- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Is Novavax a Potential Bargain After New Funding and a 16% Share Price Drop?

Reviewed by Bailey Pemberton

- Wondering if Novavax is a bargain or a big risk right now? You are not alone; there is plenty of debate around whether the current price reflects the company's true value.

- The stock price has dropped 9.1% in the last week and 16.4% over the past month, fueling questions about both its future growth and potential risks.

- Recent headlines have focused on Novavax securing new funding initiatives and expanding vaccine partnerships, which has added fresh perspective (and volatility) to the share price. Analysts and industry watchers are keeping a close eye on how these developments might change Novavax’s long-term outlook.

- On our valuation checks, Novavax scores 3 out of 6 for being undervalued, putting it right in the middle of the pack. Let's break down how we arrive at that figure, and later in the article, reveal an even better way to get a handle on what the stock is worth.

Find out why Novavax's -13.3% return over the last year is lagging behind its peers.

Approach 1: Novavax Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company's shares should be worth today by forecasting its future cash flows and then discounting them back to the present. It tries to determine value based on projections of how much cash the business will generate, not just what it is earning right now.

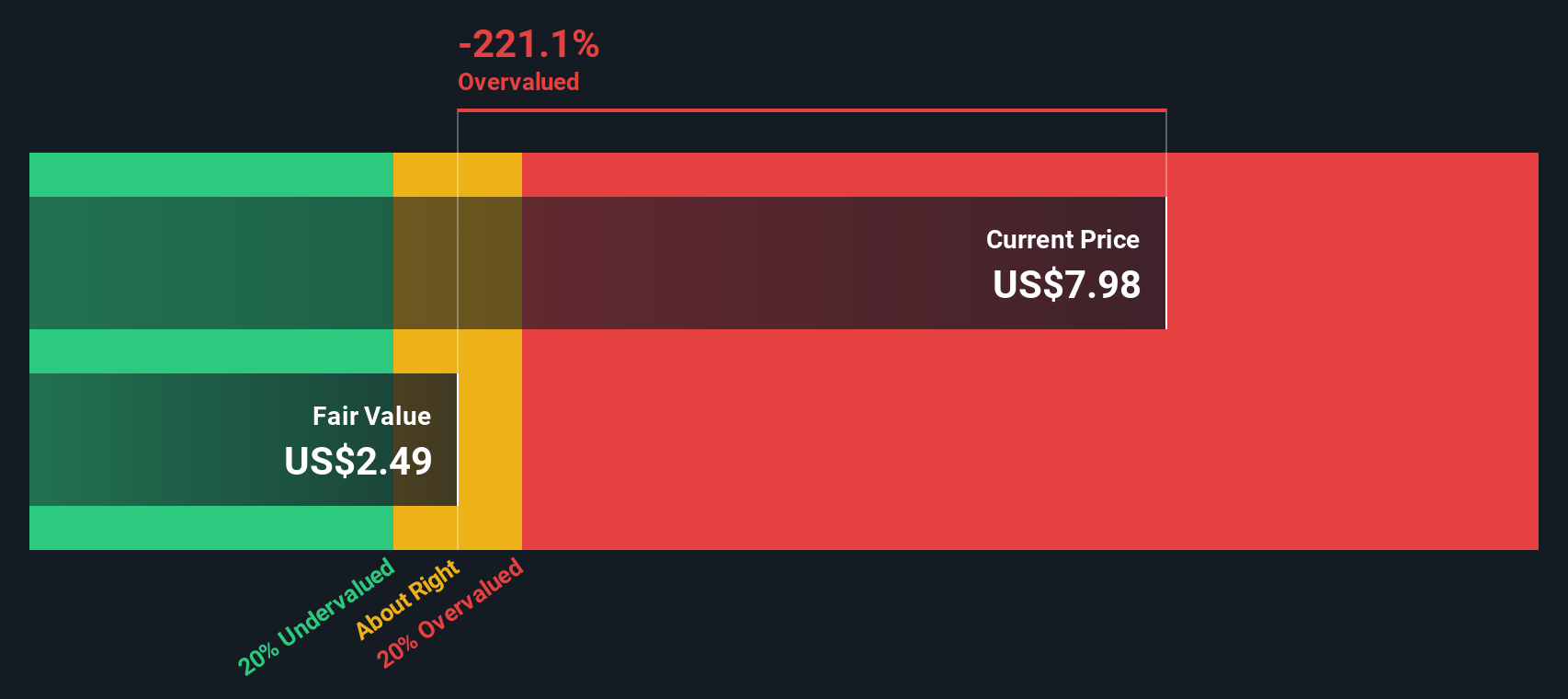

For Novavax, the most recent data shows a Free Cash Flow over the last twelve months of -$668 million, reflecting substantial cash outflows. Looking ahead, analysts have provided limited estimates up to 2029. They project Free Cash Flow to grow to $76 million in that year. Projections beyond that, reaching up to 2035, are extrapolated and indicate only modest additional growth, never topping $263 million in any year.

Based on these forecasts, Novavax's estimated intrinsic value per share comes out to $2.44. Compared to the current share price, this DCF calculation suggests the stock is 224.5% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novavax may be overvalued by 224.5%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Novavax Price vs Earnings (PE Ratio)

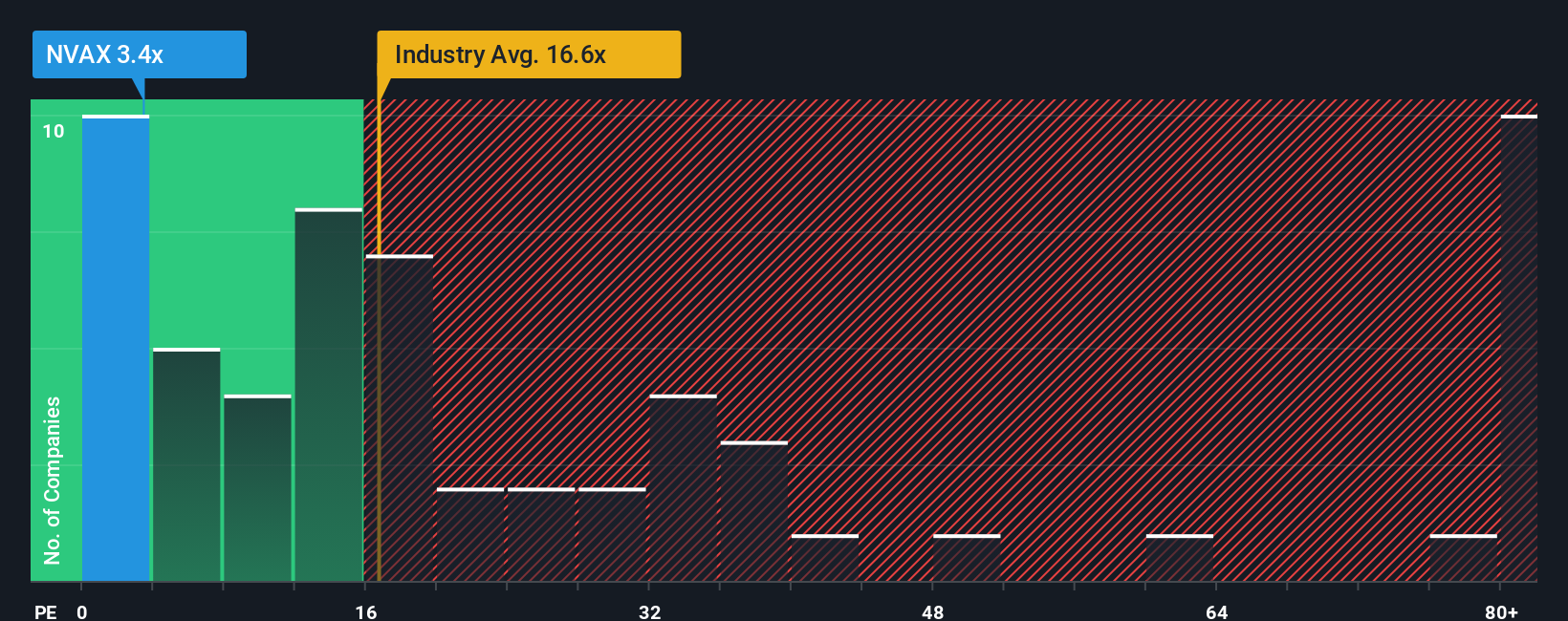

The Price-to-Earnings (PE) ratio is a favored tool for valuing companies that are profitable because it directly relates a company's share price to its earnings. When a company is generating positive earnings, the PE ratio can offer insight into how much investors are willing to pay for a dollar of those earnings, making it a practical metric for comparing valuation across the industry.

Growth expectations, risk, and sector dynamics all shape what a "normal" or "fair" PE ratio looks like. High-growth or low-risk companies generally justify higher PE ratios, while riskier or slower-growing businesses tend to trade at lower multiples. For Novavax, the current PE is 3x, which is well below both the biotech industry average of 17x and the peer average of 52x.

Simply Wall St uses a proprietary "Fair Ratio," which calculates the expected PE multiple for Novavax based on factors like earnings growth outlook, profit margins, industry trends, company size, and risk profile. This offers a more tailored benchmark than just comparing against peers or industry averages alone. Novavax's Fair Ratio stands at 11.5x, reflecting the company’s unique risk-reward balance and business dynamics.

Comparing Novavax's actual PE of 3x to its Fair Ratio of 11.5x, the stock appears undervalued by this metric, indicating that the current price may not fully reflect the company’s earnings potential given its circumstances.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novavax Narrative

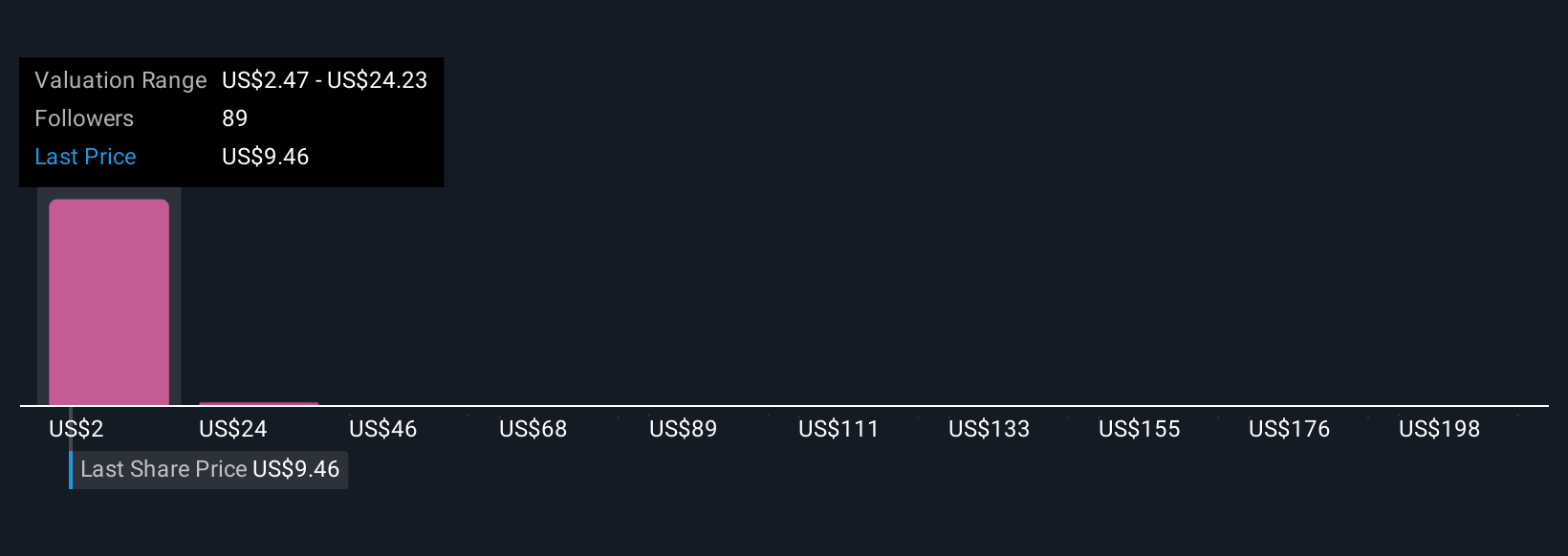

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are accessible, interactive tools that let you build or select a story behind the numbers. This approach allows you to create your own informed perspective about Novavax's future by combining what you know about the business, industry trends, and your assumptions for revenue, margins, and fair value.

Instead of relying solely on formulas, a Narrative directly links the company’s evolving story to a specific financial forecast, which in turn produces your estimated fair value. Narratives are simple to use and are available to everyone on Simply Wall St’s Community page, already used by millions of investors worldwide.

With Narratives, you can see exactly how your thesis compares to the market. If your fair value is above today’s price, it may signal a buy, and if below, a sell. Crucially, as new news or earnings updates arrive, Narratives automatically factor in the latest data, keeping your view fresh and actionable.

For example, some investors might be highly optimistic about Novavax’s shift to licensing and partnerships, projecting a fair value of $25.00 per share. More cautious investors may see regulatory risks and expect only $6.00 per share. Narratives empower you to make and update your own call with every new development.

Do you think there's more to the story for Novavax? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives