- United States

- /

- Pharma

- /

- NasdaqGM:PAHC

Phibro Animal Health (PAHC): Evaluating Valuation Following Recent Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Phibro Animal Health.

Phibro Animal Health’s strong momentum continues, with its share price climbing 31.2% over the past quarter and notching an impressive year-to-date return of 86.1%. Over the last year, total shareholder return reached 61.3%, highlighting sustained outperformance as investors reassess the company’s future prospects.

If you’re tracking which stocks have strong momentum and high insider confidence, this is an ideal moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading well above analyst targets and the company posting robust financial growth, investors are left to wonder if Phibro Animal Health is undervalued or if the market has already factored in its future success.

Most Popular Narrative: 7.9% Overvalued

Phibro Animal Health’s widely followed narrative points to a fair value of $35.75, which is close but slightly below the last close price of $38.57. This context sets the scene for a debate over whether strong growth can justify the current premium.

Despite recent vaccine and nutritional specialties growth, management expects these higher-margin segments to stabilize. This suggests the outsized margin improvement seen in FY25 is unlikely to persist and could compress as underlying category growth rates revert, impacting net margins and EBITDA growth rates.

Think this fair value is built on conservative forecasts? Behind the scenes, analysts are calling for margin expansion, ambitious profit growth, and a sharply lower future P/E. How does this bullish outlook stack up against the current premium in the share price? Unlock the full narrative for the numbers that drive this debate.

Result: Fair Value of $35.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong global protein demand or further successful integration of new acquisitions could quickly reshape expectations for Phibro Animal Health’s growth trajectory.

Find out about the key risks to this Phibro Animal Health narrative.

Another View: DCF Model Suggests Deep Value

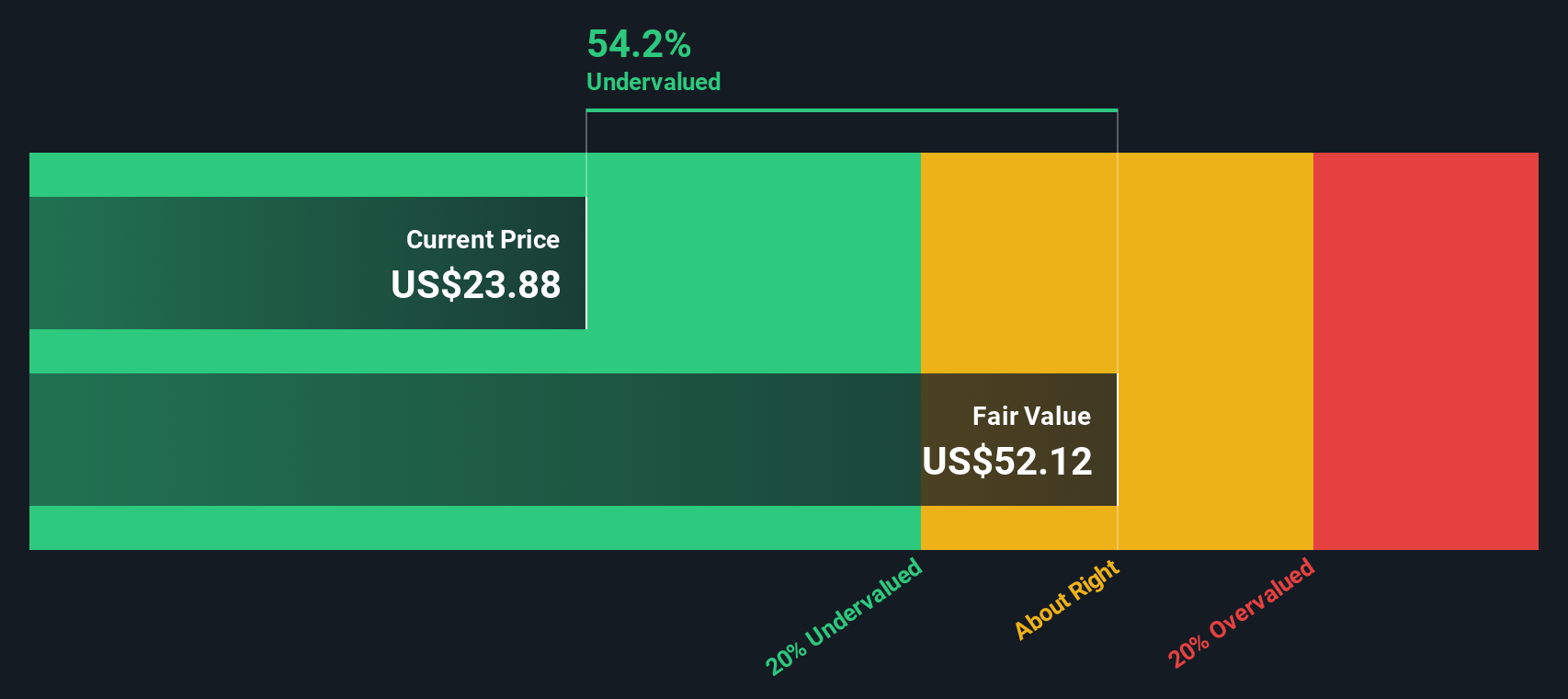

While analysts believe Phibro Animal Health is overvalued compared to their price target, the Simply Wall St DCF model offers a very different perspective. Based on projected cash flows, the DCF suggests the stock could be trading at a significant discount, indicating meaningful upside potential for long-term investors. Which model will prove more accurate as the market changes?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Phibro Animal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Phibro Animal Health Narrative

If you have a different perspective or want to dig into the figures personally, you can easily build your own story in just a few minutes, your way. Do it your way.

A great starting point for your Phibro Animal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know opportunities go far beyond a single stock. Use the Simply Wall Street Screener and you could uncover major trends that others miss.

- Capture higher income by targeting companies offering attractive yields with these 20 dividend stocks with yields > 3%. This approach can help your portfolio grow faster while staying resilient.

- Fuel your portfolio’s growth when you connect with the innovators shaping medicine through breakthroughs in artificial intelligence by exploring these 33 healthcare AI stocks.

- Take your strategy further by zeroing in on deep value opportunities using these 875 undervalued stocks based on cash flows. With this method, you never let the next bargain slip past you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PAHC

Phibro Animal Health

Operates as an animal health and mineral nutrition company in the United States, Latin America and Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives