- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

If You Had Bought Novavax (NASDAQ:NVAX) Stock Three Years Ago, You'd Be Sitting On A 91% Loss, Today

As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Novavax, Inc. (NASDAQ:NVAX); the share price is down a whopping 91% in the last three years. That'd be enough to cause even the strongest minds some disquiet. And more recent buyers are having a tough time too, with a drop of 76% in the last year. On top of that, the share price has dropped a further 78% in a month.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Novavax

Given that Novavax didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Novavax grew revenue at 8.2% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 54% share price drop (each year) is entirely about the revenue. More likely, the market was spooked by the cost of that revenue. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

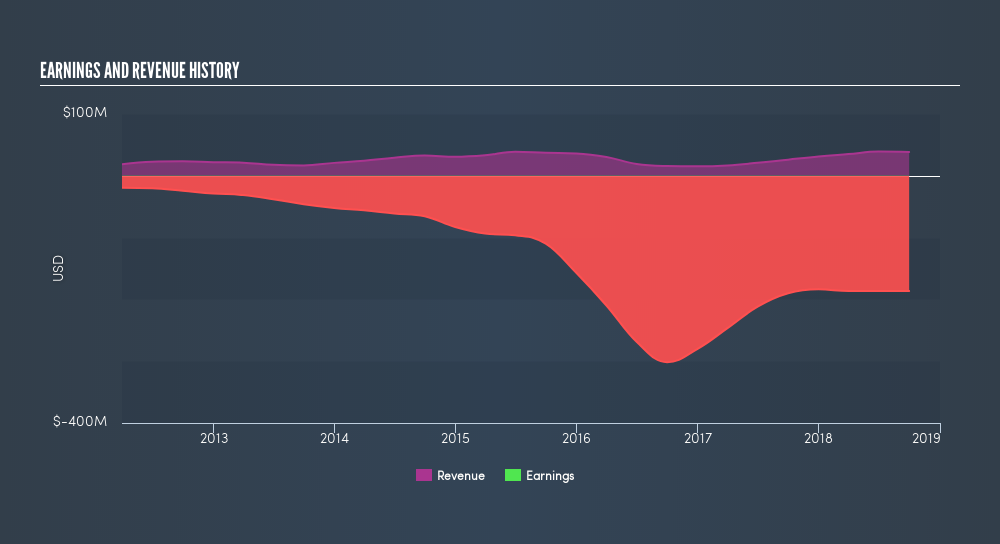

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Novavax in this interactivegraph of future profit estimates.

A Different Perspective

Investors in Novavax had a tough year, with a total loss of 76%, against a market gain of about 1.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 37% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Novavax is not the only stock insiders are buying. So take a peek at this freelist of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives