- United States

- /

- Life Sciences

- /

- NasdaqGM:OLK

Further weakness as Olink Holding (NASDAQ:OLK) drops 8.5% this week, taking one-year losses to 55%

While not a mind-blowing move, it is good to see that the Olink Holding AB (publ) (NASDAQ:OLK) share price has gained 16% in the last three months. But that's small comfort given the dismal price performance over the last year. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 55% in that time. The share price recovery is not so impressive when you consider the fall. You could argue that the sell-off was too severe.

After losing 8.5% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Olink Holding

Olink Holding isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Olink Holding increased its revenue by 76%. That's a strong result which is better than most other loss making companies. In contrast the share price is down 55% over twelve months. Yes, the market can be a fickle mistress. This could mean hype has come out of the stock because the bottom line is concerning investors. We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

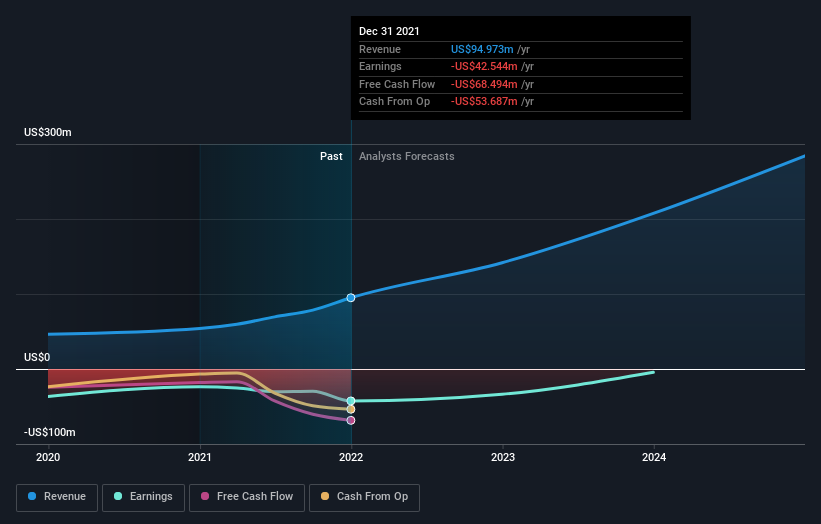

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Olink Holding's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 2.0% in the last year, Olink Holding shareholders might be miffed that they lost 55%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 16%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Olink Holding is showing 2 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:OLK

Olink Holding

Develops, produces, markets, and sells biotechnological products and services for the academic, government, biopharmaceutical, biotechnology, service provider, and other institutions that focuses on life science research.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives