- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NTRA): A Neutral Look at Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

Over the past month, Natera (NTRA) shares have advanced 17%, fueled by steady annual revenue growth and sharply improving net income trends. Investors are eyeing how these gains fit with the company’s long-term performance trajectory.

See our latest analysis for Natera.

Bolstered by a 17% jump in the share price over the past month, Natera has caught fresh attention from investors, especially with strong 1-year total shareholder returns of 63.6% and multi-year returns that suggest momentum is still building. Recent price activity points to revived optimism about the company’s long-term growth story, even as volatility remains a factor.

If you’re looking to spot more movers with similar energy, now is an opportune moment to broaden your search and discover fast growing stocks with high insider ownership

With Natera's stock now trading just 1% below consensus analyst targets and sitting on impressive multi-year gains, the key question is whether there is still untapped value here or if the market is already pricing in future growth.

Most Popular Narrative: Fairly Valued

Natera's fair value estimate from the most popular narrative closely matches its recent closing price. This highlights a market consensus in the context of high expectations and industry buzz.

Investment in new product launches (for example, Fetal Focus NIPT, Signatera Genome, and AI-based biomarkers) and a robust R&D pipeline positions Natera to capture growth from long-term trends in personalized medicine and early detection, supporting future revenue expansion.

Curious what bold growth assumptions are fueling this elevated valuation? There is a striking set of projections around Natera’s future revenue and profit trajectory that might surprise you. Discover the blueprint behind these consensus numbers and see what is driving the story forward.

Result: Fair Value of $193.8 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant reliance on successful clinical trials and the ongoing need for regulatory approvals could still undermine the optimistic valuation outlook for Natera.

Find out about the key risks to this Natera narrative.

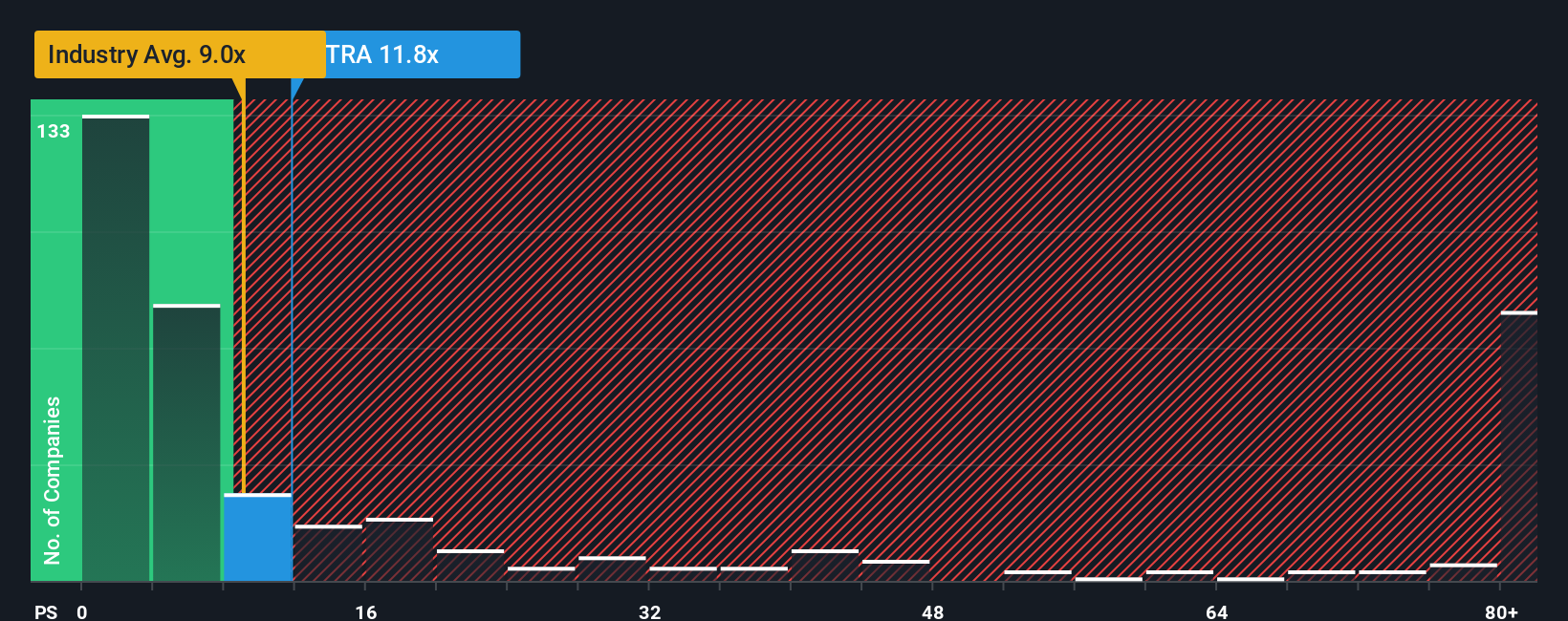

Another View: Multiples Paint a Different Picture

While analyst consensus pegs Natera as fairly valued around recent prices, a look at its price-to-sales metric suggests caution. Natera trades at 13.5 times sales, well above the US Biotechs industry average of 10.8x, the peer group average of 5.8x, and even above a fair ratio of 7.3x. These gaps highlight a valuation premium that could leave investors vulnerable if market sentiment shifts. Is this a reasonable premium for future growth, or does it expose downside risk if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Natera Narrative

If you have your own take or want to interpret the numbers firsthand, you can quickly build your own storyline and insights in just a few minutes. Do it your way

A great starting point for your Natera research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Ready to spot compelling opportunities beyond the headlines? The Simply Wall Street Screener puts you in front of tomorrow’s growth, value, and AI trends before the crowd catches on.

- Position yourself early with these 3566 penny stocks with strong financials, which combine affordability and strong financials to help you access the next breakout stories at ground floor prices.

- Catch the rise of a new digital era by evaluating these 27 AI penny stocks, designed to surface the most promising advancements in artificial intelligence innovation.

- Secure your portfolio’s edge with these 881 undervalued stocks based on cash flows, which spotlights companies the market may be overlooking for their real, cash-driven potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives