- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX) Draws Spotlight as ACIP Reviews Covid Vaccine—Is Market Position Set to Shift?

Reviewed by Simply Wall St

- The newly restructured Advisory Committee on Immunization Practices (ACIP) recently convened to review updated Covid vaccines from Novavax, Pfizer, and Moderna, following an appointment of panelists by Robert F. Kennedy Jr. amid continued debate over vaccine policy.

- This evaluation draws unusual attention to Novavax's product and could influence its vaccination uptake depending on the panel's recommendations and broader industry sentiment.

- We'll examine how the ACIP's high-profile evaluation of Novavax's Covid vaccine could impact the company's projected revenue stability and market position.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Novavax Investment Narrative Recap

To own Novavax stock, you have to believe its partnerships, pipeline, and distinctive Covid vaccine technology can carve out sustainable value in a fiercely competitive market and amid evolving vaccination policy. The high-profile ACIP evaluation, while drawing fresh attention, has not meaningfully shifted Novavax’s biggest near-term catalyst, robust uptake of new Covid formulations, nor reduced the primary risk: high exposure to variable Covid vaccine demand and partner execution beyond its direct control.

Among Novavax’s recent updates, the September 4 milestone payment from Takeda for the Omicron-targeted Nuvaxovid vaccine directly ties to the ACIP’s review of updated Covid vaccine options. This regulatory progress advances a key revenue opportunity, but also underscores just how important third-party uptake and health authority endorsement are to any revenue stabilization moving forward. In contrast, investors should be aware that...

Read the full narrative on Novavax (it's free!)

Novavax's outlook anticipates $348.5 million in revenue and $55.9 million in earnings by 2028. This reflects a -31.4% annual revenue decline and a sharp $366.9 million decrease in earnings from $422.8 million currently.

Uncover how Novavax's forecasts yield a $12.50 fair value, a 44% upside to its current price.

Exploring Other Perspectives

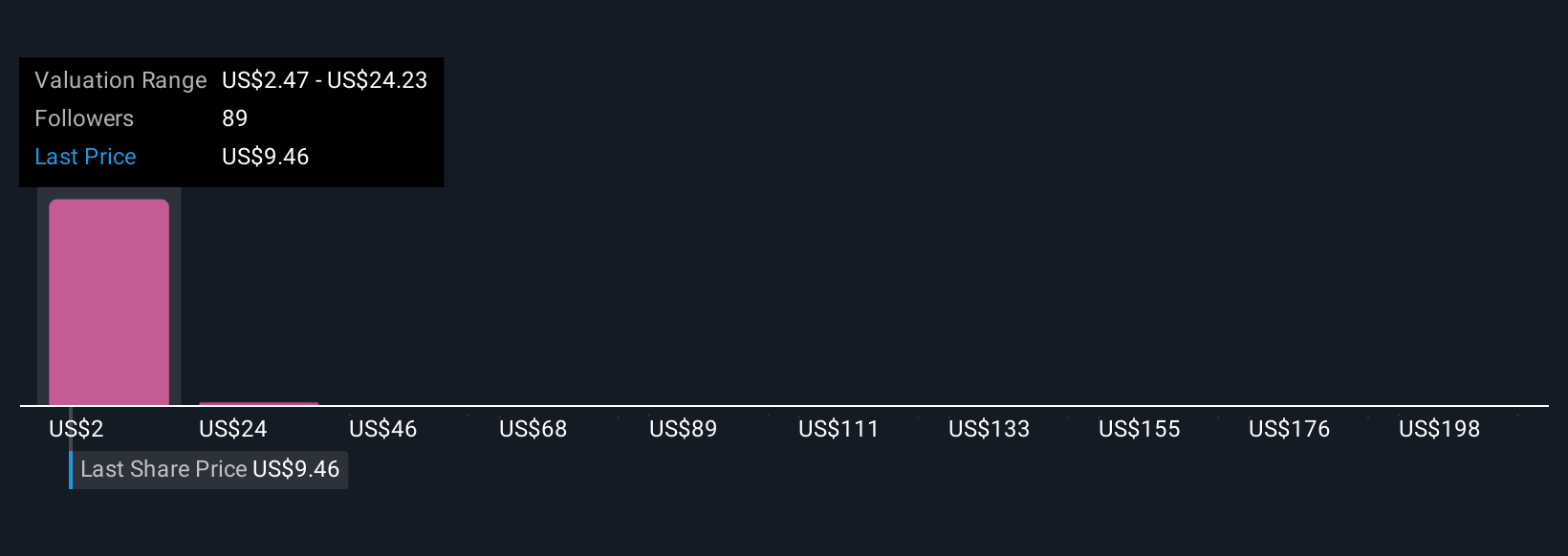

Fourteen fair value estimates from the Simply Wall St Community range widely from US$2.49 to US$220 per share. These diverse opinions highlight how much Novavax’s future hinges on variables like Covid vaccine market share and shifting partner performance, so consider exploring several viewpoints before making any decision.

Explore 14 other fair value estimates on Novavax - why the stock might be a potential multi-bagger!

Build Your Own Novavax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Novavax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novavax's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success