- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

Praxis Precision Medicines (PRAX): Evaluating Valuation After Positive Phase 3 Results for Essential Tremor Drug

Reviewed by Simply Wall St

Praxis Precision Medicines (PRAX) caught the market’s attention this month after announcing successful topline results from its Phase 3 Essential3 trial for ulixacaltamide in essential tremor. The company now plans to pursue FDA approval.

See our latest analysis for Praxis Precision Medicines.

The stunning topline results from Praxis’s Phase 3 trial lit a fire under the shares this month, with the stock posting a remarkable 254.6% 1-month share price return and total shareholder return of 159% over the past year. Not only did the successful ulixacaltamide trial reframe its growth story, but the company also completed a significant equity offering, providing fresh capital as it looks ahead to FDA review. While momentum is clearly building, long-term investors are still climbing back from sizable past losses, so the recent rally marks a major change in sentiment rather than the end of the story.

If discovering breakthrough moves like Praxis’s inspires you, now’s the perfect moment to broaden your search and see what’s possible with See the full list for free.

With shares rocketing higher on its latest breakthrough, is Praxis still trading below its true worth? Or has the market already fully priced in the company’s future growth after this pivotal news?

Price-to-Book of 9.7x: Is it justified?

Praxis Precision Medicines trades at a price-to-book ratio of 9.7x, which stands out both relative to the overall market and its biotech peers. With a recent close at $185.94, this valuation raises the question: are investors getting ahead of themselves, or is this premium justifiable?

The price-to-book ratio compares a company’s market capitalization to its net asset value. This is a popular benchmark in asset-heavy sectors like biotechs. A higher ratio can indicate optimism for future breakthroughs but may also signal market exuberance if not supported by robust business prospects.

Compared to the US biotechs industry average of just 2.5x, Praxis is trading at a significant premium. However, when compared to a peer group average of 12.8x, Praxis looks like relative value in a high-growth, high-expectation field. The current figure shows the market is betting heavily on Praxis’s long-term pipeline progress, but this may change as its asset base evolves.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 9.7x (OVERVALUED)

However, substantial net losses and reliance on ongoing trial success could quickly reverse momentum if future results or funding do not meet expectations.

Find out about the key risks to this Praxis Precision Medicines narrative.

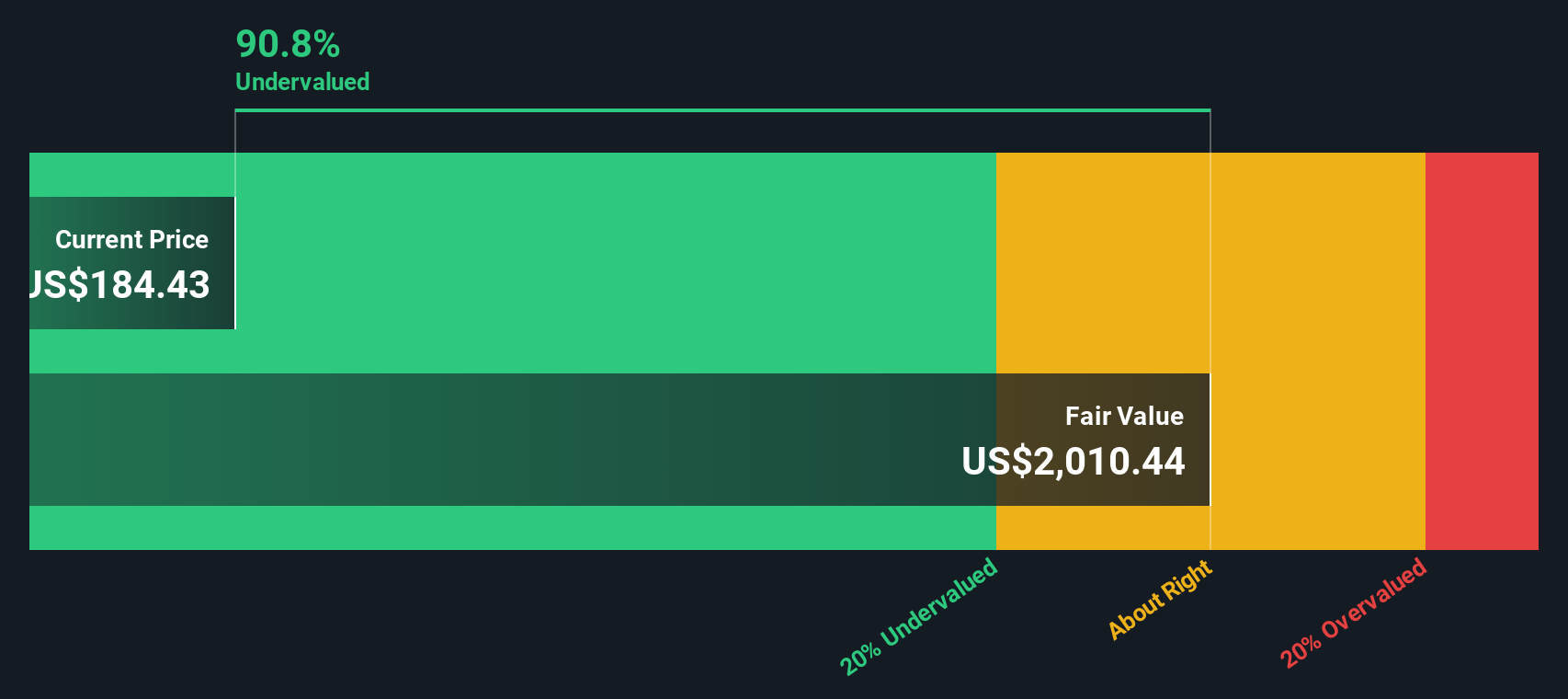

Another View: Discounted Cash Flow Shows a Different Picture

While the price-to-book ratio suggests Praxis is expensive versus the sector, our SWS DCF model tells a different story. Based on this method, Praxis appears dramatically undervalued and is trading about 90.7% below the estimate of fair value. In other words, there may be much more upside than the current price reflects.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Praxis Precision Medicines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Praxis Precision Medicines Narrative

If you’re inclined to dig deeper or believe there’s another side to the Praxis Precision Medicines story, take just a few minutes to craft your own perspective. Do it your way

A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Broaden your investing horizons and seize the next great opportunity before the crowd catches on. The market never waits, so why should you?

- Uncover fresh potential with these 874 undervalued stocks based on cash flows and spot companies the market is overlooking.

- Earn consistent income by strengthening your portfolio with these 19 dividend stocks with yields > 3%, which features reliable yields above 3%.

- Get ahead of breakthrough technology trends with these 27 AI penny stocks at the frontier of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Flawless balance sheet and fair value.

Market Insights

Community Narratives