- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

PTC Therapeutics (PTCT) Is Down 9.5% After Broad S&P Additions And Insider Moves Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In late November 2025, PTC Therapeutics was added to the S&P 1000, S&P Composite 1500, S&P 600, and S&P 600 Health Care indices, while also approving new employee inducement equity grants and recording insider share sales by its CEO and a board director.

- This cluster of index inclusions, insider transactions, and equity awards comes shortly after PTC reported a profitable third quarter and early commercial momentum for its new rare-disease drug Sephience.

- We’ll now examine how PTC’s broad S&P index inclusions may influence its investment narrative, particularly around visibility and liquidity.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

PTC Therapeutics Investment Narrative Recap

To own PTC Therapeutics today, you have to believe Sephience and the late‑stage rare‑disease pipeline can offset concentration risks around a small product set and uneven revenue visibility. The fresh S&P index inclusions and insider transactions do not materially change the near term focus on Sephience execution as the key catalyst, or the dependence on Translarna access and pipeline approvals as the biggest current risks.

The most relevant update here is PTC’s swing to profitability in Q3 2025, with US$211.0 million in revenue and US$15.9 million in net income. That step into the black, supported by early Sephience sales, is what underpins both the bullish narrative around rare‑disease leverage and the concern that any setback in Sephience demand or in pending regulatory decisions could quickly pressure cash flows again.

Yet investors also need to weigh how fragile PTC’s revenue base remains if Translarna access or Sephience uptake were to unexpectedly...

Read the full narrative on PTC Therapeutics (it's free!)

PTC Therapeutics’ narrative projects $1.3 billion in revenue and $55.4 million in earnings by 2028.

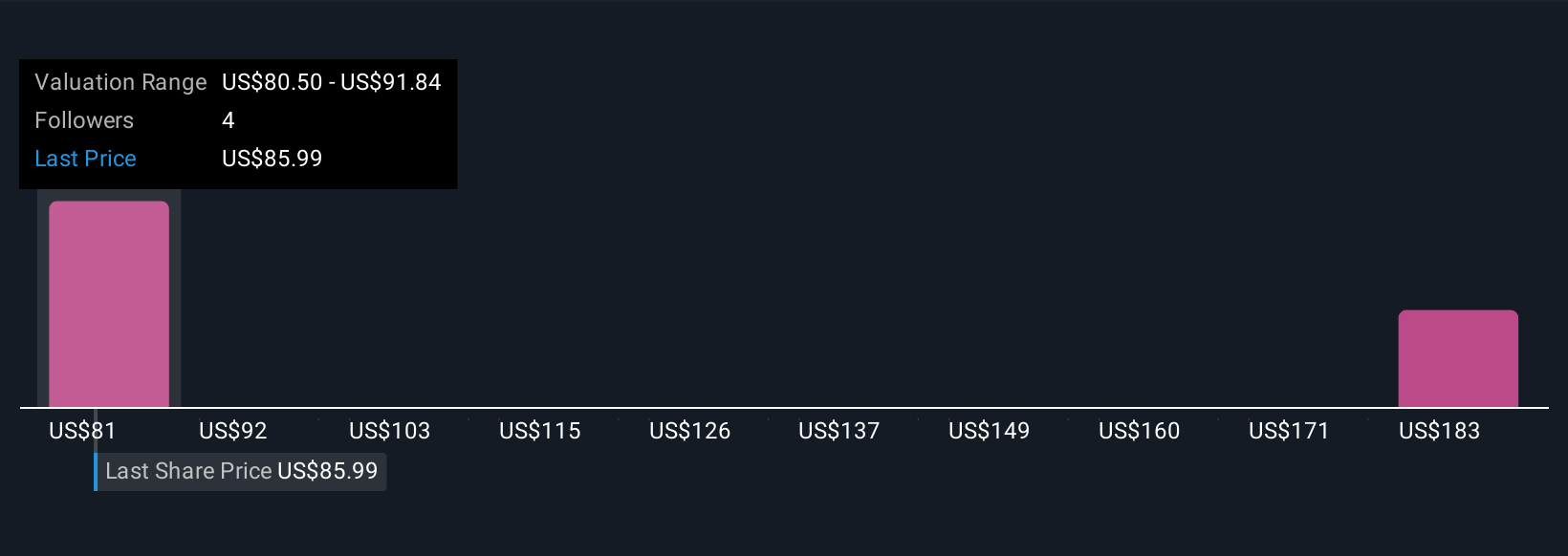

Uncover how PTC Therapeutics' forecasts yield a $80.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$80.50 to US$192.43 per share, underlining how far apart individual views can be. Against that backdrop, the company’s reliance on a few key rare‑disease products for revenue concentration becomes a central issue that readers may want to examine through several contrasting opinions.

Explore 3 other fair value estimates on PTC Therapeutics - why the stock might be worth just $80.50!

Build Your Own PTC Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC Therapeutics research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PTC Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026