- United States

- /

- Pharma

- /

- NasdaqGM:OCUL

Ocular Therapeutix (OCUL): Losses Accelerate Despite Fastest-In-Class Revenue Growth Forecasts, Testing Bullish Narratives

Reviewed by Simply Wall St

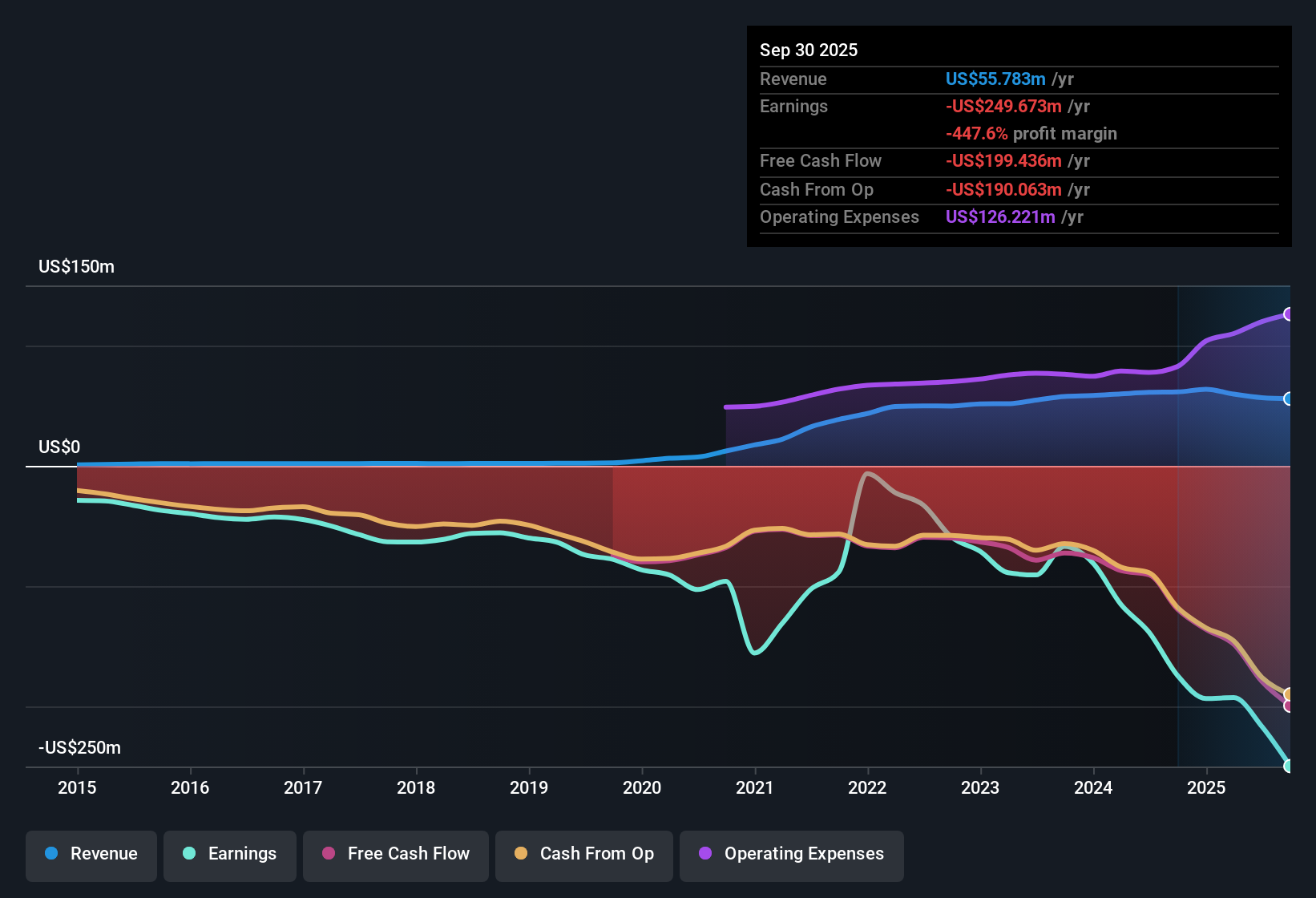

Ocular Therapeutix (OCUL) is projected to grow revenue by a rapid 52.8% per year, far outpacing the US market average of 10.5%. Despite the impressive growth outlook, the company posted increased annual losses of 22.7% per year over the last five years and is expected to remain unprofitable for at least the next three years. The stock is currently priced at $10.90, which is significantly below its estimated fair value of $25.23 based on discounted cash flow analysis. However, it trades at a steep price-to-sales ratio of 41.4x compared to industry averages. Investors are weighing these high growth prospects and the discounted stock price against persistent unprofitability and a premium valuation.

See our full analysis for Ocular Therapeutix.The next section will set these latest numbers against the dominant market narratives and see which stories hold up, as well as which might be challenged.

See what the community is saying about Ocular Therapeutix

Cash Runway Stretches Into 2028

- The company reports a strong cash position, having raised over $390 million, which is expected to extend its ability to fund operations and product development well into 2028.

- According to the consensus narrative, this sizable cash reserve heavily supports the bullish case that Ocular Therapeutix can continue investing in commercialization and pipeline expansion without the immediate risk of shareholder dilution or disruptive fundraising.

- This also enables the launch of multiple clinical programs, such as SOL-1 and SOL-R, as well as the expansion of AXPAXLI into additional high-burden indications.

- The consensus narrative notes this positioning as a shield against short-term financial pressures and gives Ocular more breathing room compared to peers facing tighter cash constraints.

- Further attracting interest is that analysts expect the number of shares outstanding to grow by just 7.0% per year for the next three years, rather than at the dilutive pace sometimes seen in high-burn biotech stories.

Profit Margin Gap Remains Wide

- Ocular’s current profit margin sits at -382.5%, a figure far below the US Pharmaceuticals industry average of 23.2%. Analysts do not expect profitability within the next three years.

- Consensus narrative spotlights the ongoing challenge: despite rapid revenue growth, persistent high R&D spending for AXPAXLI and a lack of proven commercial returns in new indications could depress net margins and prolong unprofitability.

- This means Ocular’s path to closing the margin gap depends less on new launches and more on demonstrating that late-stage clinical data can translate into meaningful real-world sales and pricing power.

- Critics highlight that even if AXPAXLI secures regulatory approval, payer pushback could still threaten premium pricing and keep the margin story under pressure for longer than bullish investors expect.

DCF Fair Value Suggests Upside

- The DCF fair value for Ocular Therapeutix is $25.23, considerably higher than the current share price of $10.90 and suggesting significant upside if growth materializes as projected.

- Analysts’ consensus view emphasizes that while revenue predictions are bold, Ocular’s reliance on AXPAXLI and heavy dependence on successful execution across multiple late-stage programs introduces risk into the fair value gap.

- Any clinical or regulatory setback in key trials like SOL-1 or SOL-R could sharply reduce future expected revenue streams and force analysts to cut fair value estimates.

- The consensus narrative points out that investors will need to decide whether the steep price-to-sales ratio of 41.4x is justified by potential market leadership or if it leaves little room for error as the company aims for 2028 profitability targets.

- Investors weighing this valuation gap may want to see the full consensus narrative on where Ocular stands in the ophthalmology race.

📊 Read the full Ocular Therapeutix Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ocular Therapeutix on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the numbers? Share your own perspective and shape the story in just a few minutes by clicking Do it your way.

A great starting point for your Ocular Therapeutix research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Ocular Therapeutix still faces persistently negative margins, unproven commercial traction, and uncertain pricing for its key pipeline. These factors cast doubt on its near-term path to profitability.

If you’re seeking steadier companies that consistently expand sales and earnings across cycles, use our stable growth stocks screener (2077 results) tool to spot investment ideas built on proven stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCUL

Ocular Therapeutix

A biopharmaceutical company, engages in the development and commercialization of therapies for retinal diseases and other eye conditions using its bioresorbable hydrogel-based formulation technology in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives