- United States

- /

- Biotech

- /

- NasdaqCM:PRQR

The ProQR Therapeutics (NASDAQ:PRQR) Share Price Has Gained 163%, So Why Not Pay It Some Attention?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For instance the ProQR Therapeutics N.V. (NASDAQ:PRQR) share price is 163% higher than it was three years ago. How nice for those who held the stock! In more good news, the share price has risen 9.1% in thirty days. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

View our latest analysis for ProQR Therapeutics

Because ProQR Therapeutics is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

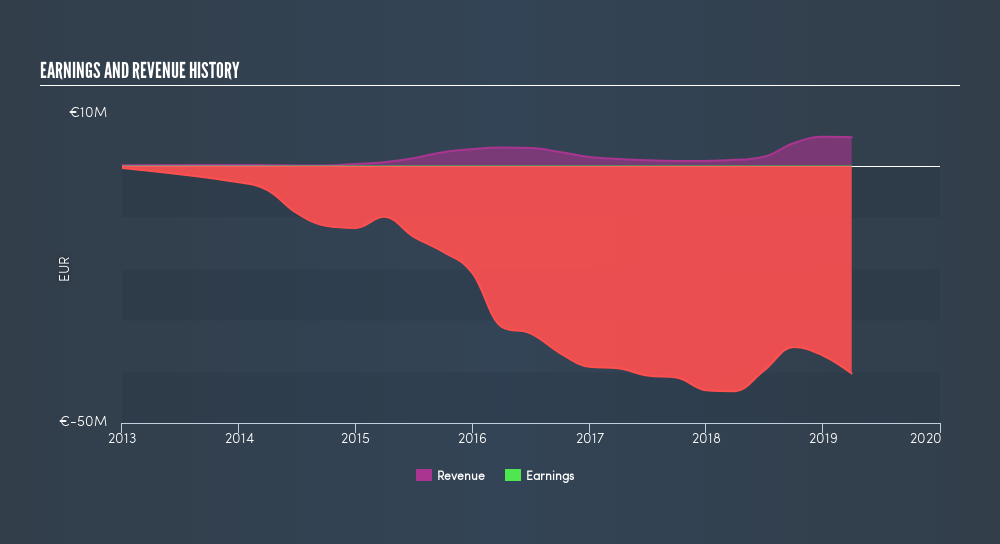

ProQR Therapeutics's revenue trended up 25% each year over three years. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 38% compound over three years. But it does seem like the market is paying attention to strong revenue growth. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Pleasingly, ProQR Therapeutics's total shareholder return last year was 134%. That gain actually surpasses the 38% TSR it generated (per year) over three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. You could get a better understanding of ProQR Therapeutics's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:PRQR

ProQR Therapeutics

A biotechnology company, focuses on the discovery and development of novel therapeutic medicines.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives