- United States

- /

- Pharma

- /

- NasdaqCM:PRPH

It's Down 65% But ProPhase Labs, Inc. (NASDAQ:PRPH) Could Be Riskier Than It Looks

ProPhase Labs, Inc. (NASDAQ:PRPH) shareholders that were waiting for something to happen have been dealt a blow with a 65% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 83% share price decline.

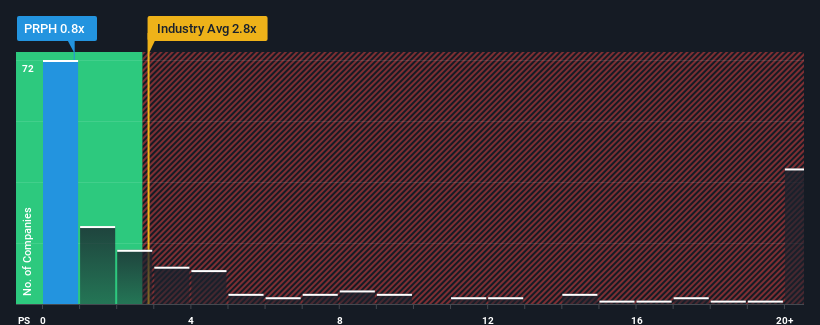

After such a large drop in price, ProPhase Labs may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 3x and even P/S higher than 16x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for ProPhase Labs

How Has ProPhase Labs Performed Recently?

ProPhase Labs hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on ProPhase Labs will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

ProPhase Labs' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 77% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 46% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 80% over the next year. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that ProPhase Labs' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On ProPhase Labs' P/S

Having almost fallen off a cliff, ProPhase Labs' share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

ProPhase Labs' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 4 warning signs for ProPhase Labs (1 makes us a bit uncomfortable!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PRPH

ProPhase Labs

Develops and commercializes novel drugs, dietary supplements, and compounds in the United States.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives