- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

Could the 68.7% One Year Rally Mean the Market Is Missing Something at PTC Therapeutics?

Reviewed by Bailey Pemberton

Trying to figure out what’s next for PTC Therapeutics? You’re not alone. Whether you’re holding shares, eyeing an entry, or just want to keep tabs on one of biotech’s more intriguing players, let’s dig in. Over the past month, the stock has put on a show, rising 8.7%. Zoom out a bit further and you’ll spot a year-to-date surge of 43.7%, with a hefty 68.7% jump over the past year. That’s more than just a good run, and it has caught the market’s attention, especially as broader industry developments have reinvigorated biotech risk appetites and shifted perceptions around smaller innovators like PTC.

But what’s driving this momentum, and is there real value left after such impressive gains? That’s where things get interesting. By classic valuation measures, PTC Therapeutics racks up a solid value score of 5 out of 6, indicating it’s undervalued in five major checks. For anyone weighing the stock now, understanding why the market has moved, and where it might go from here, comes down to digging into these different valuation angles. Up next, we’ll walk through the main approaches analysts use, but stick around, because there’s an even sharper lens for getting to the heart of PTC’s true worth later in the article.

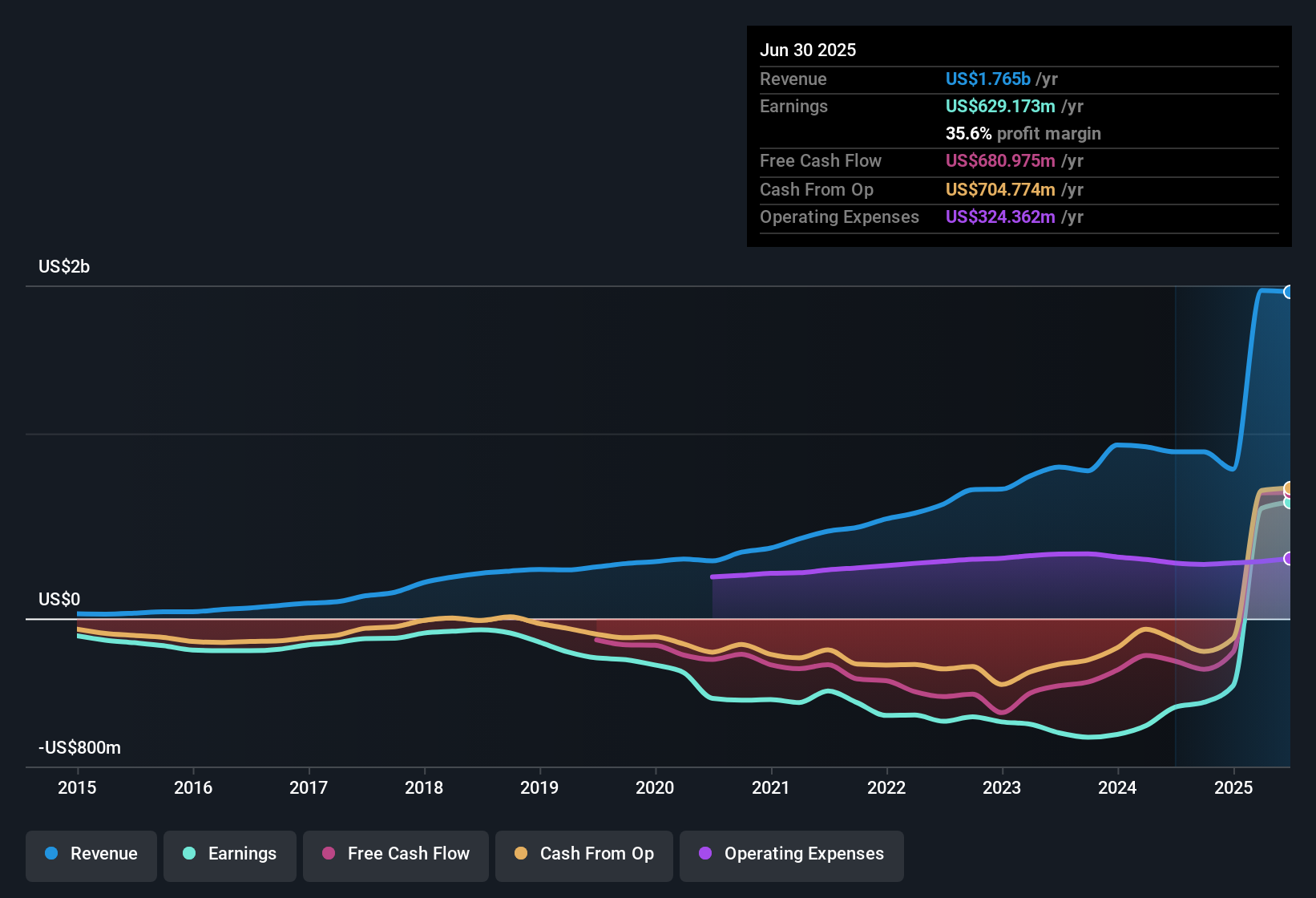

Approach 1: PTC Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s value using an appropriate rate. This helps investors understand what a company might be worth based on its ability to generate cash in the future.

For PTC Therapeutics, analysts estimate the company’s current free cash flow at $575.9 Million, with a series of projections extending roughly ten years into the future. Official analyst forecasts cover the next five years. From 2030 onward, projections are extrapolated based on historical growth patterns. By 2029, free cash flow is expected to reach $515 Million and is projected to progress even higher in the years beyond.

Taking all these cash flows into account, the 2 Stage Free Cash Flow to Equity model suggests a fair value estimate of $188.69 per share. Compared to recent share prices, this implies that PTC Therapeutics is trading at about a 65.0% discount to its intrinsic value. This points to significant potential upside if these forecasts are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PTC Therapeutics is undervalued by 65.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

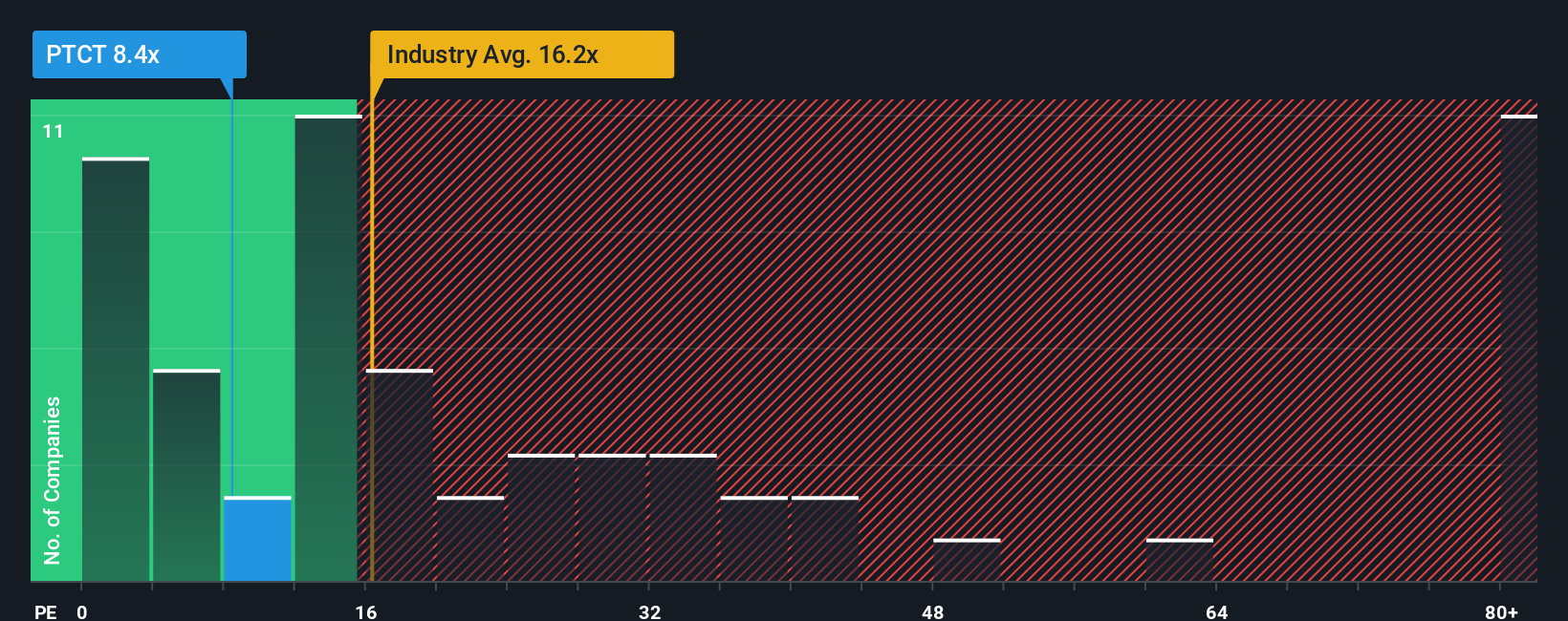

Approach 2: PTC Therapeutics Price vs Earnings

For profitable biotechs like PTC Therapeutics, the Price-to-Earnings (PE) ratio is often the go-to yardstick for valuation. It helps investors quickly gauge how much they're paying for each dollar of reported profit. A lower PE can signal undervaluation, but it's important to remember that growth prospects and risk levels play a big part in what counts as a "normal" or "fair" PE ratio. Fast-growing, lower-risk companies typically deserve a higher multiple than slower, riskier peers.

Currently, PTC Therapeutics trades at a PE ratio of 8.33x. This stacks up favorably compared to the biotech industry average of 16.40x and the peer average of 15.17x, suggesting a notable discount. However, averages don't always tell the whole story because they ignore specific factors unique to PTC, like its earnings growth outlook, margins, and risk profile.

That’s where Simply Wall St’s proprietary Fair Ratio comes in. This metric accounts for what the PE ratio should be, factoring in PTC's growth, profitability, risk, industry landscape, and even market cap. For PTC, the Fair Ratio is 11.17x. Because it actually reflects the company's unique circumstances, it provides a stronger guide than comparing with broad industry or peer averages alone.

Comparing PTC's actual PE ratio of 8.33x to its Fair Ratio of 11.17x, the stock appears undervalued by this measure. That suggests there could still be room for upside, even after recent gains.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PTC Therapeutics Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company, connecting what you believe about its business, industry, and catalysts to a custom financial forecast and a personal estimate of fair value. Narratives bring insights to life by linking the company’s journey, such as revenue outlooks, margin assumptions, and key events, directly to numbers, so you can see not just what a stock is worth, but why.

On Simply Wall St’s Community page, millions of investors use Narratives to create, update, and debate their own PTC Therapeutics stories. This tool makes investing more interactive and transparent, helping you compare your Fair Value (based on your forecast) to the real market Price, so you can decide when a stock is worth buying, holding, or selling. Plus, Narratives stay dynamic; when new information like earnings or major news hits, your scenario updates automatically so you always have a fresh perspective tied to real data.

For example, some investors see major growth ahead thanks to Sephience’s global launch and have set Fair Values as high as $118 per share. Others worry about product dependence and regulatory risk, placing their Fair Value closer to $44, so your Narrative helps you decide where you land on that spectrum.

Do you think there's more to the story for PTC Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives