- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NTRA): Valuation Insights Following Raised 2025 Outlook and Strong Quarterly Performance

Reviewed by Simply Wall St

Natera (NTRA) recently boosted its earnings outlook for 2025, revising both revenue and gross margin guidance upward in response to strong quarterly results. This update has drawn increased investor attention.

See our latest analysis for Natera.

On the heels of its upbeat outlook and fresh product integration news, Natera’s 1-month share price return of 12.4% stands out. This momentum has carried into a 26.8% gain over the last quarter. Investors have seen long-term rewards too, with a 1-year total shareholder return of nearly 40% and a staggering 474% over three years. This reflects both rising confidence and a string of positive developments.

If Natera's run has you wondering what other healthcare innovators are making waves, it’s a great moment to explore See the full list for free.

With shares near all-time highs and optimistic forecasts already out in the open, investors have to wonder: is Natera undervalued at these levels, or has the market fully priced in its future growth potential?

Most Popular Narrative: 8.2% Undervalued

According to the most widely followed narrative, Natera's fair value is estimated at $222.58, which is 8.2% higher than its recent $204.28 close. The difference reflects optimism around pipeline progress and clinical results, while acknowledging ongoing debates about sustainability.

Growing adoption of molecular diagnostics and expanded clinical validation are driving revenue growth and increased reimbursement in core areas like oncology and organ health. Investments in AI, automation, and new product launches are improving operational efficiency and positioning the company for future expansion in personalized medicine.

Want to know what’s powering this premium? A forecast model that banks on top-line acceleration and a margin turnaround worthy of biotech’s elite. The assumptions behind this valuation will surprise even seasoned investors. Think bold projections and a profitability leap. Curious yet?

Result: Fair Value of $222.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in clinical trials or slower than expected reimbursement approvals could quickly challenge even the most bullish forecasts for Natera’s growth story.

Find out about the key risks to this Natera narrative.

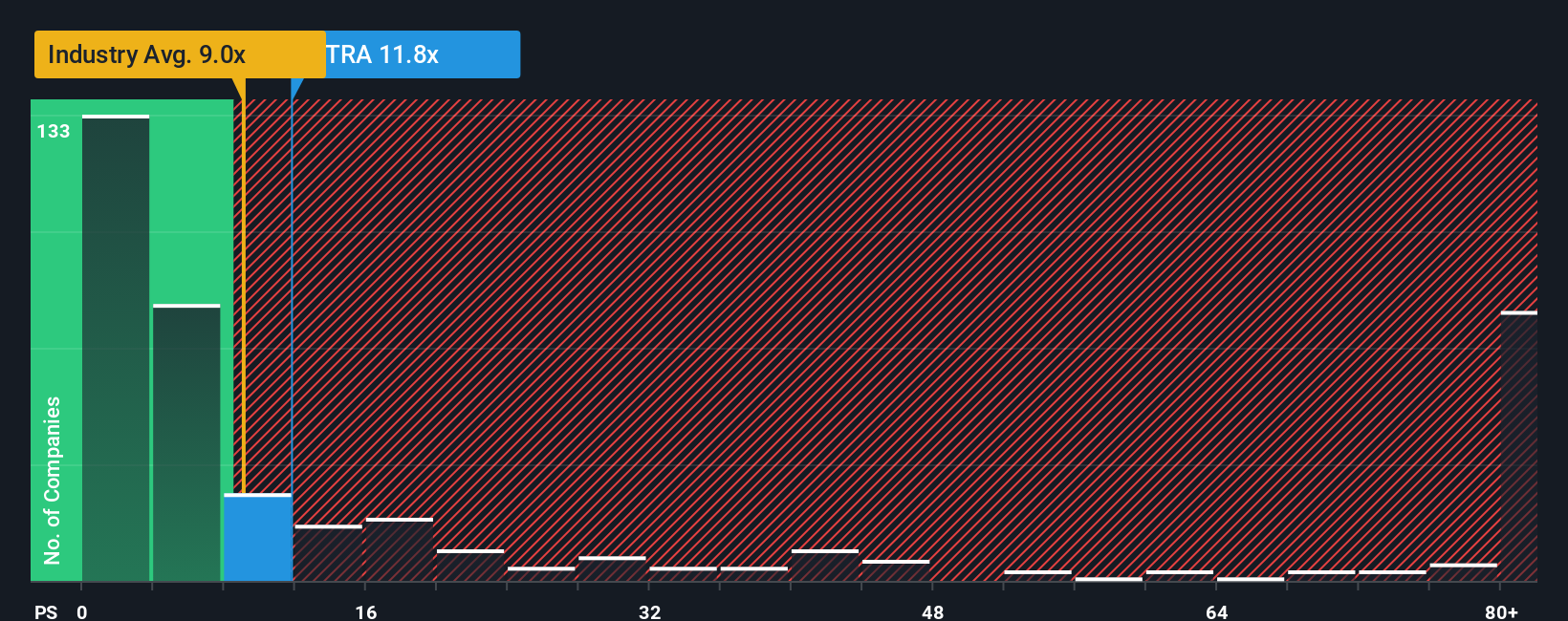

Another View: Market Comparisons Signal Caution

Looking through the lens of revenue-based market ratios, Natera stands out as expensive. Its price-to-sales multiple of 13.3x is notably higher than both peers (9.3x) and the US Biotechs industry average (10.9x). The fair ratio, where the market could gravitate, is just 7.9x. That is a sizable gap, raising questions about valuation risk. Could expectations be getting ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Natera Narrative

If you think the story runs deeper or want to dig into the details yourself, it only takes a few minutes to test your own thesis and Do it your way.

A great starting point for your Natera research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors know that opportunity rarely knocks twice. Broaden your portfolio with unique stocks that you might not have considered and stay a step ahead by checking out exceptional, ready-made ideas below.

- Snap up powerful income potential by checking out these 16 dividend stocks with yields > 3%, featuring companies delivering yields above 3% and consistent payouts.

- Position yourself for the next breakthrough by reviewing these 25 AI penny stocks making waves in artificial intelligence, from automation trailblazers to innovators in deep learning.

- Move quickly on value plays and access these 886 undervalued stocks based on cash flows for stocks trading below their intrinsic cash flow worth, before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives