- United States

- /

- Pharma

- /

- NasdaqGS:PHVS

Pharvaris (PHVS): Analyst Upgrades and Institutional Interest Spark Fresh Look at Valuation

Reviewed by Kshitija Bhandaru

Pharvaris (PHVS) is getting attention after a wave of analyst upgrades and new coverage, as well as a "Moderate Buy" consensus from several brokerages. Recent moves by institutional investors indicate increasing interest in the company.

See our latest analysis for Pharvaris.

Pharvaris has enjoyed strong momentum recently, with a share price jump of nearly 12% in the last day alone. This adds to this year’s impressive 27% share price return. Positive analyst attention and increased institutional buying are fueling this sentiment. While the 1-year total shareholder return is just over 4%, investors with a longer view have seen a remarkable 348% total return over three years, reflecting real belief in Pharvaris’ long-term growth story.

If the renewed optimism around Pharvaris has you searching for more healthcare standouts, it’s worth exploring See the full list for free.

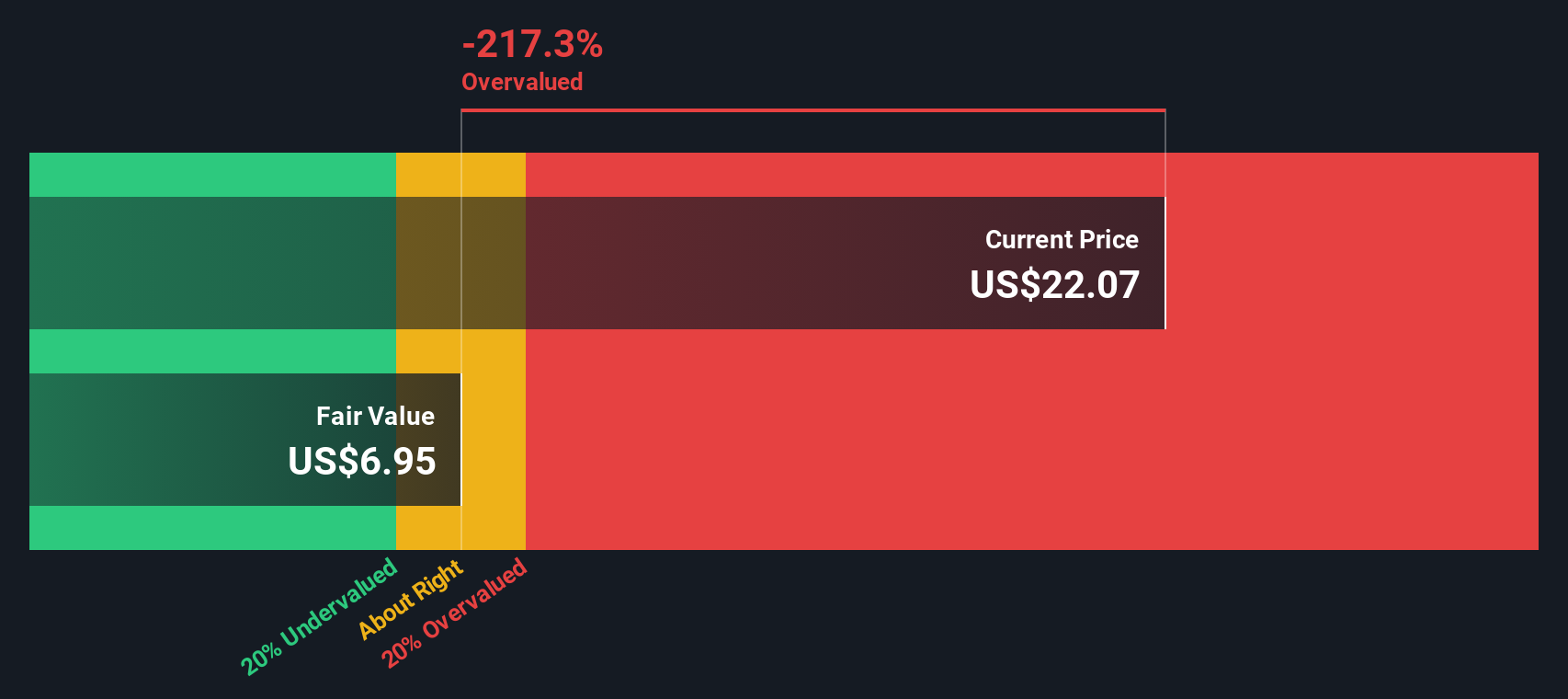

With shares trading well below analysts’ average price targets and strong price momentum this year, investors are now faced with a key question: is Pharvaris still undervalued, or is the market already pricing in future growth?

Price-to-Book Ratio of 8x: Is it justified?

Pharvaris trades at a price-to-book ratio of 8x, significantly above its immediate peers and the broader US pharmaceuticals industry. With a last close price of $23.63, the stock stands out as notably more expensive on this metric.

The price-to-book ratio compares a company’s share price to its net asset value. For pharmaceutical firms like Pharvaris, this figure often reflects investor optimism about future growth, especially in pre-profit or high R&D stages. However, a high value may also point to excessive optimism or market speculation.

Pharvaris’s 8x price-to-book is much higher than the peer average of 5x and is well above the US pharmaceuticals industry average of 2.3x. This suggests that investors are pricing in strong future potential that exceeds what is currently typical for the sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 8x (OVERVALUED)

However, investors should note that Pharvaris's lack of revenue and ongoing net losses could quickly shift sentiment if clinical or growth expectations falter.

Find out about the key risks to this Pharvaris narrative.

Another View: Discounted Cash Flow Perspective

Taking a different angle, our SWS DCF model values Pharvaris at $65.49 per share, which is 63.9% above the current price. This suggests the stock could be undervalued if future cash flows materialize as projected. However, it is important to consider whether this outlook is sustainable, given the company is still unprofitable.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pharvaris for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pharvaris Narrative

If you want to take a closer look and form your own opinion, you can generate your personal Pharvaris story in just a few minutes. Do it your way

A great starting point for your Pharvaris research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next winning stock could be just a screen away. Use these powerful tools and make smarter moves before the crowd catches on:

- Start earning more with ease by tapping into sustainable income streams through these 17 dividend stocks with yields > 3%, which features solid yields above 3%.

- Stay ahead of the technology curve by backing tomorrow’s leaders with these 24 AI penny stocks, which are setting the pace in artificial intelligence innovation.

- Capitalize on potential bargains by seizing opportunities revealed by these 873 undervalued stocks based on cash flows to invest in strong companies priced below their real worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PHVS

Pharvaris

A late-stage biopharmaceutical company, focuses on the development and commercialization of therapies for rare diseases with unmet needs covering angioedema and other bradykinin-mediated diseases.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives