- United States

- /

- Biotech

- /

- NasdaqGS:ONC

R&D Day Pipeline Updates Might Change The Case For Investing In BeOne Medicines (ONC)

Reviewed by Simply Wall St

- BeOne Medicines recently unveiled major advancements to its oncology pipeline during an investor R&D Day, showcasing more than 40 assets in clinical and commercial stages and presenting new clinical data for B-cell and solid tumor programs.

- An important highlight was compelling early data on the combination of sonrotoclax and BRUKINSA in CLL, which could influence future standards of care in hematologic cancers.

- We'll explore how this potential for a new fixed-duration CLL treatment shapes the company’s investment narrative going forward.

BeOne Medicines Investment Narrative Recap

For shareholders in BeOne Medicines, the long-term story centers on belief in the company’s ability to translate an extensive global pipeline and innovation engine into sustainable commercial success. The recent R&D Day showcased a robust pipeline with more than 40 active assets, but does not appear to materially shift the most important short-term catalyst, progress towards regulatory milestones for its hematology assets, nor does it address the key risk of regulatory and operational complexities following the company’s redomiciliation.

Among recent announcements, the positive CHMP opinion for a new tablet formulation of BRUKINSA stands out. This development directly supports BeOne’s push for growth in Europe, and, in the context of evolving treatment standards highlighted in the latest R&D Day, may reinforce the company’s competitive position as new trial results emerge.

On the other hand, investors should be aware that operational and regulatory uncertainties tied to BeOne’s move to Switzerland could...

Read the full narrative on BeOne Medicines (it's free!)

BeiGene's narrative projects $7.2 billion revenue and $1.2 billion earnings by 2028. This requires 23.4% yearly revenue growth and a $1.84 billion improvement in earnings from the current $-644.8 million.

Exploring Other Perspectives

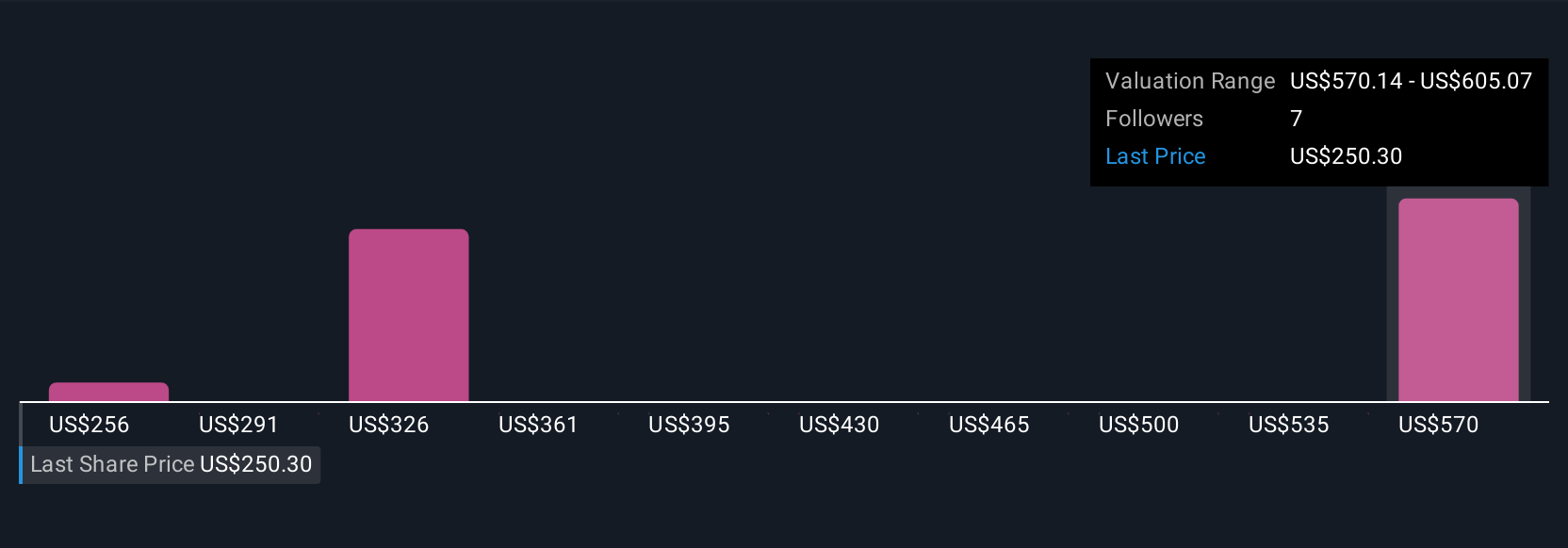

Fair value estimates from four Simply Wall St Community members range widely from US$255.78 to US$605.07 per share. With such a spread in opinions, consider how regulatory and geopolitical risks linked to the company’s redomiciliation could shape future prospects before forming your own view.

Build Your Own BeOne Medicines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BeOne Medicines research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BeOne Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BeOne Medicines' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeOne Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeOne Medicines

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives