- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

Will uniQure’s Results Pressure PTC Therapeutics’ (PTCT) Rare Disease Leadership and Revenue Ambitions?

Reviewed by Sasha Jovanovic

- Recently, clinical trial data from uniQure revealed a 75% reduction in Huntington's disease progression, increasing competition for PTC Therapeutics’ own gene therapy pipeline as insider selling and questions around revenue growth raised new concerns among investors.

- This development intensifies the spotlight on PTC's late-stage programs and heightens stakeholder scrutiny of its potential to maintain a competitive edge in rare disease treatments.

- To better understand the impact of uniQure’s clinical trial results on PTC Therapeutics, we’ll examine how heightened competitive pressure could influence its long-term outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

PTC Therapeutics Investment Narrative Recap

To be a shareholder in PTC Therapeutics, one needs to believe not only in the company’s ability to deliver innovative treatments for rare diseases, but also in its capacity to withstand competitive threats to its pipeline. uniQure’s recently published results in Huntington’s disease increase the pressure on PTC’s own late-stage gene therapy programs, though they do not materially impact Sephience, the lead near-term growth driver, which remains the most important catalyst and the focal point for the company’s revenue outlook. The biggest risk continues to be negative revenue trends and rising competitive intensity in core franchises.

Among recent announcements, the September launch of Sephience in the US and Europe stands out. This launch anchors PTC’s growth narrative, particularly as the company faces both immediate and longer-term competitive and pipeline questions, making near-term sales performance for Sephience a key metric for investors tracking upcoming catalysts.

However, in contrast to new product momentum, the increased scrutiny from growing insider selling is information investors should be aware of as they consider...

Read the full narrative on PTC Therapeutics (it's free!)

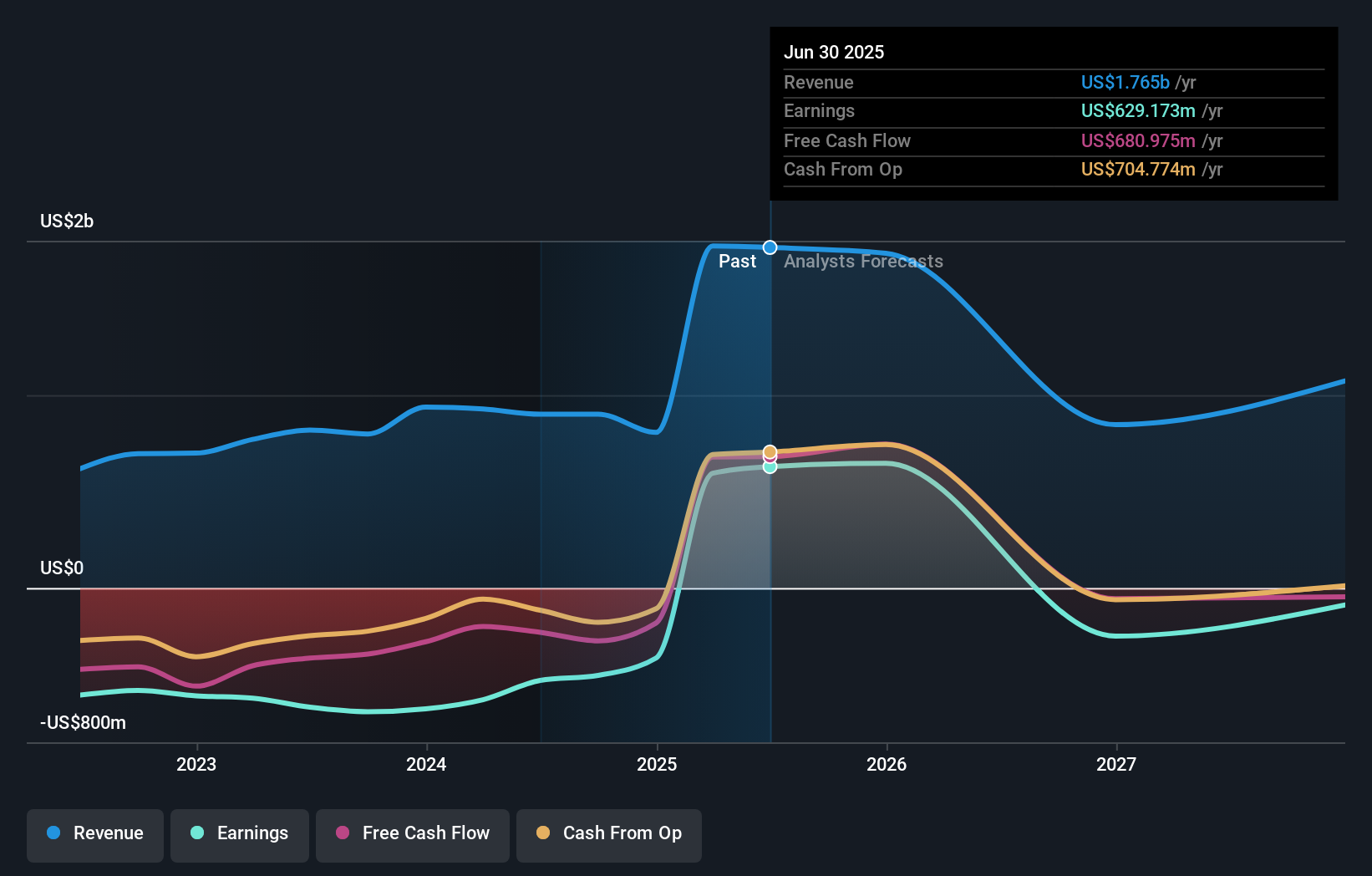

PTC Therapeutics is projected to have $1.3 billion in revenue and $55.4 million in earnings by 2028. This assumes revenues will decline by 10.3% per year and earnings will decrease by $573.8 million from the current $629.2 million.

Uncover how PTC Therapeutics' forecasts yield a $66.69 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Only one Simply Wall St Community fair value estimate is available, at US$66.69, showing limited diversity in views before the recent news. With competitive threats in rare disease treatments intensifying, you should consider how participant expectations can diverge sharply over time.

Explore another fair value estimate on PTC Therapeutics - why the stock might be worth just $66.69!

Build Your Own PTC Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC Therapeutics research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PTC Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives