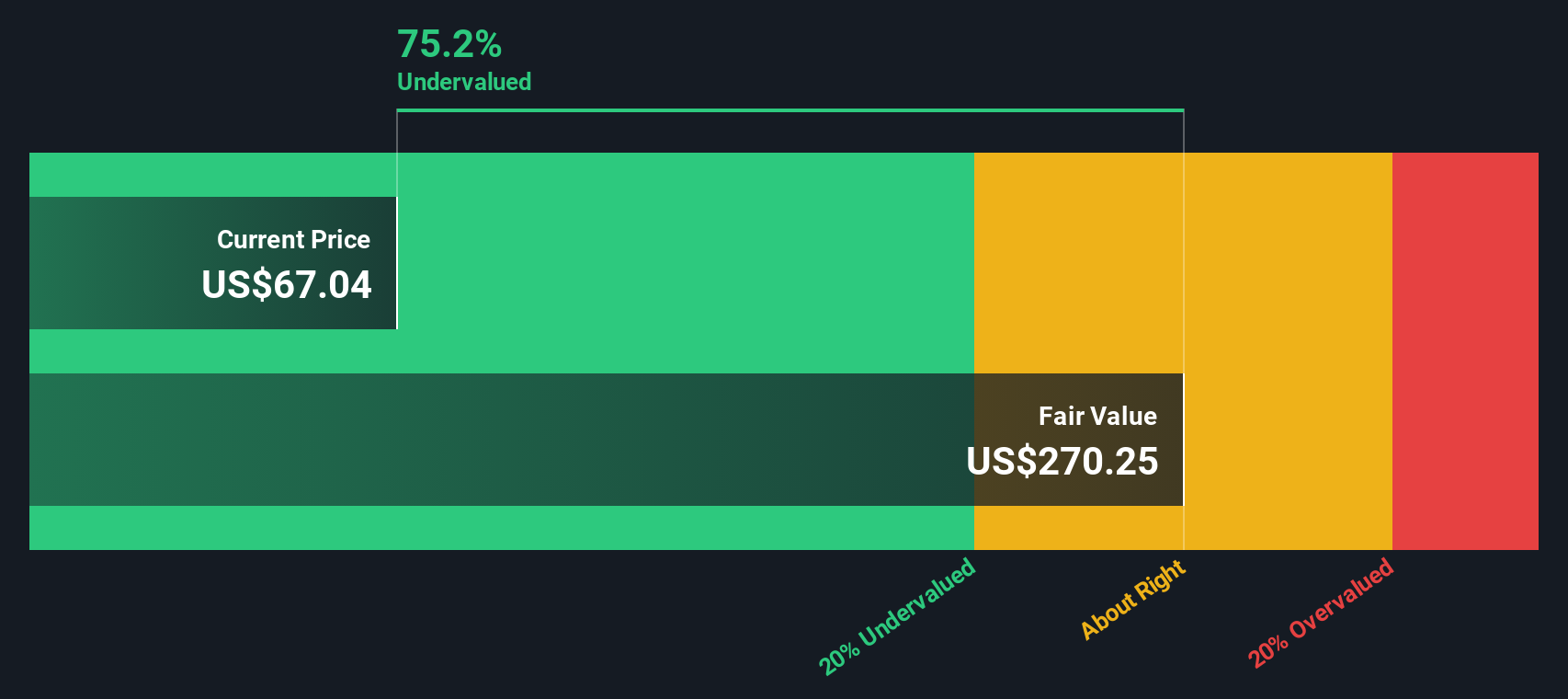

For Protagonist Therapeutics, the latest twelve month Free Cash Flow stands at $38.13 Million. Analysts project cash flow to accelerate rapidly in the coming years, with estimates culminating in $264.5 Million by the end of 2029. While detailed analyst coverage typically only extends five years, Simply Wall St has extrapolated those projections to give a ten-year outlook, suggesting substantial ongoing growth in free cash flow over that period.

Based on these projections, the DCF model estimates Protagonist’s intrinsic value at $266.08 per share. Compared to its current price, this suggests the stock is trading at a 71.2% discount to its calculated intrinsic value. This may indicate significant potential upside and suggest that the market could be underestimating the company’s long-term growth prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Protagonist Therapeutics is undervalued by 71.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Protagonist Therapeutics Price vs Earnings (PE)

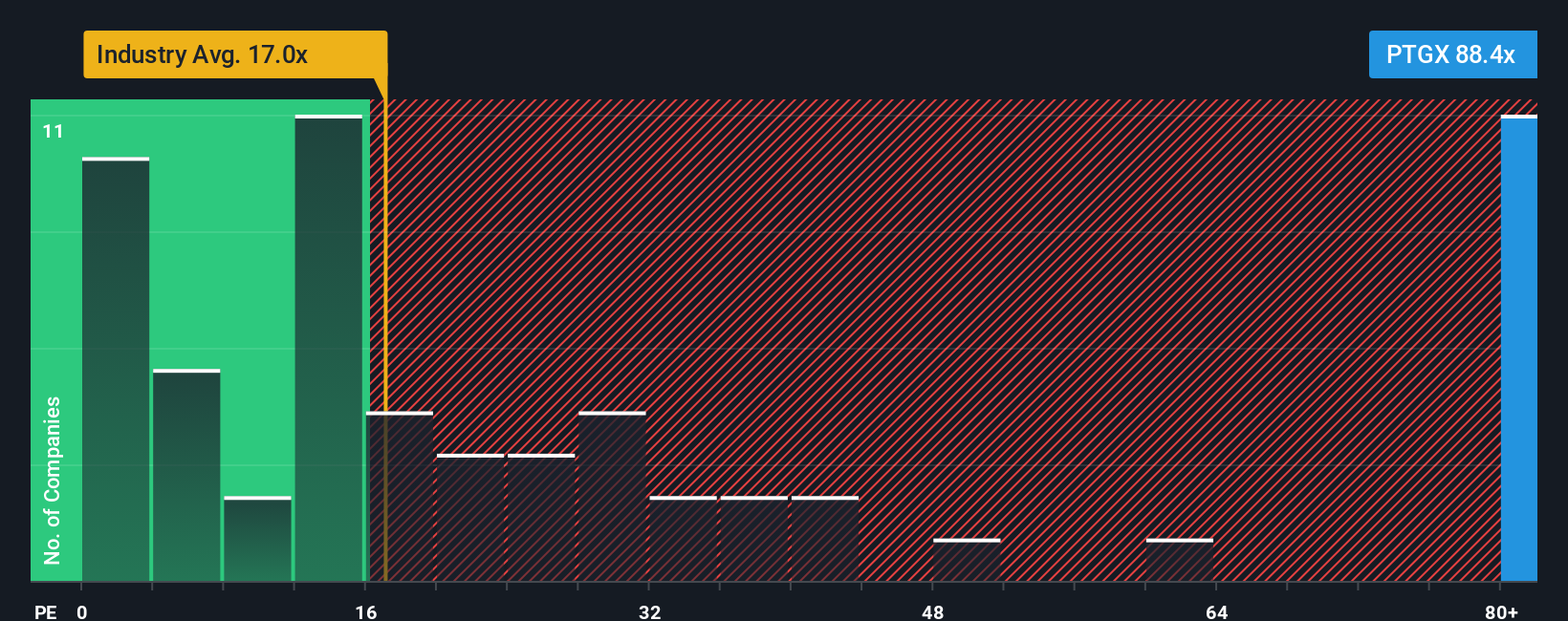

For profitable companies like Protagonist Therapeutics, the Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuation. The PE ratio compares a company's share price to its earnings per share, offering investors a sense of how much the market is willing to pay for each dollar of earnings. Useful for mature biotechs, it reflects the market’s view of future profitability and growth, while also weighing in the company’s risk profile.

Growth expectations and perceived risks play a big role in shaping what is considered a “normal” or “fair” PE ratio. Fast-growing companies or those with lower risk typically trade at higher PE multiples, since investors are willing to pay a premium for anticipated future gains. Conversely, riskier or slower-growing firms often command lower multiples.

Protagonist Therapeutics is currently trading at a PE ratio of 91.7x, which stands well above the biotech industry average of 16.2x and its peer group average of 45.7x. On the surface, this suggests the stock may be expensive. However, Simply Wall St's proprietary “Fair Ratio” offers a deeper perspective. The Fair Ratio for Protagonist is set at 32.5x, which considers more than just basic comparisons, factoring in company-specific growth, profit margins, risks, its market cap, and the unique characteristics of the biotech industry itself. This broader analysis makes the Fair Ratio a more nuanced and useful benchmark than industry or peer averages alone.

Since Protagonist’s actual PE of 91.7x is substantially above its Fair Ratio of 32.5x, the stock appears overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Protagonist Therapeutics Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple and approachable tool that allows you to tell the story you believe about a company, linking your unique perspective directly to a financial forecast and a fair value calculation. Instead of just relying on rigid ratios or analyst predictions, you can map out your own expectations for Protagonist Therapeutics, from how fast you think revenues will grow, to margins, and even your sense of risk, all in one place.

Narratives make complex investing decisions more accessible and dynamic, and they are easy to use on Simply Wall St’s Community page, where millions of investors share and compare their views. With Narratives, you can see at a glance how your chosen fair value stacks up against the current share price and use that insight to decide when buying or selling makes sense for you. Plus, every Narrative updates automatically when fresh news or earnings data arrives, so your view always reflects the latest information. For example, one investor’s Narrative for Protagonist Therapeutics might set a high fair value based on breakthrough trial results, while another could be more conservative based on concerns around competition and cash burn.

Do you think there's more to the story for Protagonist Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PTGX

Protagonist Therapeutics

A biopharmaceutical company, develops peptide therapeutics for hematology and blood disorders, and inflammatory and immunomodulatory diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives