- United States

- /

- Biotech

- /

- NasdaqGM:NTLA

What Does a 58% Drop Mean for Intellia Therapeutics Stock in 2025?

Reviewed by Bailey Pemberton

- Wondering if Intellia Therapeutics is undervalued, overpriced, or finally at a sweet spot? You are definitely not alone, as many investors are asking the same question with all the action in biotech stocks lately.

- After a tough few weeks, Intellia’s share price has fallen by 16.6% in just the past 7 days and is down 58.5% over the last month. This may have some wondering if the market sees hidden risks or changing prospects.

- Much of this recent volatility has been attributed to broader sector pressure and market sentiment shifting around gene-editing technology stocks. Headlines about competition in the CRISPR field and news of partnership updates have added context to why investors are rethinking Intellia’s near-term story.

- When it comes to the numbers, Intellia Therapeutics scores a 2 out of 6 on our undervaluation checks. There is more to the valuation picture than first meets the eye, and we will break down a few classic approaches in this article. Stick around for a perspective that might change the way you look at value altogether.

Intellia Therapeutics scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intellia Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and discounting them back to today's dollars. The idea is to assess what the business is really worth if we look at the cash it’s expected to generate over time.

For Intellia Therapeutics, the DCF analysis uses a 2 Stage Free Cash Flow to Equity model. Currently, the company has negative Free Cash Flow, standing at -$419.96 Million, which captures its ongoing investment and clinical pipeline expenses. While analysts provide cash flow estimates for the next five years, turning slightly positive by 2029 at $115.8 Million, projections further out are extrapolated based on trends typical for high-growth biotech firms.

With this approach, the estimated intrinsic value for Intellia Therapeutics comes out to $79.66 per share. Compared to the current share price, this implies an 87.2% discount, signaling that the market might be significantly undervaluing the company based on these future cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intellia Therapeutics is undervalued by 87.2%. Track this in your watchlist or portfolio, or discover 858 more undervalued stocks based on cash flows.

Approach 2: Intellia Therapeutics Price vs Sales

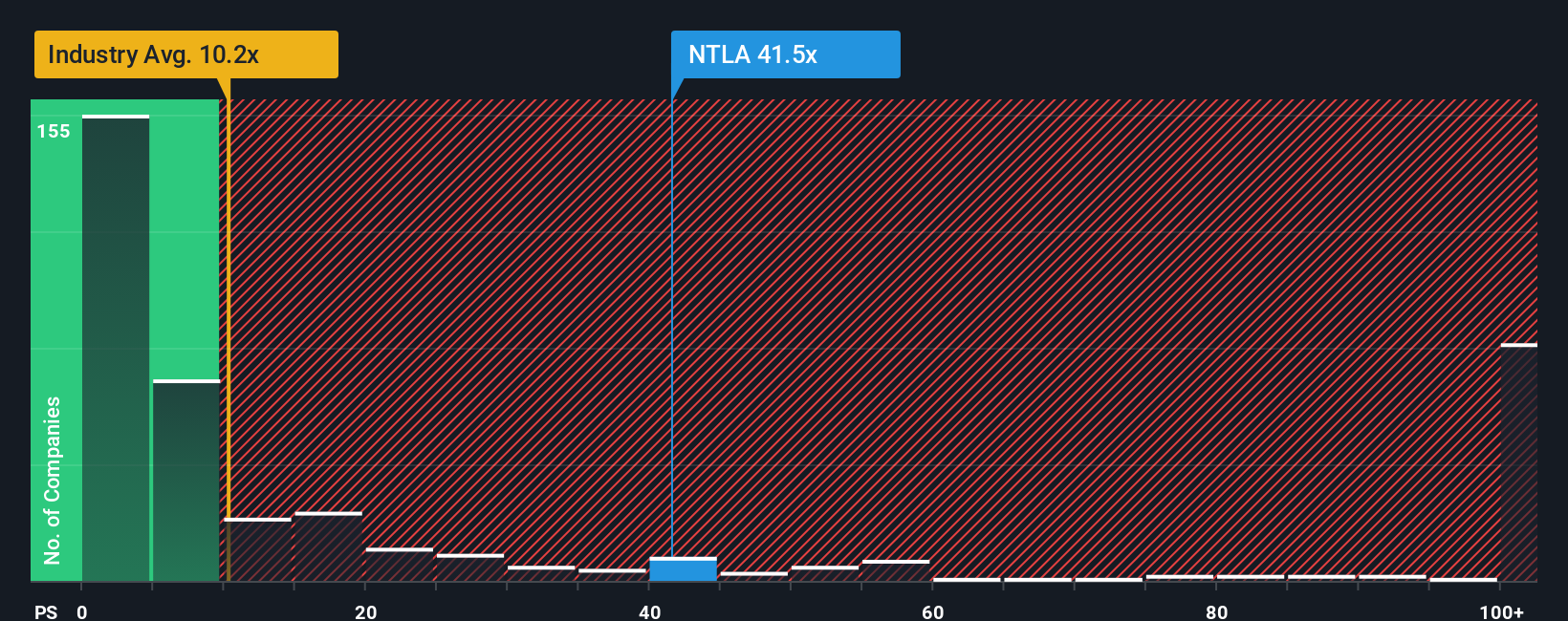

For companies in the biotechnology sector that do not yet generate positive earnings, the Price-to-Sales (P/S) ratio is often the most relevant valuation multiple. Unlike profits, which can be negative during the early growth phases, revenue can be a more stable baseline for understanding value, especially when a company is still investing heavily in R&D or is pre-profit.

When considering a “normal” or fair P/S ratio, expectations for future growth and the risks specific to a high-innovation field like gene editing are vital. High-growth biotech firms often trade at a premium P/S multiple due to the potential for rapid revenue expansion and blockbuster therapies. However, heightened risks such as clinical trial setbacks can suppress these multiples.

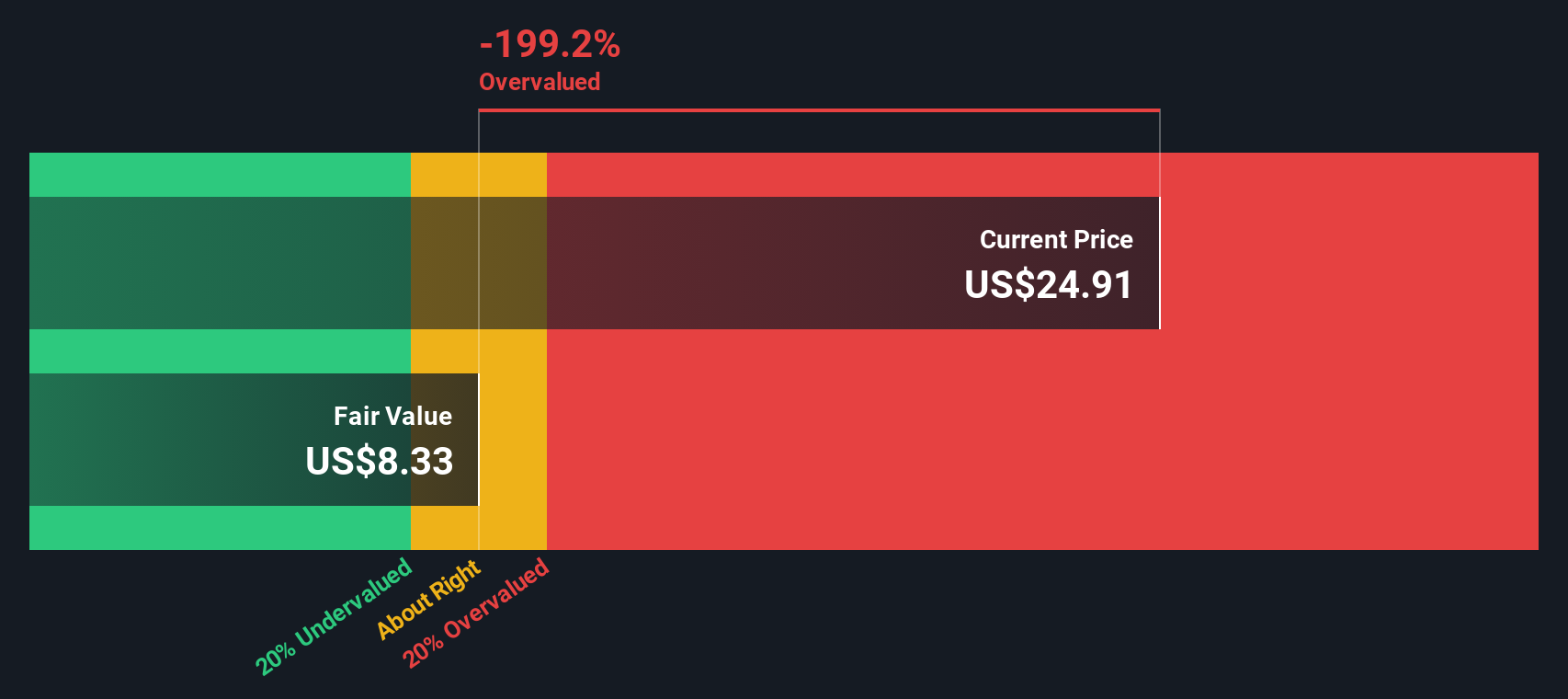

Intellia Therapeutics currently trades at a P/S ratio of 20.5x, which sits well above the biotech industry average of 12.1x and its peer average of 4.9x. While these benchmarks are useful, Simply Wall St introduces the concept of a “Fair Ratio,” a proprietary metric that blends in revenue growth outlook, profit margins, company size, risk factors, and sector trends. For Intellia, the Fair Ratio is calculated to be just 0.00x. This tailored benchmark is more insightful than a simple industry or peer comparison as it recognizes the unique risk-reward profile and fundamentals of the company.

With Intellia’s current P/S multiple so far above its Fair Ratio, the stock appears significantly overvalued on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1367 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intellia Therapeutics Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story investors create about a company that connects real-world developments to the numbers, for example, their own outlook on future sales, profits, and ultimately, what they believe a stock’s fair value should be. Narratives give meaning to financial models by linking Intellia Therapeutics’ science, clinical milestones, and competitive dynamics with concrete forecasts, helping investors see how the story behind the business drives valuation.

Simply Wall St makes Narratives accessible to anyone via the Community page, used by millions of investors. With Narratives, you can compare your view of Intellia’s fair value to the current price, and decide whether you see an opportunity or a risk. Narratives are updated dynamically as news breaks or earnings are released, so your investment view is always up to date.

For example, one investor tracking Intellia’s rapid clinical enrollments and growing market could forecast a price target at the high end ($106.00), anticipating strong commercial success. Another might focus on recent clinical holds and safety concerns, leading them to a much lower value ($7.00) to reflect higher risks.

Do you think there's more to the story for Intellia Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NTLA

Intellia Therapeutics

A clinical-stage gene editing company, focuses on the development of curative genome editing treatments.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives