- United States

- /

- Life Sciences

- /

- NasdaqGS:PACB

Pacific Biosciences (PACB): Assessing Valuation Following SPRQ-Nx Launch and Major Genomics Project Wins

Reviewed by Kshitija Bhandaru

Pacific Biosciences of California (PACB) is in the spotlight after unveiling its SPRQ-Nx sequencing chemistry. This move lowers sequencing costs and enhances its Revio and Vega platforms with new features.

See our latest analysis for Pacific Biosciences of California.

There’s been a noticeable rebound in Pacific Biosciences’ share price lately, up 33% over the past month, as excitement builds around new features and large-scale project wins. However, looking at the bigger picture, the one-year total shareholder return is still down 17%. This reminds investors that while momentum is improving, long-term performance has lagged.

If seeing breakthroughs in genomics platforms has you curious about what’s next, you might want to explore other innovators. Check out the full roster with our See the full list for free..

With the share price still well below its highs despite recent momentum, investors are left to weigh whether PacBio is undervalued today or if the market is already factoring in future growth and innovation potential.

Most Popular Narrative: 22% Undervalued

Compared to the last close price of $1.64, the narrative places Pacific Biosciences’ fair value higher, suggesting notable upside if projections hold true. Let’s look at what’s powering this outlook.

The growing number of national-scale population genomics and multi-omic initiatives globally, many adopting PacBio's long-read HiFi technology (for example, 1,000 Genomes Long-Read Project, Southeast Asia and Nordic national programs), positions PacBio to capture expanding large-volume projects. This should materially increase future revenues and drive recurring consumables demand.

What are the hidden catalysts behind this bold valuation? The narrative hinges on ambitious revenue acceleration, clinical market gains, and a long-term profit surge. You’ll want to discover which financial assumptions set this story apart from the crowd.

Result: Fair Value of $2.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on academic funding and international volatility could derail forecasts. Investors should watch for shifts in research budgets or global demand.

Find out about the key risks to this Pacific Biosciences of California narrative.

Another View: What Do Multiples Say?

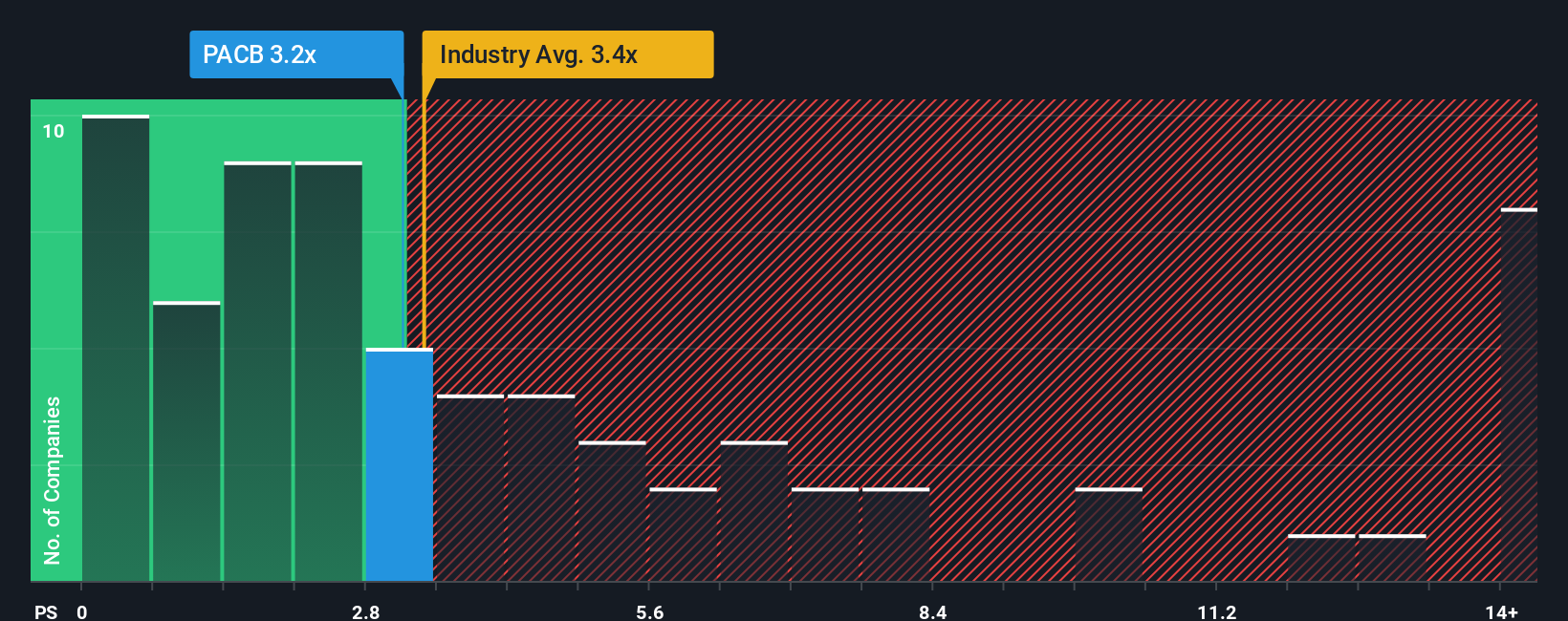

While the first narrative suggests Pacific Biosciences is undervalued, traditional market multiples paint a more complex picture. Its price-to-sales sits at 3.2x, higher than the peer average of 2.3x and above the fair ratio of 2.4x. This means the stock is priced above both peers and where the market might expect it to be. Are investors overlooking something, or could there be more room for adjustment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pacific Biosciences of California Narrative

If you see the story differently or want to dig deeper into the data on your own terms, you can quickly craft your own take in just a few minutes. Do it your way

A great starting point for your Pacific Biosciences of California research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip away. Use these powerful tools to spot hidden gems and accelerate your investing strategy today:

- Uncover companies harnessing artificial intelligence by using these 24 AI penny stocks. This tool targets fast-moving trends and industry disruptors before they hit the mainstream.

- Capture value with these 878 undervalued stocks based on cash flows, where stocks trading below their intrinsic worth are ready for your strategic move.

- Supercharge your search for future financial leaders by tapping into these 18 dividend stocks with yields > 3%, which features yields above 3% for reliable, income-generating picks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PACB

Pacific Biosciences of California

Designs, develops, and manufactures sequencing solution to resolve genetically complex problems.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives