Stock Analysis

- United States

- /

- Diversified Financial

- /

- NasdaqCM:PAYS

US Penny Stocks With Promise: 3 Picks Under $200M Market Cap

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn, with major indices like the Dow Jones and Nasdaq Composite sliding, investors are increasingly looking for opportunities beyond large-cap tech stocks. Penny stocks, although a somewhat outdated term, continue to offer potential growth opportunities in smaller or newer companies when backed by strong financial health. These investments can present a mix of affordability and growth potential, making them an intriguing option for those seeking under-the-radar opportunities in today's shifting market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.30 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $103.25M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.84 | $6.43M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.90 | $234.98M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.25 | $8.83M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.85 | $86.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.59 | $49.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.62 | $22.53M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9125 | $76.47M | ★★★★★☆ |

Click here to see the full list of 732 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Paysign (NasdaqCM:PAYS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Paysign, Inc. offers prepaid card programs, patient affordability solutions, digital banking services, and integrated payment processing for businesses, consumers, and government institutions with a market cap of $162.79 million.

Operations: Paysign generates its revenue primarily from data processing, amounting to $56.47 million.

Market Cap: $162.79M

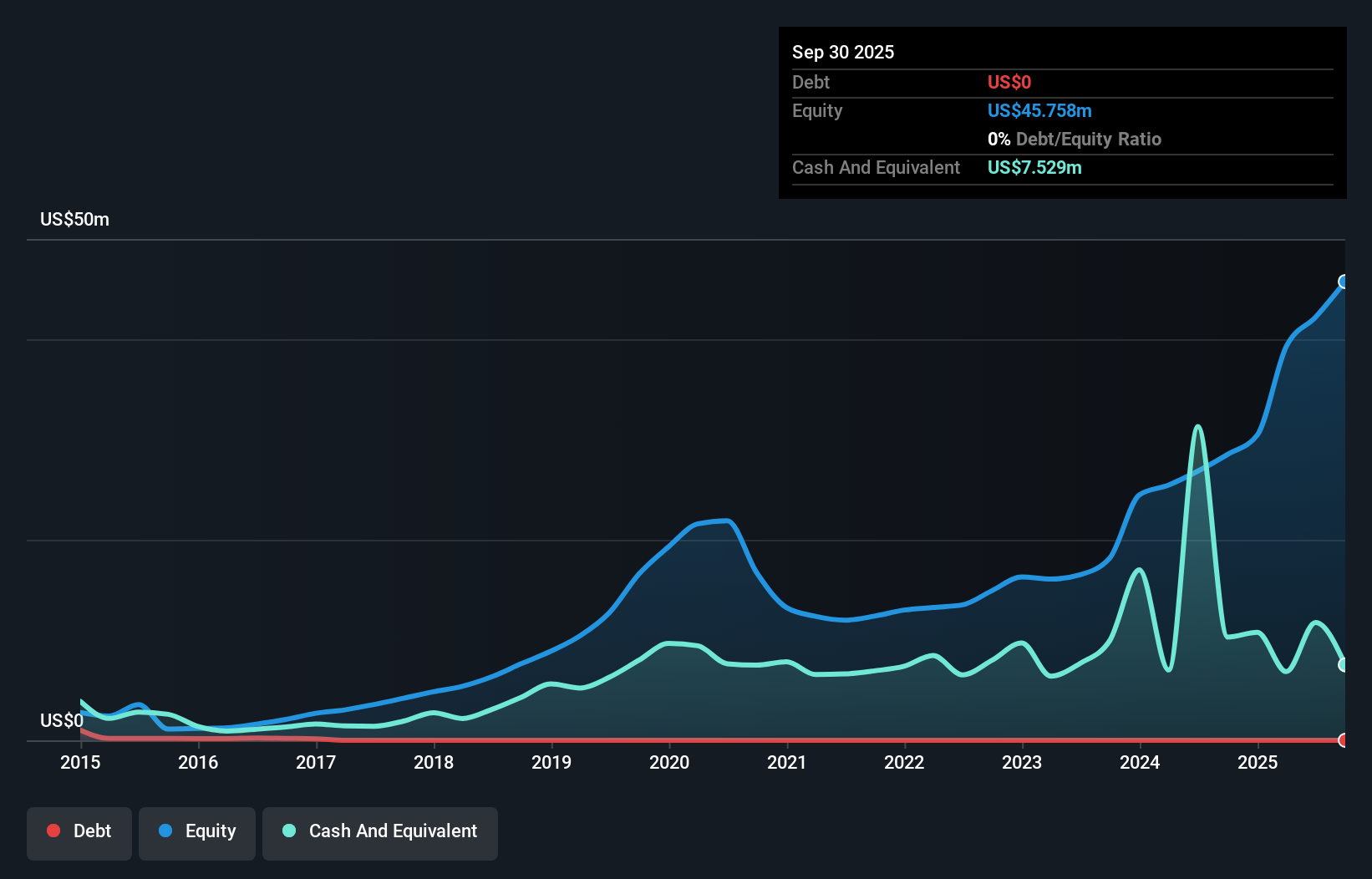

Paysign, Inc. has shown robust earnings growth of 420.5% over the past year, far exceeding industry averages, with a high Return on Equity of 28.3%. The company is debt-free and maintains strong short-term financial health with assets surpassing liabilities. Recent earnings reports highlight increased revenue and net income compared to the previous year, supporting its forecasted revenue growth of 11.1% annually despite anticipated declines in earnings. Paysign's management and board are experienced, contributing to stable operations amid significant insider selling recently observed. The company completed a share buyback program while maintaining positive profit margins and quality earnings.

- Jump into the full analysis health report here for a deeper understanding of Paysign.

- Gain insights into Paysign's future direction by reviewing our growth report.

Puma Biotechnology (NasdaqGS:PBYI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Puma Biotechnology, Inc. is a biopharmaceutical company dedicated to developing and commercializing cancer care products in the United States and internationally, with a market cap of approximately $148.24 million.

Operations: The company's revenue of $243.57 million is derived from the development and commercialization of innovative cancer care products.

Market Cap: $148.24M

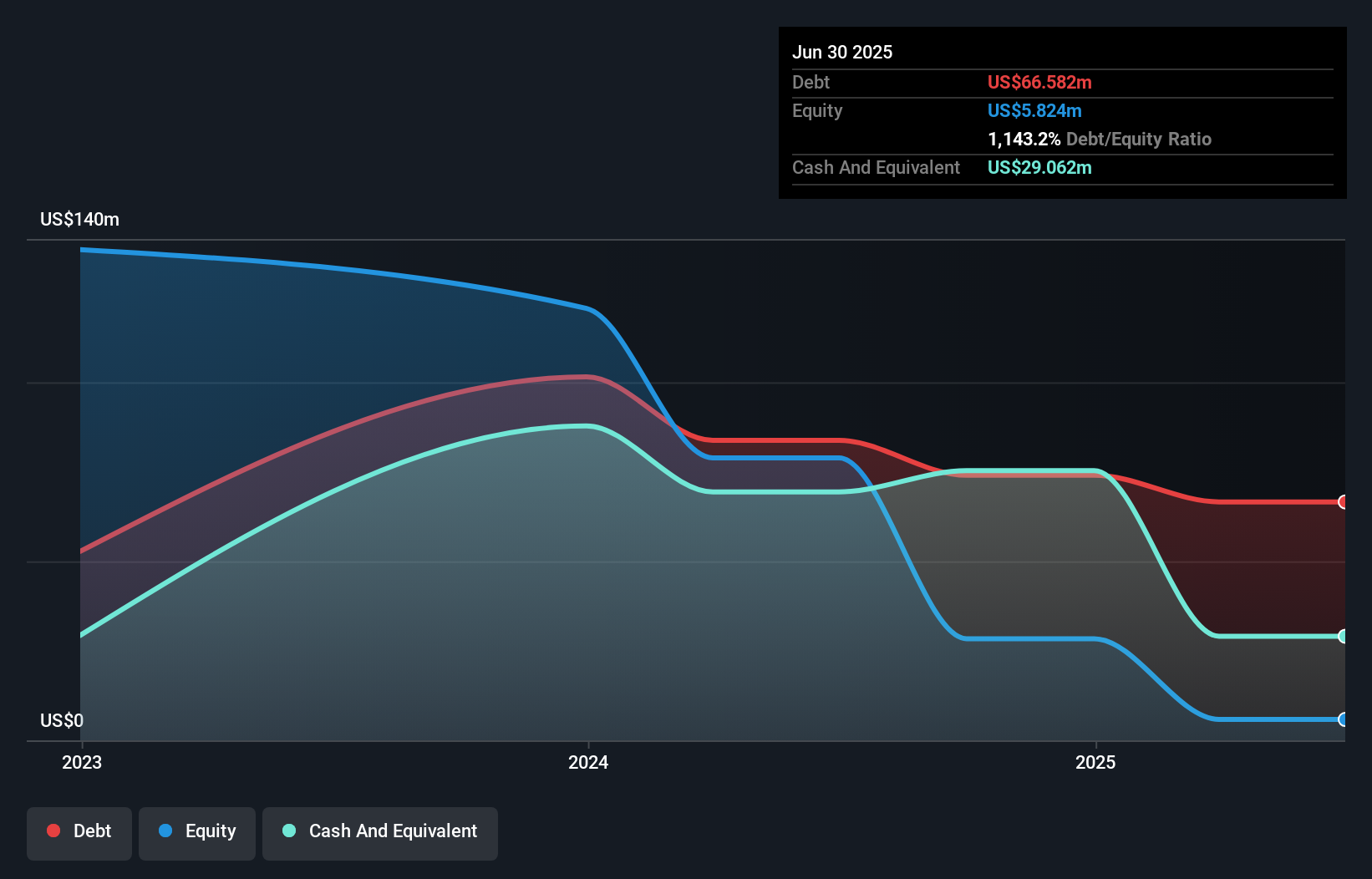

Puma Biotechnology has demonstrated significant financial growth, with earnings surging by 525.3% over the past year and a net profit margin improving to 9.5%. The company's short-term assets of US$156.8 million comfortably cover both its short and long-term liabilities, suggesting solid financial footing. Despite shareholder dilution over the past year, Puma's debt levels have decreased considerably from previous highs, now well-covered by operating cash flow. Recent updates to cancer treatment guidelines include their product neratinib for certain cervical cancers, potentially enhancing market reach alongside ongoing clinical trials for alisertib in breast cancer therapy.

- Click here and access our complete financial health analysis report to understand the dynamics of Puma Biotechnology.

- Examine Puma Biotechnology's earnings growth report to understand how analysts expect it to perform.

Mynd.ai (NYSEAM:MYND)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mynd.ai, Inc., a subsidiary of NetDragon Websoft Holdings Limited, focuses on artificial intelligence technology solutions and has a market capitalization of $91.75 million.

Operations: The company generates revenue primarily from its eLMTree segment, amounting to $336.11 million.

Market Cap: $91.75M

Mynd.ai, Inc., with a market cap of US$91.75 million, has announced a share repurchase program of up to US$10 million, reflecting confidence in its valuation despite recent revenue declines. The company's stock is trading at 60% below estimated fair value but remains highly volatile. While unprofitable and experiencing a negative return on equity, Mynd.ai benefits from adequate liquidity with short-term assets exceeding both short and long-term liabilities. The management team and board are relatively new, indicating potential for strategic shifts as they navigate the competitive landscape in artificial intelligence solutions.

- Dive into the specifics of Mynd.ai here with our thorough balance sheet health report.

- Learn about Mynd.ai's historical performance here.

Turning Ideas Into Actions

- Navigate through the entire inventory of 732 US Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PAYS

Paysign

Provides prepaid card programs, comprehensive patient affordability offerings, digital banking services, and integrated payment processing services for businesses, consumers, and government institutions.