- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

A Look at Praxis Precision Medicines (PRAX) Valuation Following FDA Progress on Rare Epilepsy Program

Reviewed by Simply Wall St

Praxis Precision Medicines (PRAX) just announced it has aligned with the FDA on the regulatory path for its relutrigine program targeting rare pediatric epilepsies like SCN2A and SCN8A-DEEs. This development could open a path to a New Drug Application in early 2026. This is a key milestone considering there are currently no FDA approved therapies for these severe conditions.

See our latest analysis for Praxis Precision Medicines.

Shares of Praxis Precision Medicines are enjoying a resurgence, with a 4.7% jump in the last day and a remarkable 134% share price return year-to-date. Investors are reacting to both the recent FDA alignment news and a sequence of high-profile conference presentations. While the company is still posting quarterly losses, the energy surrounding its regulatory progress and rare disease pipeline has clearly fueled long-term momentum. This is reflected in a stellar 159.8% total return over the past year.

Curious about where medical innovation is driving the next big moves? Discover fresh opportunities with our See the full list for free..

With the stock still priced at a notable discount to consensus analyst targets, investors are left to wonder whether the recent surge is just the beginning of a larger rally or if the market has already factored in all of Praxis's future upside.

Price-to-Book of 13.6x: Is it justified?

Praxis Precision Medicines is trading at a price-to-book ratio of 13.6x, placing its shares at a premium compared to both peer and industry averages despite recent momentum. At last close of $186.42, investors are paying up for future prospects rather than current assets.

The price-to-book ratio compares a company's market value to its net asset value. This metric offers insight into how much the market is willing to pay for each dollar of equity. It is particularly relevant for companies in biotechnology, where current profitability may not fully capture the value of a promising pipeline or intellectual property.

With Praxis’s price-to-book ratio of 13.6x, the stock appears expensive against the US Biotechs industry average of just 2.5x and a peer group average of 12.1x. This significant premium suggests that the market is assigning high expectations to future growth and regulatory milestones. It may also leave little room for disappointment if those developments do not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 13.6x (OVERVALUED)

However, delays in regulatory approvals or unexpected clinical trial results could quickly dampen investor enthusiasm and challenge current valuations.

Find out about the key risks to this Praxis Precision Medicines narrative.

Another View: Deep Discount to SWS DCF Model

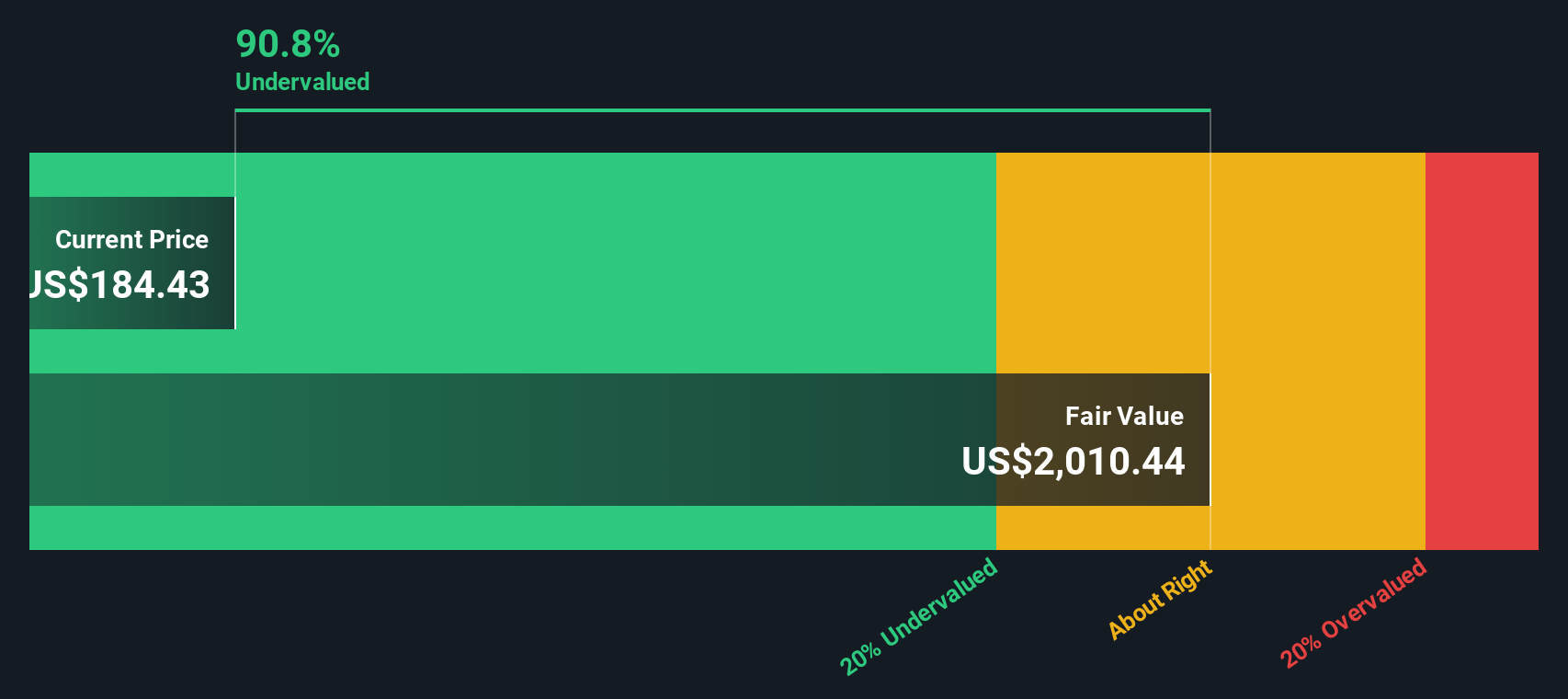

While the current price-to-book ratio signals that Praxis shares look expensive compared to peers, our DCF model tells a very different story. At $186.42, Praxis trades at a striking 90.1% discount to its estimated fair value of $1,891.95. Is the market underestimating what is possible if the pipeline delivers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Praxis Precision Medicines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Praxis Precision Medicines Narrative

Prefer a hands-on approach or want to see if your perspective stands out? You can easily craft your own take in just minutes by clicking Do it your way.

A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Expand your investing toolkit by accessing breakthrough ideas in trendsetting industries. Don’t let your next potential winner pass you by. See what else is out there right now:

- Uncover stocks with reliable yields and financial strength in these 16 dividend stocks with yields > 3%. This can give your portfolio a powerful edge during market uncertainty.

- Tap into tomorrow’s breakthroughs by reviewing these 24 AI penny stocks. These opportunities are shaping artificial intelligence and driving digital transformation.

- Spot hidden value by checking out these 885 undervalued stocks based on cash flows. Here, you can act ahead of the crowd on stocks priced below their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Flawless balance sheet with low risk.

Market Insights

Community Narratives