- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX): Valuation in Focus as Sanofi Takes Over Nuvaxovid and Milestone Payments Unlock

Reviewed by Simply Wall St

The recent completion of the Nuvaxovid transfer marks a significant step for Novavax (NVAX) as Sanofi takes over commercial and regulatory control in the EU. This change could influence Novavax’s financial outlook, as it is expected to result in upcoming milestone payments.

See our latest analysis for Novavax.

With the Nuvaxovid handoff to Sanofi now complete, Novavax has caught fresh attention, especially as anticipation builds for its upcoming earnings. The stock has shown renewed momentum with a 24% share price return over the past three months. However, its one-year total shareholder return remains negative, highlighting lingering volatility and the market's wait-and-see stance.

If you're interested in the next big opportunities in this sector, consider checking out See the full list for free..

With shares trading at a sharp discount to analyst targets, but growth still uncertain, investors may be wondering if Novavax is undervalued or if the market is already factoring in any rebound ahead.

Most Popular Narrative: 36% Undervalued

Novavax’s widely followed narrative assigns a fair value of $13.21, well above the last close of $8.40. This spread focuses attention on upcoming catalysts and the evolving business model that could determine whether the company’s turnaround gains traction. Investors are eager to understand what is fueling such optimism.

Ongoing cost optimization and the shift to a leaner, partnership-focused operational model, with substantial SG&A reductions and Sanofi absorbing additional costs, position Novavax for improved gross and net margins. This supports an accelerated path to sustained profitability and stronger long-term earnings.

There is an aggressive path to margin growth beneath the surface. What exactly are analysts expecting to change about Novavax’s bottom line and business model? The story hinges on a potential profit transformation, driven by partnerships and strategic shifts. Dive into the full narrative to uncover the numbers and assumptions shaping this bullish valuation.

Result: Fair Value of $13.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on partner execution and regulatory successes could still derail Novavax’s turnaround if expected milestone payments or approvals are delayed.

Find out about the key risks to this Novavax narrative.

Another View: Discounted Cash Flow Challenges the Bullish Narrative

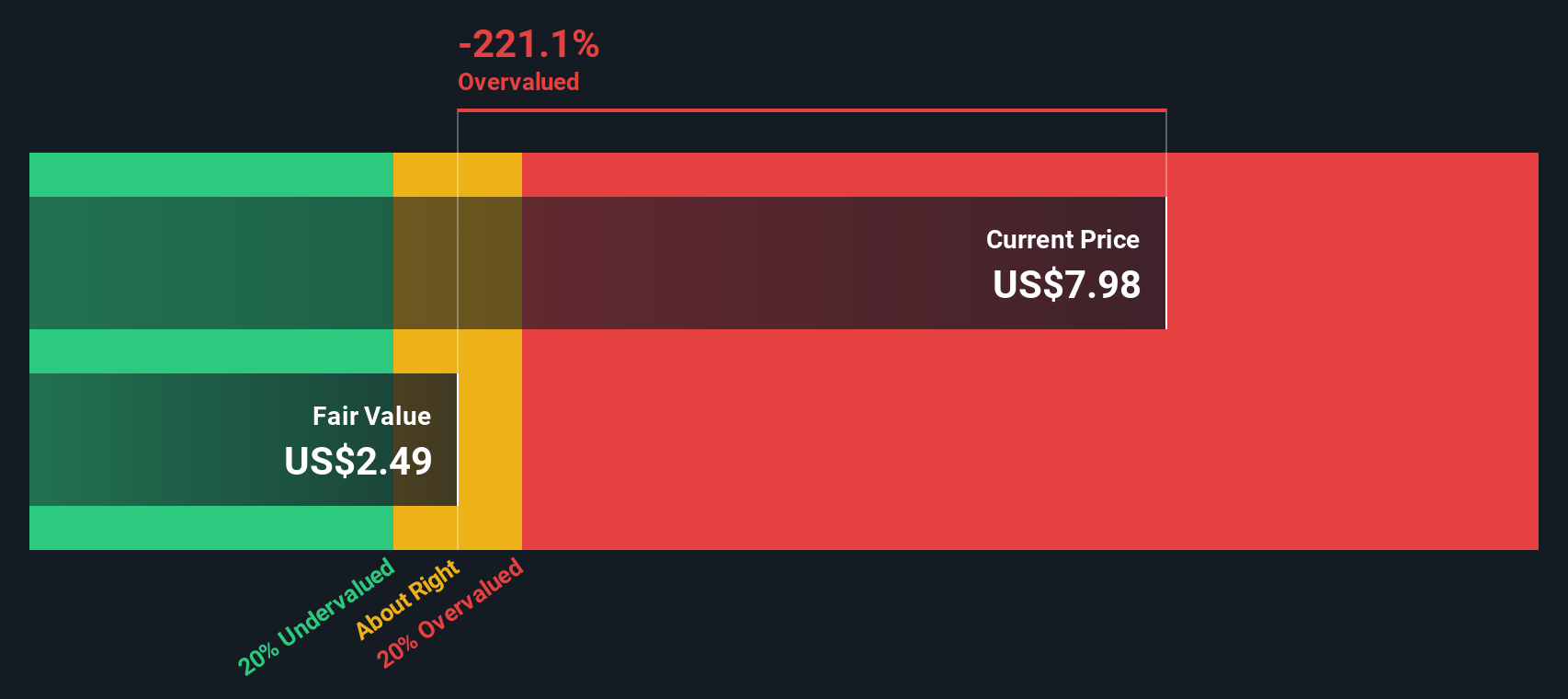

Looking at Novavax through our DCF model paints a different picture. With shares currently at $8.40 and the DCF fair value estimate at just $2.44, the model suggests Novavax is actually trading above what its future cash flows might justify. Does the market see hidden value, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novavax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novavax Narrative

If the conclusions above don’t align with your view, or you’d rather dive into the numbers yourself, you can build your own story using the data and tools in just minutes. Do it your way.

A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Your next opportunity could be just a click away. Don’t miss out on the latest high-potential stocks. Savvy investors are already using these powerful tools to build stronger portfolios.

- Kickstart your search for high return potential by checking out these 3588 penny stocks with strong financials, uncovering companies with robust financial footing and substantial upside.

- Tap into the future of healthcare by exploring these 33 healthcare AI stocks, spotlighting businesses harnessing artificial intelligence to transform patient outcomes and medical innovation.

- Boost your passive income strategy with these 22 dividend stocks with yields > 3%, which highlights stocks yielding more than 3% for those serious about growing their payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives