- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

Praxis Precision Medicines (PRAX) Is Up 10.8% After FDA OKs Early NDA Path for Relutrigine

Reviewed by Sasha Jovanovic

- Praxis Precision Medicines recently announced it has reached alignment with the FDA on using interim results from the EMBOLD study as a potential basis for early NDA submission for relutrigine in rare pediatric epilepsies, pending positive data in late 2025.

- This regulatory agreement marks an important step toward accelerating access to a potential first approved treatment for ultra-rare, life-threatening epileptic encephalopathies that currently have no FDA-approved options.

- We'll explore how FDA alignment on an expedited approval path for relutrigine shapes Praxis Precision Medicines' investment story.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Praxis Precision Medicines' Investment Narrative?

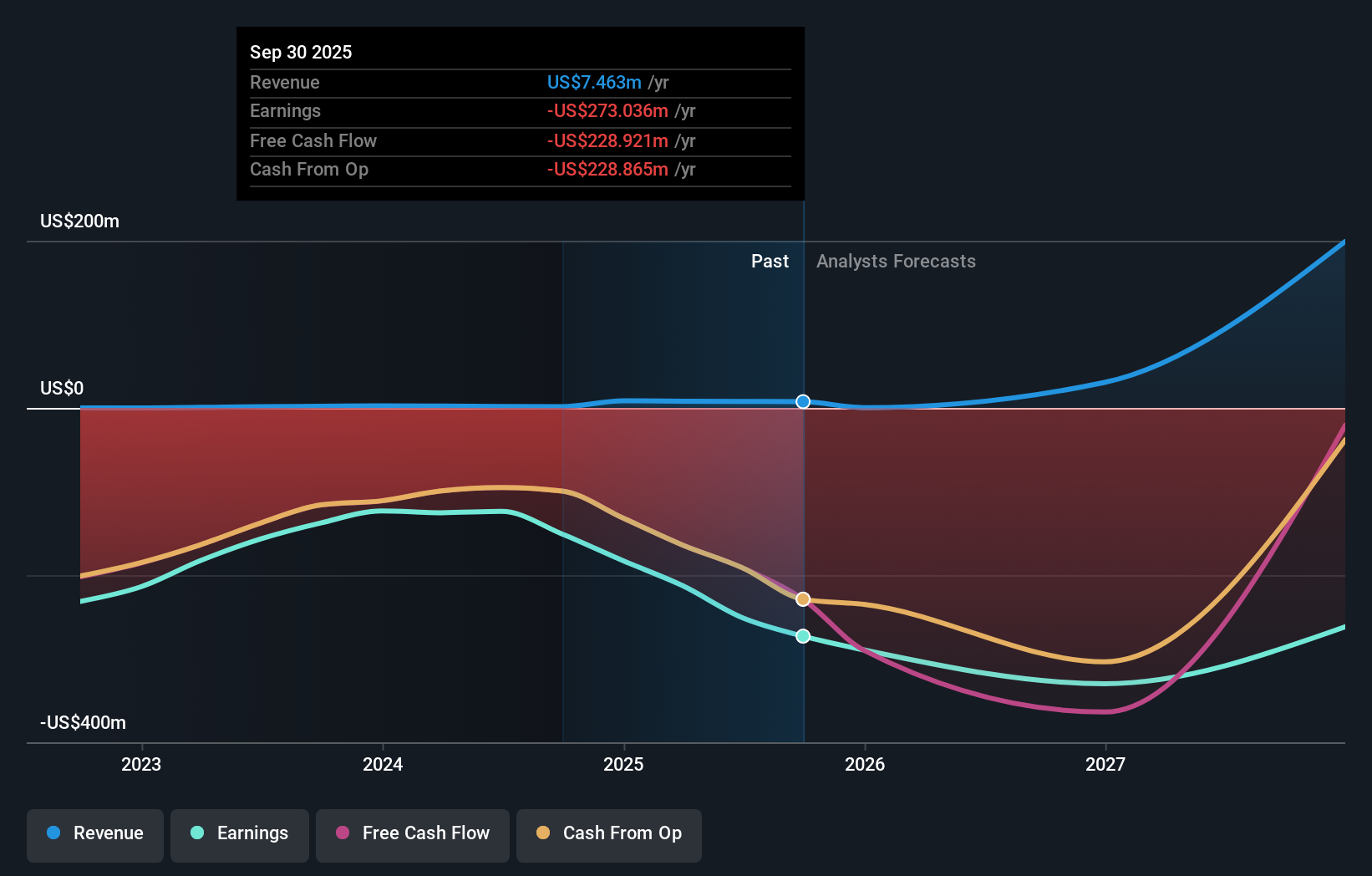

For anyone considering a stake in Praxis Precision Medicines, the investment case ultimately depends on belief in its ability to deliver FDA-approved therapies in rare neurological disease spaces, where current treatment options are limited or nonexistent. The recent FDA alignment on relutrigine's interim EMBOLD study data adds fresh weight to the company’s pipeline potential, setting up a new short-term catalyst around the fourth quarter of 2025. This could accelerate timelines and shift market attention squarely onto Praxis’s late-stage rare disease programs, boosting near-term sentiment. However, this optimism comes against a backdrop of continuing significant losses, recent shareholder dilution, and an uncertain pathway to profitability, with the EMBOLD outcome now looming even larger as a crucial risk factor. Ultimately, investors face a concentrated bet: if Praxis delivers positive data, it could be transformative; if not, the risks around capital needs and execution only grow. In contrast, the risk of ongoing cash burn and trial setbacks should not be underestimated.

Praxis Precision Medicines' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Praxis Precision Medicines - why the stock might be worth over 10x more than the current price!

Build Your Own Praxis Precision Medicines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Praxis Precision Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Praxis Precision Medicines' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Flawless balance sheet with low risk.

Market Insights

Community Narratives