- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

How Investors Are Reacting To Praxis Precision Medicines (PRAX) Securities Probe After Mixed Seizure Study Results

Reviewed by Simply Wall St

- In early August 2025, Praxis Precision Medicines announced topline results from its Phase 2 RADIANT study of vormatrigine for focal onset seizures and reported a net loss of US$71.13 million for the second quarter, with subsequent special calls and an earnings announcement.

- This news was shortly followed by Pomerantz LLP launching an investigation into the company, raising further scrutiny amid concerns about treatment-emergent adverse events and discontinuation rates observed in the study.

- We'll explore how the investigation into potential securities fraud following mixed clinical results could impact Praxis Precision Medicines' investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Praxis Precision Medicines' Investment Narrative?

To be a shareholder in Praxis Precision Medicines right now, you’re essentially betting on its ability to turn promising clinical momentum into long-term value, despite a record of financial losses and heavy R&D spend. The company’s topline Phase 2 results for vormatrigine signaled potential for a differentiated epilepsy treatment, setting up late-2025 clinical milestones as critical short-term catalysts. However, the accompanying report of treatment-emergent adverse events and discontinuations saw the market react swiftly, with shares dropping and investor law firms initiating investigations into potential securities law violations. This raises immediate questions about trial safety profiles and future study enrollment, risking delays in upcoming readouts like the POWER1 and EMBOLD-2 studies. Previously, the catalyst calendar was dominated by data updates and regulatory milestones, but now investors must also factor in legal scrutiny and possibly heightened risk aversion among stakeholders. If these investigations remain non-material, the catalysts may remain intact, but sentiment and risk perception have clearly shifted in the near term.

In contrast, the level of regulatory and legal scrutiny emerging is a risk long-term holders should not overlook.

Exploring Other Perspectives

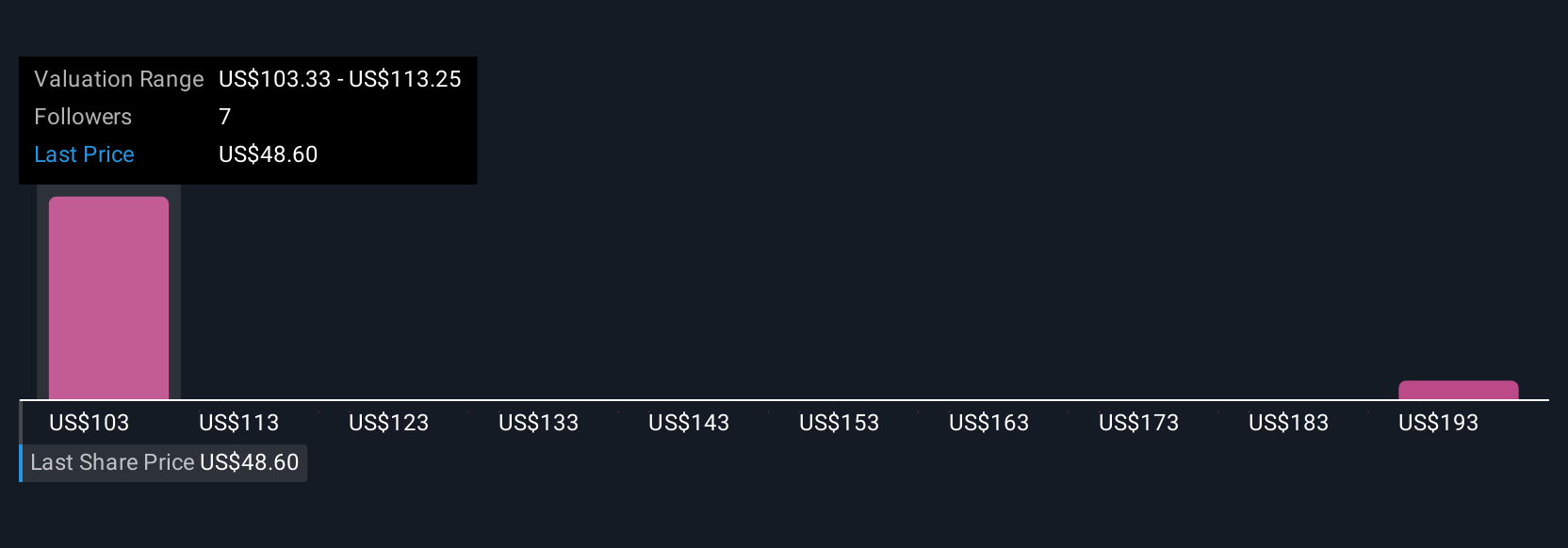

Explore 2 other fair value estimates on Praxis Precision Medicines - why the stock might be worth just $103.33!

Build Your Own Praxis Precision Medicines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Praxis Precision Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Praxis Precision Medicines' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Flawless balance sheet and fair value.

Market Insights

Community Narratives