- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Why Novavax (NVAX) Is Up 9.6% After Pivot to Partnerships and Higher 2025 Guidance

Reviewed by Sasha Jovanovic

- In November 2025, Novavax announced at the Jefferies London Healthcare Conference that it is shifting its business model toward a greater focus on research and development through partnerships, especially with Sanofi, while raising its full-year 2025 adjusted revenue projection and forecasting US$610 million in Nuvaxovid sales.

- An intriguing outcome is that Novavax's move away from direct COVID-19 commercial operations has led to a notable increase in licensing and royalty revenues, highlighting the company's growing reliance on external collaborations for recurring income.

- We'll explore how Novavax's shift toward R&D partnerships and higher royalty revenues could reshape its long-term investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Novavax Investment Narrative Recap

To be a Novavax shareholder today, you need to believe in the company's ability to transition from COVID-19 commercial operations to a partnership-driven R&D model that delivers steady licensing and royalty revenue. The recent news of stronger 2025 revenue guidance and the Sanofi partnership bolsters confidence in royalty streams, but the company’s financial health remains closely linked to partner performance, a key near-term catalyst and risk that remains significant.

One recent announcement that stands out is the transfer of U.S. marketing authorization for Nuvaxovid to Sanofi, which secured a US$25 million milestone payment and underscores a shift towards milestone and royalty-based revenues. This change directly relates to how Novavax’s future income and stability may ride on meeting regulatory and commercialization milestones through its partners rather than through direct sales.

However, despite new royalty streams, investors should also consider how quickly partner milestones materialize, especially since delays could...

Read the full narrative on Novavax (it's free!)

Novavax's outlook points to $348.5 million in revenue and $55.9 million in earnings by 2028. This reflects a 31.4% annual decline in revenue and an earnings decrease of $366.9 million from the current $422.8 million.

Uncover how Novavax's forecasts yield a $13.11 fair value, a 89% upside to its current price.

Exploring Other Perspectives

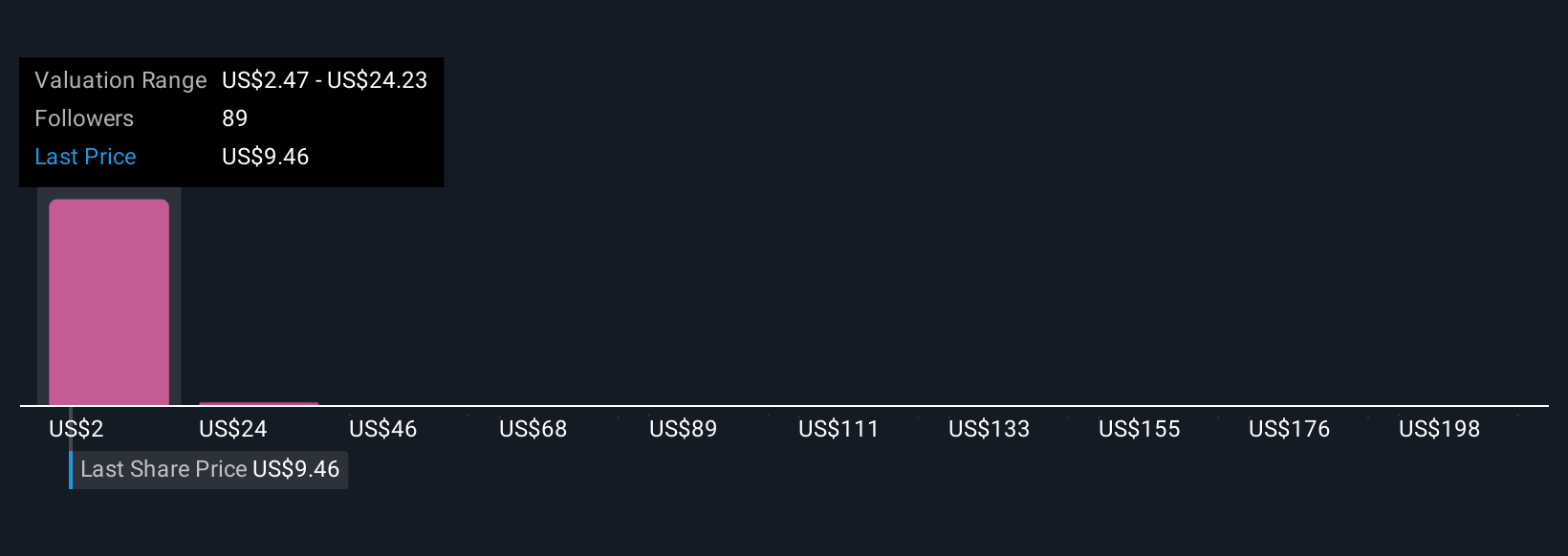

Ten members of the Simply Wall St Community value Novavax between US$4.59 and US$100 per share. While royalty catalysts drive optimism for some, reliance on partner execution could shape revenue outcomes and investor returns, compare these perspectives for a broader view.

Explore 10 other fair value estimates on Novavax - why the stock might be a potential multi-bagger!

Build Your Own Novavax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Novavax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novavax's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success