- United States

- /

- Life Sciences

- /

- NasdaqGM:PSNL

Personalis, Inc. (NASDAQ:PSNL) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Personalis, Inc. (NASDAQ:PSNL) share price has dived 26% in the last thirty days, prolonging recent pain. The good news is that in the last year, the stock has shone bright like a diamond, gaining 166%.

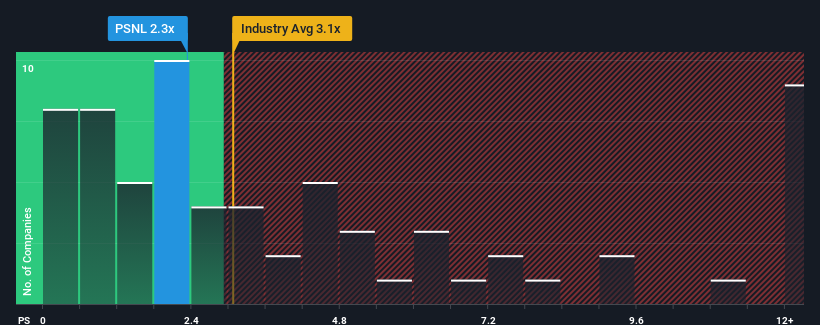

Since its price has dipped substantially, Personalis' price-to-sales (or "P/S") ratio of 2.3x might make it look like a buy right now compared to the Life Sciences industry in the United States, where around half of the companies have P/S ratios above 3.1x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Personalis

What Does Personalis' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Personalis has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Personalis.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Personalis' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 35% per annum as estimated by the six analysts watching the company. With the industry only predicted to deliver 7.1% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Personalis is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Personalis' P/S?

The southerly movements of Personalis' shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Personalis' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Personalis that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PSNL

Personalis

Develops, markets, and sells advanced cancer genomic tests and services in the United States and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives