- United States

- /

- Biotech

- /

- NasdaqCM:IRD

Investors Still Aren't Entirely Convinced By Ocuphire Pharma, Inc.'s (NASDAQ:OCUP) Revenues Despite 30% Price Jump

Ocuphire Pharma, Inc. (NASDAQ:OCUP) shareholders have had their patience rewarded with a 30% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 48% in the last twelve months.

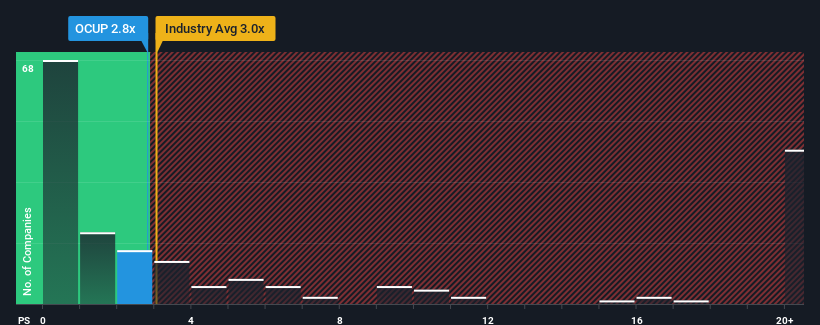

Although its price has surged higher, there still wouldn't be many who think Ocuphire Pharma's price-to-sales (or "P/S") ratio of 2.8x is worth a mention when the median P/S in the United States' Pharmaceuticals industry is similar at about 3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Ocuphire Pharma

What Does Ocuphire Pharma's P/S Mean For Shareholders?

Ocuphire Pharma hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Ocuphire Pharma will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Ocuphire Pharma?

Ocuphire Pharma's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 54%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 92% per annum as estimated by the three analysts watching the company. With the industry only predicted to deliver 20% per annum, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Ocuphire Pharma is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Ocuphire Pharma's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Ocuphire Pharma's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Ocuphire Pharma.

If these risks are making you reconsider your opinion on Ocuphire Pharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IRD

Opus Genetics

A clinical-stage ophthalmic biopharmaceutical company, focuses on developing and commercializing therapies for the treatment of inherited retinal diseases (IRDs).

Flawless balance sheet low.

Market Insights

Community Narratives