- United States

- /

- Life Sciences

- /

- NasdaqGM:PSNL

Investors Still Aren't Entirely Convinced By Personalis, Inc.'s (NASDAQ:PSNL) Revenues Despite 28% Price Jump

Personalis, Inc. (NASDAQ:PSNL) shares have continued their recent momentum with a 28% gain in the last month alone. This latest share price bounce rounds out a remarkable 306% gain over the last twelve months.

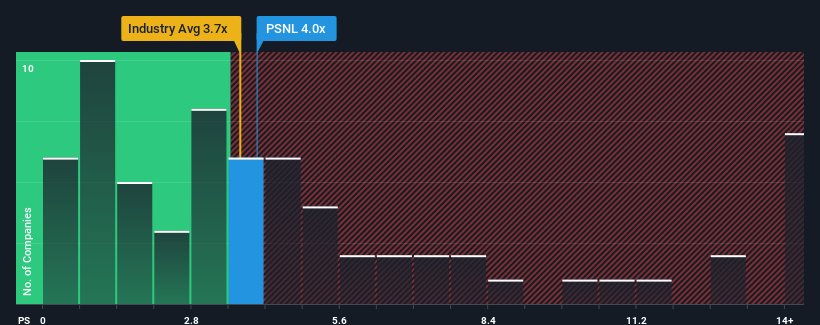

Although its price has surged higher, there still wouldn't be many who think Personalis' price-to-sales (or "P/S") ratio of 4x is worth a mention when the median P/S in the United States' Life Sciences industry is similar at about 3.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Personalis

How Has Personalis Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Personalis has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Personalis' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Personalis?

Personalis' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 3.0% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 33% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 7.2% each year growth forecast for the broader industry.

In light of this, it's curious that Personalis' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Personalis' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Personalis' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Personalis (1 is concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Personalis, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PSNL

Personalis

Develops, markets, and sells advanced cancer genomic tests and services in the United States and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives