Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

Puma Biotechnology, Inc. (NASDAQ:PBYI) shareholders should be happy to see the share price up 12% in the last quarter. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Five years have seen the share price descend precipitously, down a full 78%. The recent bounce might mean the long decline is over, but we are not confident. The fundamental business performance will ultimately determine if the turnaround can be sustained.

Check out our latest analysis for Puma Biotechnology

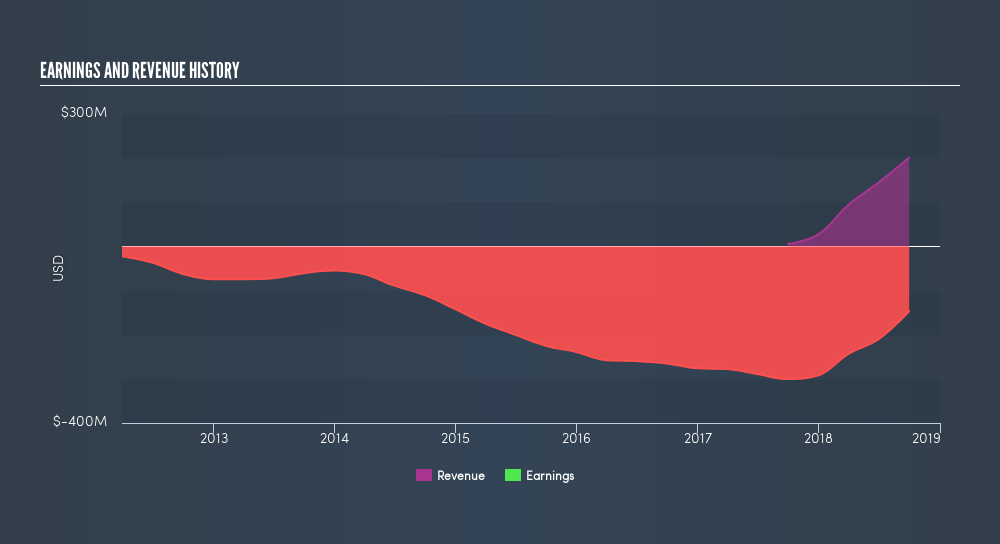

Puma Biotechnology isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't yet make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

This free interactive report on Puma Biotechnology's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Puma Biotechnology had a tough year, with a total loss of 62%, against a market gain of about 3.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 26% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:PBYI

Puma Biotechnology

A biopharmaceutical company, focuses on the development and commercialization of products to enhance cancer care in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives