- United States

- /

- Biotech

- /

- NasdaqGS:NUVL

Nuvalent (NUVL): Assessing Valuation as Investor Sentiment Shows Early Signs of Shifting

Reviewed by Simply Wall St

Price-to-Book of 6x: Is it justified?

Based on the price-to-book multiple, Nuvalent's shares trade at 6 times book value, making them appear expensive compared to the US biotech industry average of 2.1 times book. This suggests a substantial premium is being placed on the company's assets by the market.

The price-to-book ratio measures the market’s valuation of a company’s equity relative to its net asset value. For biotech firms, this multiple can be influenced by factors such as pipeline potential, intellectual property, and anticipated growth, since many operate at a loss in early growth stages.

This premium could reflect high investor expectations for Nuvalent’s future development pipeline or strategic progress. The key question is whether these expectations are realistic, given the company’s current lack of profitability and increasing losses in recent years.

Result: Fair Value of $78.33 (OVERVALUED)

See our latest analysis for Nuvalent.However, weaker revenue growth or escalating net losses could challenge the optimistic outlook. This may quickly shift investor sentiment and put pressure on Nuvalent's valuation.

Find out about the key risks to this Nuvalent narrative.Another View: What Does Our DCF Model Suggest?

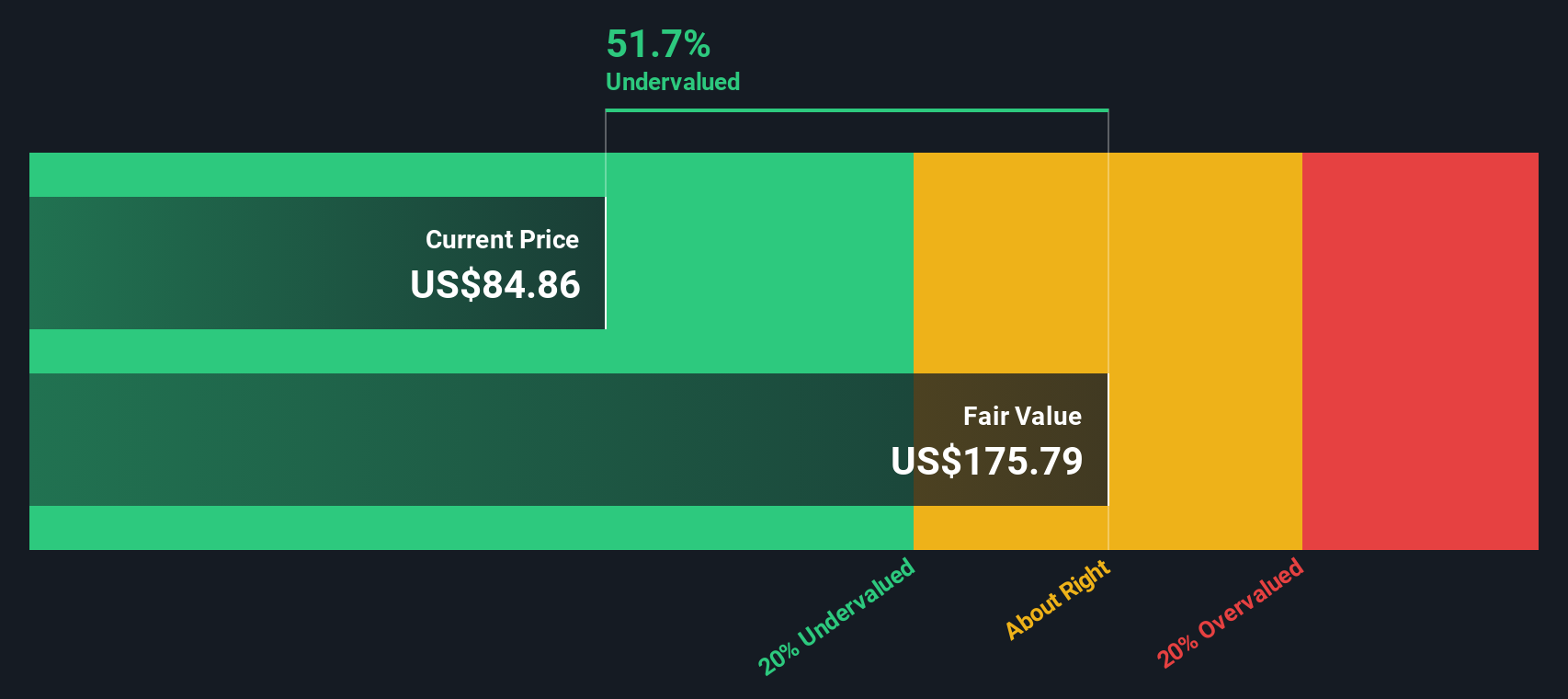

While the price-to-book ratio paints Nuvalent as potentially overvalued, our DCF model tells a different story. It suggests the stock may actually be trading below its estimated worth. Could this signal an overlooked opportunity, or just a difference in tools?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nuvalent Narrative

If you have a different perspective or want to investigate Nuvalent’s outlook on your own terms, you can easily build your own analysis in just minutes using our tools. Do it your way.

A great starting point for your Nuvalent research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that broadening their search uncovers overlooked winners. Use Simply Wall Street’s suite of screeners to spot your next strong opportunity before it hits the headlines.

- Unlock potentially overlooked bargains by evaluating the most promising candidates through our curated list of undervalued stocks based on cash flows.

- Boost your income strategy by zeroing in on shares offering attractive yields. See which opportunities await with our handpicked dividend stocks with yields > 3%.

- Seize the momentum of innovation by targeting companies powering tomorrow’s breakthroughs using the dedicated quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvalent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NUVL

Nuvalent

A clinical-stage biopharmaceutical company, engages in the development of therapies for patients with cancer.

Excellent balance sheet and fair value.

Market Insights

Community Narratives