- United States

- /

- Pharma

- /

- NasdaqGS:PHVS

Pharvaris (PHVS): Reassessing Valuation After Strong RAPIDe-3 Phase 3 Success in Hereditary Angioedema

Reviewed by Simply Wall St

Pharvaris (NasdaqGS:PHVS) just cleared a major clinical hurdle, with its RAPIDe-3 Phase 3 trial of oral deucrictibant hitting all primary and secondary endpoints in hereditary angioedema. The company intends to use these data as the basis for 2026 approval filings.

See our latest analysis for Pharvaris.

Even with the recent pullback, including a 1 day share price return of minus 4.6 percent and minus 6.9 percent over 7 days, Pharvaris still shows building momentum with a 30 day share price return above 20 percent and a three year total shareholder return above 200 percent.

If deucrictibant’s progress has you watching rare disease names more closely, it could be worth scanning other specialist healthcare stocks that might be setting up for their next catalyst.

With shares still trading at a steep discount to consensus targets despite strong late stage data and a multiyear rally, is Pharvaris quietly undervalued, or is the market already baking in years of future growth?

Price to Book of 4.7x: Is it justified?

On a price to book basis, Pharvaris looks expensive at the last close of $26.42, trading well above both industry and peer benchmarks.

The price to book ratio compares the company’s market value to its net assets, a common yardstick for development stage biotechs with little or no revenue. For Pharvaris, a 4.7x multiple implies investors are paying a sizeable premium over the company’s current balance sheet value, effectively front loading expectations for future commercial success from deucrictibant.

However, this premium stands out. Pharvaris is described as expensive versus the broader US pharmaceuticals industry, where the average price to book is just 2.5x, and it also screens as expensive against a 3.5x peer average. That gap suggests the market is assigning Pharvaris a richer valuation than many similar names, with the multiple positioned well above levels the industry typically supports.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 4.7x (OVERVALUED)

However, setbacks in Phase 3 execution or slower than expected HAE adoption could quickly compress Pharvaris’s premium multiple and stall its recent momentum.

Find out about the key risks to this Pharvaris narrative.

Another Lens on Value

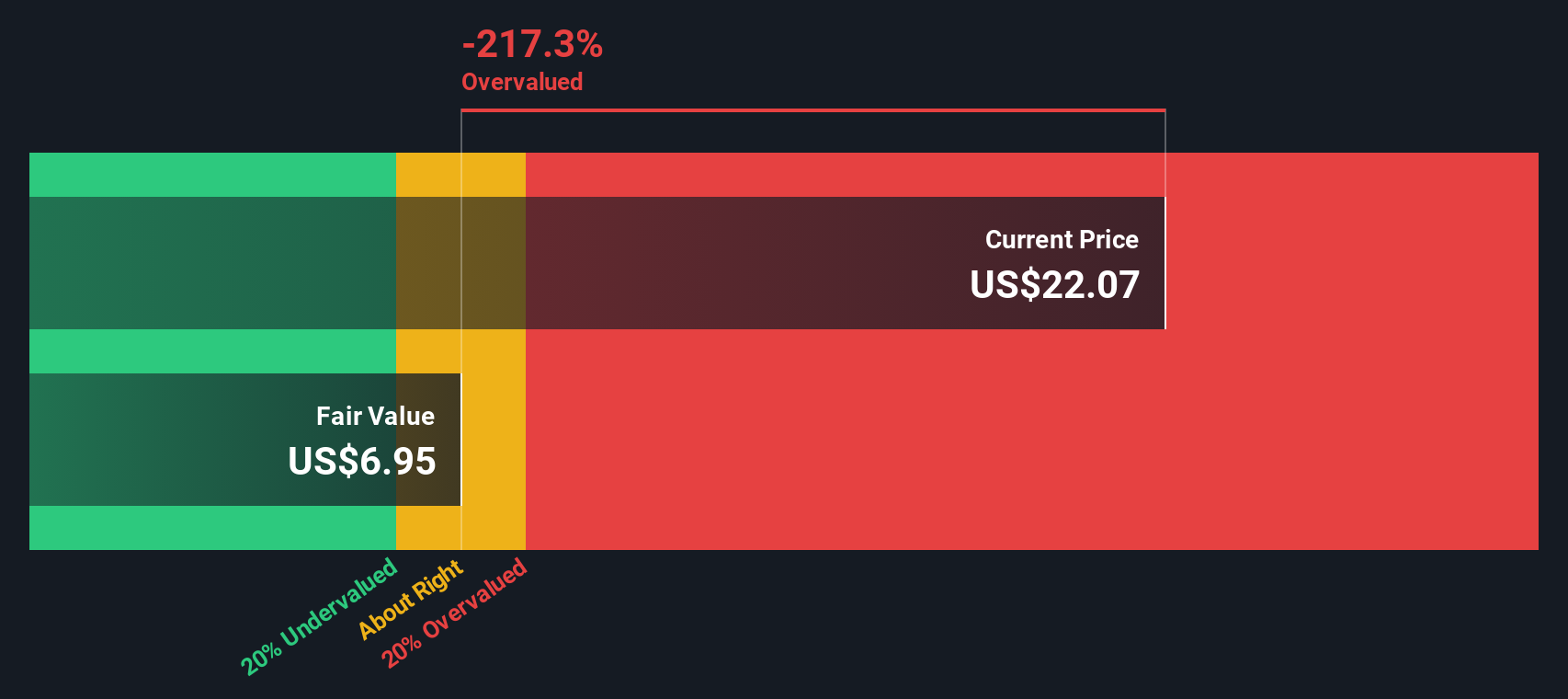

Our DCF model paints a very different picture, suggesting Pharvaris is trading well above an estimated fair value of about $9.79 per share. If that cash flow view is closer to reality than today’s growth story pricing, how much downside are investors really underwriting?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pharvaris for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pharvaris Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised Pharvaris storyline in just a few minutes: Do it your way.

A great starting point for your Pharvaris research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next watchlist candidates with the Simply Wall St Screener, so you never leave potential winners sitting unseen.

- Capture early-stage momentum by scanning these 3576 penny stocks with strong financials that pair tiny share prices with surprisingly resilient fundamentals and balance sheets.

- Supercharge your growth hunt with these 26 AI penny stocks, pinpointing businesses building real products and revenue around artificial intelligence rather than hype alone.

- Explore value-focused opportunities using these 906 undervalued stocks based on cash flows that trade below their cash flow potential while the broader market looks the other way.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PHVS

Pharvaris

A late-stage biopharmaceutical company, focuses on the development and commercialization of therapies for rare diseases with unmet needs covering angioedema and other bradykinin-mediated diseases.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026