- United States

- /

- Biotech

- /

- NasdaqGM:ORKA

Pipeline Progress on Monoclonal Antibodies Might Change The Case For Investing In Oruka Therapeutics (ORKA)

Reviewed by Sasha Jovanovic

- Oruka Therapeutics has attracted investor attention following advancements in its monoclonal antibody therapeutics pipeline, including its lead candidate ORKA-001 targeting psoriasis and other inflammatory conditions.

- Analyst enthusiasm for Oruka’s developing treatments highlights growing excitement about novel approaches to address significant unmet needs in the biotechnology sector.

- We’ll explore how momentum around Oruka’s monoclonal antibody pipeline is shaping the company’s investment narrative and future potential.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Oruka Therapeutics' Investment Narrative?

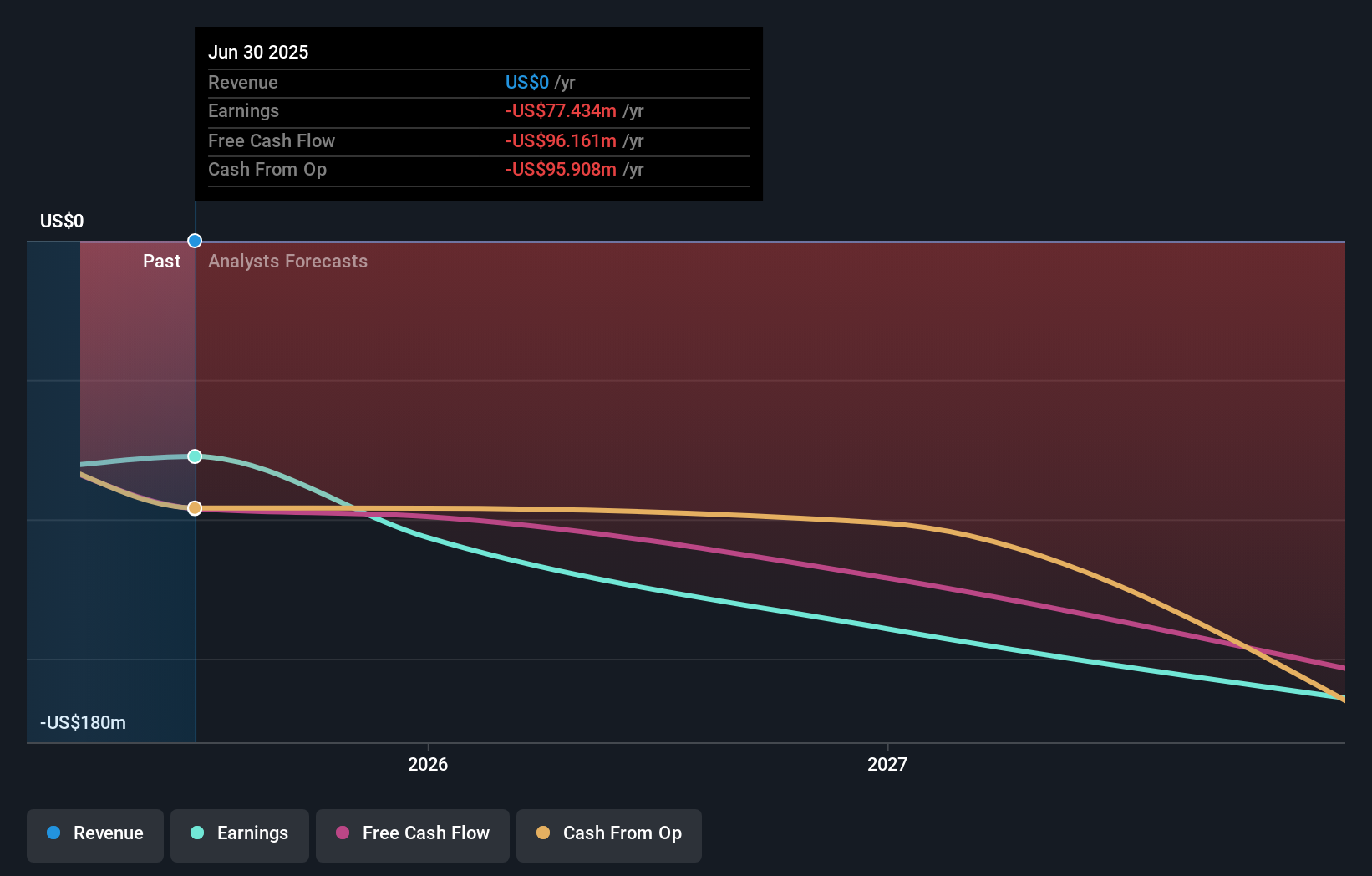

To see the potential in Oruka Therapeutics, an investor needs to believe in the promise of early-stage biotech innovation and the ability to translate clinical advances into long-term value. The recent news about analyst support and target prices for Oruka, coming after its ongoing progress with ORKA-001, injects further optimism but doesn't erase the biggest risks right now, such as a lack of revenue, ongoing losses, and heavy dilution from recent equity offerings. While headlines may stoke short-term excitement and could spark more price moves if positive clinical milestones continue, Oruka still relies on successful trial results, regulatory decisions, and eventually commercializing its therapies to justify today’s valuation. The company’s recent momentum does help shift attention from its short operating history and unproven pipeline, but risk remains high while revenues are absent and its valuation is well above most sector averages. Yet, it's important not to overlook the potential for further dilution as Oruka advances its ambitious pipeline.

Insights from our recent valuation report point to the potential overvaluation of Oruka Therapeutics shares in the market.Exploring Other Perspectives

Explore 2 other fair value estimates on Oruka Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Oruka Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oruka Therapeutics research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oruka Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oruka Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ORKA

Oruka Therapeutics

A clinical-stage biopharmaceutical company, focuses on developing novel monoclonal antibody therapeutics for psoriasis (PsO), and other inflammatory and immunology (I&I) indications.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives