- United States

- /

- Pharma

- /

- NasdaqGS:PHVS

How Investors Are Reacting To Pharvaris (PHVS) Updated Timeline for RAPIDe-3 Phase 3 Trial Data

Reviewed by Simply Wall St

- On July 10, 2025, Pharvaris announced updated guidance for the release of topline data from its pivotal Phase 3 RAPIDe-3 study of deucrictibant IR capsules for on-demand treatment of hereditary angioedema, now anticipated in the fourth quarter of 2025 followed by a potential NDA submission in the first half of 2026.

- This timeline emphasizes advancing late-stage development and highlights ongoing regulatory and commercial planning as Pharvaris positions for potential entry into the HAE treatment landscape.

- We'll explore how the updated clinical trial timeline strengthens Pharvaris' investment narrative with clear steps toward potential regulatory milestones.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

What Is Pharvaris' Investment Narrative?

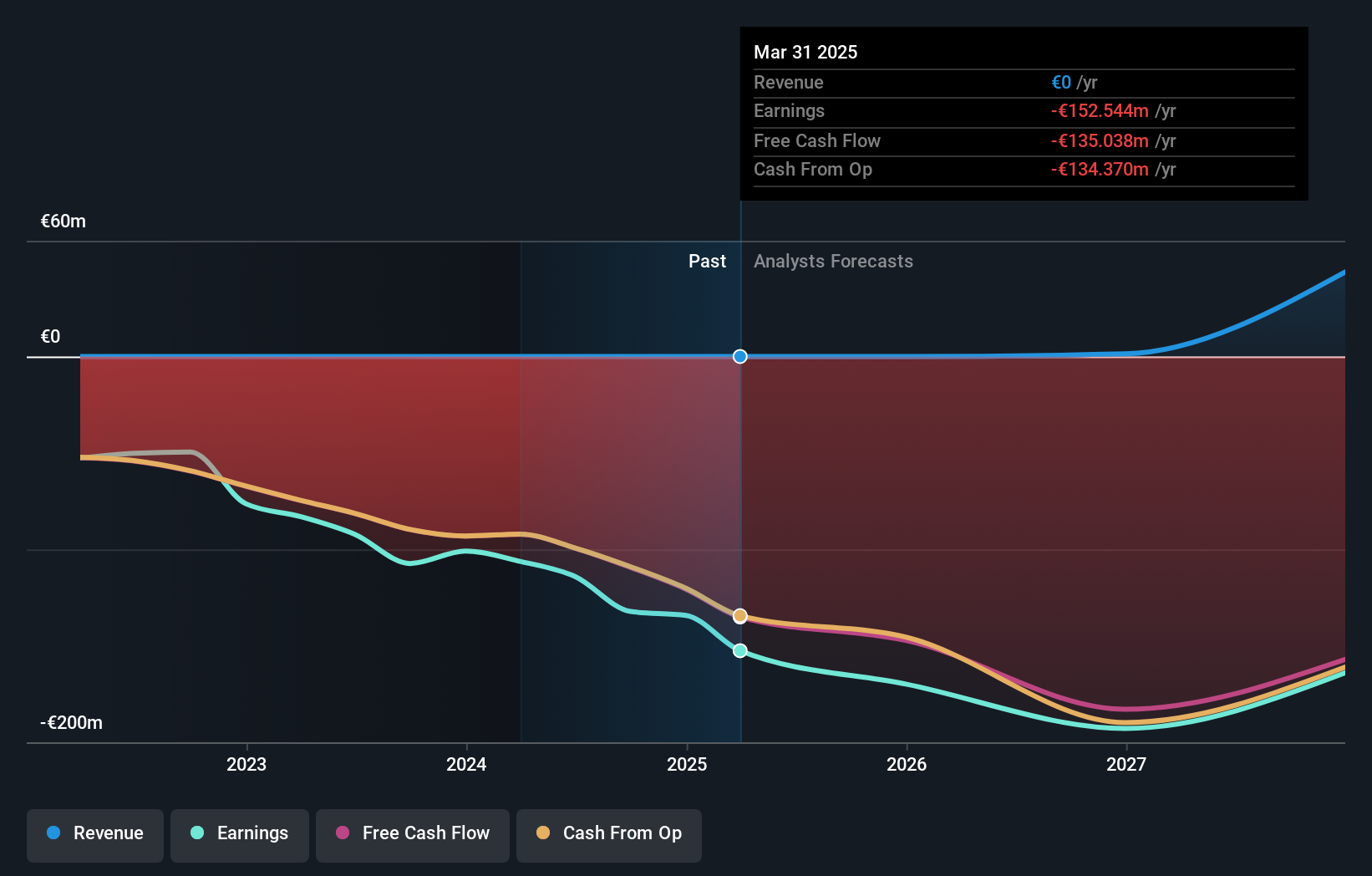

To be a shareholder in Pharvaris at this stage, you need conviction in the company's ability to bring deucrictibant to market and secure a foothold in hereditary angioedema (HAE) treatment. The recent timeline update for the RAPIDe-3 Phase 3 trial is meaningful: investors now have a clearer line of sight to potential clinical and regulatory milestones over the next 12 months. This updated guidance helps sharpen focus on two key short-term catalysts, topline RAPIDe-3 data expected in late 2025 and a possible NDA filing in the first half of 2026. While this progress affirms the company's R&D execution, the risk profile remains similar, anchored by ongoing net losses, a lack of revenue, and increasing cash burn as Pharvaris advances its late-stage programs. The share price’s upward move after the announcement reflects incremental optimism, but the fundamental challenges in navigating regulatory outcomes and commercial readiness persist. However, regulatory timelines can shift, impacting expectations for new data and potential approvals.

Pharvaris' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Pharvaris - why the stock might be worth just $33.50!

Build Your Own Pharvaris Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pharvaris research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Pharvaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pharvaris' overall financial health at a glance.

No Opportunity In Pharvaris?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PHVS

Pharvaris

A late-stage biopharmaceutical company, focuses on the development and commercialization of therapies for rare diseases with unmet needs covering angioedema and other bradykinin-mediated diseases.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives