- United States

- /

- Pharma

- /

- NasdaqGM:OCUL

Ocular Therapeutix (OCUL): Assessing Valuation After Clinical Progress, Analyst Upgrades, and Major Fundraising

Reviewed by Kshitija Bhandaru

Ocular Therapeutix (OCUL) has attracted attention following a series of positive developments, including new analyst updates related to progress in key clinical trials for diabetic retinopathy and wet age-related macular degeneration.

See our latest analysis for Ocular Therapeutix.

Ocular Therapeutix has had a string of headline-making moments lately, from advancing its retinal disease programs to completing a substantial $475 million stock offering and scheduling high-profile presentations at national conferences. Despite a recent dip, the 2025 year-to-date share price return stands at 34.78%, and the 1-year total shareholder return comes in at 20.45%. These trends suggest growing market optimism as trial milestones and fresh funding bolster the long-term story.

If you’re curious to see what other biotech innovators are drawing investor attention this year, check out the latest picks in our free See the full list for free..

With the share price still trading at a sizable discount to even the most recent analyst targets, is there a buying opportunity here? Or has the market already priced in Ocular Therapeutix’s future growth potential?

Most Popular Narrative: 41.6% Undervalued

With Ocular Therapeutix closing at $11.78, the most popular narrative assigns a considerably higher fair value of $20.17, highlighting a substantial divergence between market price and perceived potential. This gap creates an opportunity to explore the ambitious growth story fueling such optimism.

The anticipated approval of AXPAXLI, potentially the first wet AMD product with a superiority label and longer dosing intervals (every 6, 12 months), may allow Ocular Therapeutix to capture significant market share in a rapidly growing population of elderly patients with retinal disease, unlocking large revenue growth opportunities as the global prevalence of ophthalmic disorders increases.

Curious what financial projections are fueling this high target? The fair value relies on rapid sales growth and transformative pipeline milestones. Discover exactly which assumptions drive these numbers and how analysts justify such aggressive future profit multiples. Think you know what it takes to reach this valuation? The surprising financial details await in the full narrative.

Result: Fair Value of $20.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in key clinical trials or delays in regulatory approvals could quickly challenge these bullish projections and reshape the outlook for Ocular Therapeutix.

Find out about the key risks to this Ocular Therapeutix narrative.

Another View: What Do Current Market Ratios Say?

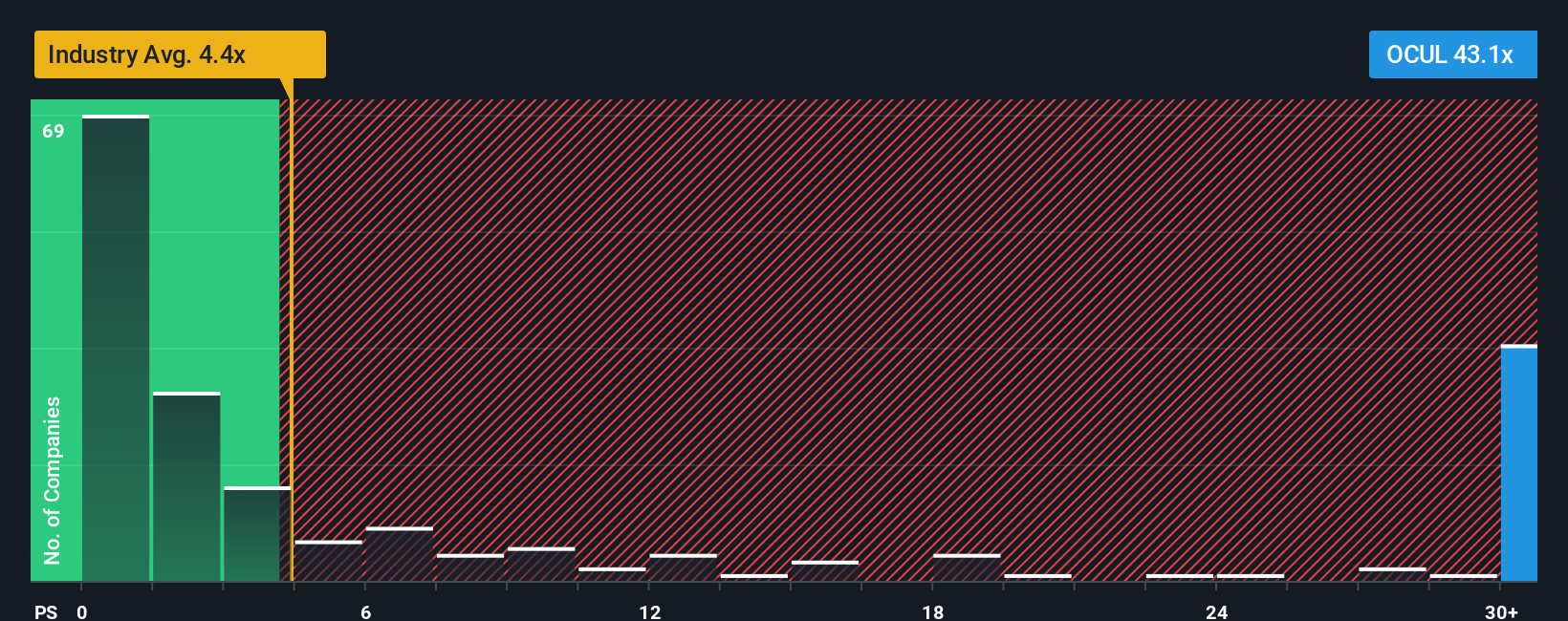

While analyst targets and fair value models point to opportunity, the current price-to-sales ratio for Ocular Therapeutix is a striking 44.1x. That is dramatically higher than the US Pharmaceuticals industry average of 4.6x and the peer average of 2x. Compared to the fair ratio of 0.4x, this signals the market is already baking in highly optimistic future growth. Such a wide gap may mean valuation risk is elevated if ambitious expectations are not met. Could sentiment be racing ahead of fundamentals, or will strong results justify these premium multiples?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ocular Therapeutix Narrative

If you have a different perspective or want to dig deeper into the numbers, you can easily build your own Ocular Therapeutix view in just a few minutes, Do it your way.

A great starting point for your Ocular Therapeutix research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to get ahead and discover new stocks with game-changing potential, don't miss out on the latest insights available through our powerful screeners.

- Find income opportunities by tapping into these 19 dividend stocks with yields > 3%. This screener features shares with yields above 3% that can strengthen your portfolio's cash flow.

- Catch the innovations shaping tomorrow by exploring these 24 AI penny stocks. This tool spotlights companies making waves in artificial intelligence and automation.

- Capitalize on market inefficiencies with these 891 undervalued stocks based on cash flows. This screener showcases stocks trading below their intrinsic value and offering growth at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCUL

Ocular Therapeutix

A biopharmaceutical company, engages in the development and commercialization of therapies for retinal diseases and other eye conditions using its bioresorbable hydrogel-based formulation technology in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives