- United States

- /

- Life Sciences

- /

- NasdaqGS:PACB

Could PacBio’s (PACB) Push for Affordable Genomics Signal a Shift in Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- Pacific Biosciences of California, Inc. recently announced innovations to its Revio and Vega platforms, including new SPRQ-Nx sequencing chemistry aimed at reducing costs and enhancing multiomic capabilities, and was selected as the sequencing technology provider for major research initiatives such as the Korean Pangenome Reference Project and the National Institute on Aging's Long Life Family Study.

- These developments showcase PacBio's growing influence on global population genomics and its potential to set new industry benchmarks for affordability and accuracy in large-scale sequencing projects.

- We’ll explore how PacBio’s focus on cost-effective, high-throughput genomics could reshape its investment narrative and industry standing.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Pacific Biosciences of California Investment Narrative Recap

To be a shareholder in Pacific Biosciences of California, you need to believe in the company’s ability to drive widespread adoption of its HiFi long-read sequencing platforms in large-scale clinical and population studies. The recent news surrounding SPRQ-Nx chemistry, offering up to 40% lower sequencing costs, directly targets the biggest short-term catalyst: accelerating uptake for population genomics projects. However, the most pressing risk, persistent unprofitability coupled with negative cash flow, is not materially altered by this announcement.

Among recent announcements, PacBio’s selection as the sequencing provider for the Korean Pangenome Reference Project stands out. This initiative signals growing international validation and volume, directly tied to the company’s efforts to expand its recurring consumables revenue stream, a key catalyst for improving gross margins and reducing reliance on volatile instrument sales.

In contrast, investors should be aware of the ongoing challenge of turning expanded customer adoption into sustained profitability and what that means for potential dilution if operating losses persist...

Read the full narrative on Pacific Biosciences of California (it's free!)

Pacific Biosciences of California's outlook projects $242.5 million in revenue and $34.5 million in earnings by 2028. This implies a 15.8% annual revenue growth rate and a $560.9 million increase in earnings from the current level of -$526.4 million.

Uncover how Pacific Biosciences of California's forecasts yield a $2.11 fair value, a 20% upside to its current price.

Exploring Other Perspectives

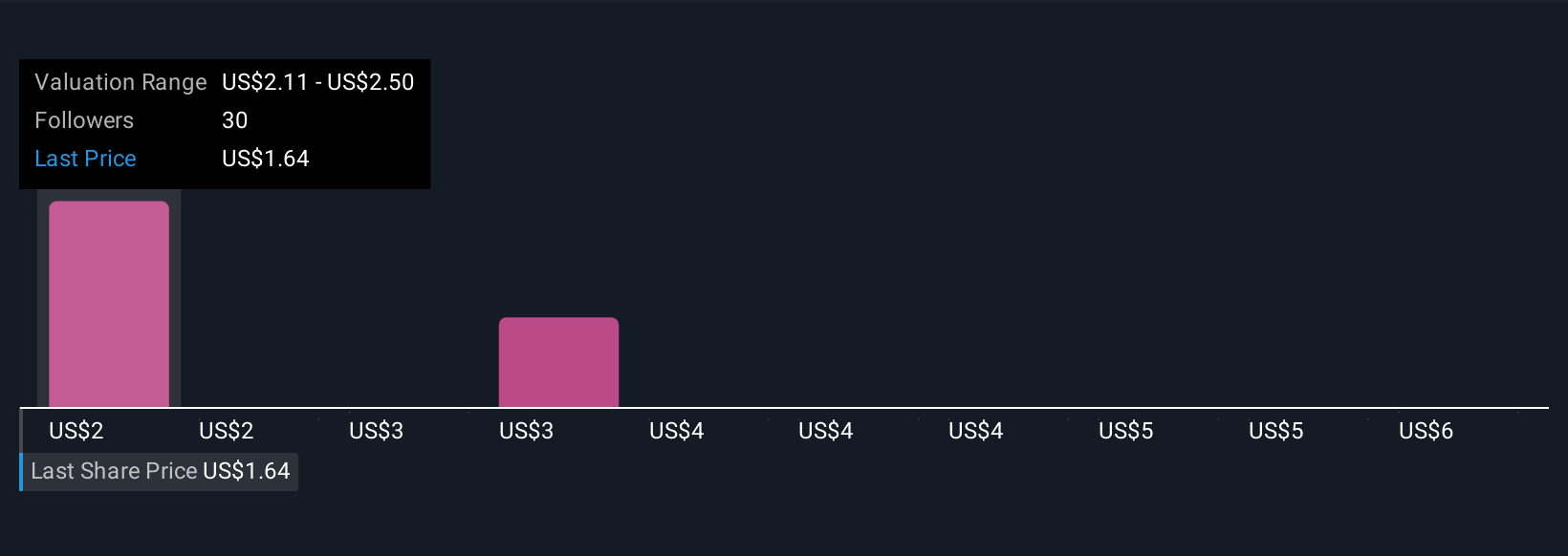

Simply Wall St Community members estimated PacBio’s fair value between US$2.11 and US$6.00, based on five unique analyses. With ongoing negative net margins, your view on future profitability could have a significant impact on your assessment of opportunities and risks for the company.

Explore 5 other fair value estimates on Pacific Biosciences of California - why the stock might be worth just $2.11!

Build Your Own Pacific Biosciences of California Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pacific Biosciences of California research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pacific Biosciences of California research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pacific Biosciences of California's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PACB

Pacific Biosciences of California

Designs, develops, and manufactures sequencing solution to resolve genetically complex problems.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives